David Warsh: Money follows development and vice versa

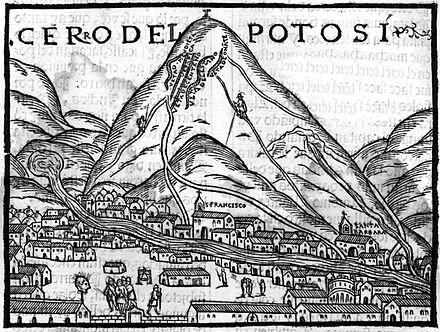

Cerro Rico del Potosi, the first European image, in 1553, of a silver-ore-rich mountain in what became Bolivia. It was heavily exploited by Spain.

SOMERVILLE, Mass.

A candy bar that cost a nickel in 1950 today costs $1.25 or so, depending on where you buy it. That, in a paper wrapper, is the price revolution of the 20th Century. Why did it happen? The answer usually given is that the quantity of money increased – too much paper money chasing too few candy bars.

A more satisfying explanation, casual though it may be, is to recognize that the global economy has grown considerably more complex since 1950, and the system of money, banking, and credit more complex along with it. The price of the candy bar wasn’t going to return to its previous level, no matter what the Fed or the candy-manufacturers did.

I’ve believed this for forty years, since writing The Idea of Economic Complexity, which appeared in 1984. While nothing has happened to change my mind, it has been interesting, at least to me, to have spent a few Saturdays thinking about what I have learned since then. Let me sum it up with a last few words of explanation, before putting it away.

At the moment, the jolt to increased economic complexity has to do with Russia’s war on Ukraine, the post-Cold War expansion of the NATO alliance and long-lasting disruptions of world trade stemming from the COVID pandemic. These “cost-push” factors are more fundamental to today’s rising prices, I believe, than whatever misjudgments that monetary authorities have made in responding to them. But arguing about recent events is the wrong way to develop views about phenomena as mysterious as the formation of money prices. For that, long-term developments serve best.

The price revolution of the 16th Century is the best example in the last thousand years of a lengthy, unreversed increase in money prices of everyday things. Its magnitude was modest by current standards; but then, so were monetary systems in those days. Between 1501 and 1650, prices of everyday goods across Europe rose six-fold before leveling off and remaining more or less stable on a new level for the next hundred years.

Practically from the beginning, scholars have argued about whether the discovery of the riches of Spanish America initiated the price revolution, or whether the voyages of discovery were undertaken in response to European events already underway. Jehan Cherruyt de Malenstroit blamed rising prices on shortages of precious metals and the extravagance of kings. In a widely read rejoinder, philosophe Jean Bodin, in 1568, ascribed rising prices to the influence of the treasure of The Americas – such was the beginning of what we have called ever since the quantity theory of money.

Economic historians were still arguing about these matters four centuries later. In American Treasure and the Price Revolution in Spain, Earl Hamilton wrote, in 1934, that an “extremely close correlation” between growth in the volume of gold and silver imports from the New World and commodity prices in Spain “demonstrated beyond question” that the abundance of mines in New Spain was “the principal cause” of the price revolution. In Economic Development and the Price Level, in 1962, Geoffrey Maynard argued the opposite: that money generally adjusts to trade, rather than trade to money. In very different formats, the argument continues today.

“Development” is a bland word with which to describe the difference between the world economy in the time of Columbus and the world today. Economic philosopher David Ellerman has suggested that diversity describes the key difference, grounding his description in information theory; I proposed complexity in that 1984 book. But what is it that has become more diverse or complex? Not until I read “Increasing Returns an Economic Progress” (1928), by Allyn Young, did it occur to me that the growing complexity I had been thinking about were increases, of one sort or another, in the division of labor.

And there I left the subject behind. I was working for a magazine when I began writing about price history, complexity and plenitude, an exotic argument about the tacit assumptions of quantity theory of money, gleaned from reading Arthur O. Lovejoy’s The Great Chain of Being (1936). Magazines are lightweight vessels, quick to maneuver in pursuit of advantage, quick to move on. There was no way I could continue to write about economics.

Fortunately, I made my way to a serious newspaper. I finished the book I had begun, and soon put complexity behind me – until this spring, when I briefly took it out to re-examine it. Meanwhile, I had become an economic journalist, following the profession. I stumble on developments in growth theory, and these, too, eventually became a book, Knowledge and the Wealth of Nations: A Story of Economic Discovery (2006).

So what have I learned? That journalism is about knowing, whereas economics is about proving. A great deal more truth can become known than can be proved, as physicist Richard Feynman once said. Complexity of the division of labor is still out there. Economists will get to it someday. See, for example, Hendrick Houthakker, “Economics and Biology: Specialization and Speciation” (1955). In the meantime, there are other important stories, happening now.

In case you are feeling unsatisfied, though, remember that five-cent candy bar. Are you comfortable with the too-much-money-chasing-too-few-goods story? Do you believe that the Fed could have prevented the rise in its price? And if wasn’t “inflation,” then what was it? The depreciation of money, relative to goods?

As with the 16th Century voyages of discovery, money follows development and development follows money. If you have only the quantity theory of money to rely on, you don’t know what is going on.

David Warsh, a veteran columnist and an economic historian, is proprietor of Somerville-based economicprincipals.com, where this essay first ran.