Chris Powell: Racism? Get specific; pass Larson’s Social Security bill

The village of Thompsonville, in Enfield, Conn. Thompsonville was established in the 19th Century as a carpet-manufacturing center. Orrin Thompson, for whom the community is named, built a dam across Freshwater Brook in 1828 and opened the first carpet mill in 1829. Thompson's first mill employed skilled weavers brought from Scotland.

Carpeting continued to be manufactured in Thompsonville until 1971, by which time most production had shifted to the southern United States.

— Photo by Mirandalovely (talk)

MANCHESTER, Conn.

How racist is Enfield, Conn.? Town government's overreaction to a recent disgraceful but trivial incident is giving the impression that the town has become the northern headquarters of the Ku Klux Klan, even though the incident could have happened anywhere.

It occurred as members of the Enfield High School football team were knocking on doors throughout town soliciting financial donations. At one door a Black player was scorned and sent away with a racial epithet from the resident. Police investigated but determined that, abhorrent as the resident's conduct was, there was no cause for arrest.

Whereupon town government convened another of those "community conversations on race," as if the whole town needed to be lectured on decent behavior.

Maybe Enfield really is that hateful. But if so, specific evidence of anything seriously wrong in town regarding race has not been reported and was not produced at the first "community conversation," which drew about 200 people to Enfield High School. Instead the moderator urged people to examine their own consciences about race, as if some might be obliged to make confession.

In the absence of evidence apart from a single small incident, summoning a "community conversation" was presumptuous, if also politically correct.

Enfield and other towns should have a "community conversation" on race, but of a different sort — that is, regular hearings to air specific complaints about racism in town and to investigate them.

The perpetrator of the insult to the high-school football player is known to police, the player and others and should be invited to the first such hearing along with the insulted player for questioning and discussion. Other witnesses to what they consider racism in town should come forward too and their complaints should be followed up at future hearings, with the accused people and institutions invited. Town officials and residents then could discuss what if anything should be done.

Such procedure would generate real and relevant conversations, not the pious and irrelevant handwringing of the first "community conversation." Far more than such handwringing, a hearing on specifics might deter racists, warning them that they might be held accountable in public for their hatefulness.

More likely, of course, such a procedure would generate few if any complaints of racism in Enfield. Maybe then the town could begin to get its good name back and, along with Connecticut generally, might pay less attention to the occasional, and trivial misconduct of jerks on their own doorsteps and more attention to the state's longstanding racial disparities.

Those disparities include the racial-performance gap in education, zoning's obstruction of racial and economic integration, and welfare policy's destruction of the family and creation of a racial underclass.

Obsessing about occasional racist epithets uttered by nobodies is a pathetic copout.

xxx

As they campaign for re-election, Democrats on the national and state level are touting lots of new programs created in the name of alleviating poverty, even as soaring inflation, caused in part by the explosion of those programs and other government spending, erases the programs' benefits.

Meanwhile, the nation's most comprehensive anti-poverty program, Social Security, is eroding under that inflation even as Connecticut's own U.S. Rep. John B. Larson bravely keeps pressing legislation to improve the system's benefits and finances.

But according to a recent report in Politico, Larson's Social Security bill is being blocked not by the usual retrograde Republicans in Congress but by the Democratic leader in the House, Speaker Nancy Pelosi.

Larson's bill isn't another giveaway to be financed by debt and inflation. It would be financed largely by eliminating the limit on Social Security taxes paid by high earners, whose Social Security taxes now are capped at the first $400,000 of annual income.

Pelosi and her husband have gotten rich trading stocks whose values are heavily affected by the federal legislation she steers and votes on. Her party should push her out of the way and pass Larson's Social Security bill while the Democrats still have a majority in Congress and a president who would sign it.

Chris Powell is a columnist for the Journal Inquirer, in Manchester. He can be reached at CPowell@JournalInquirer.com.

Sam Pizzigati: Biden tax plan would reduce inequality

“The tax collector's office,’’ by Pieter Brueghel the Younger (1640)

Via OtherWords.org

BOSTON

Want to know where the 2020 presidential election is heading? Don’t obsess about the polls. Pay attention to tax lawyers and accountants.

These experts in reducing rich people’s tax bills understand what many Americans still haven’t quite fathomed: The nation’s wealthiest will likely pay significantly more in taxes if Joe Biden becomes president.

Why? Because the massive tax cuts for corporations and the rich that Trump and the GOP passed in 2017 may soon be shredded.

If these rich don’t take immediate steps to “protect their fortunes,” their law firms are advising, they could lose out big-time. “We’ve been telling people: ‘Use it or lose it,’” says Jere Doyle, a strategist at BNY Mellon Wealth Management.

At first, these concerns may appear overblown. Under Biden’s plan, the tax rate on America’s top income tax bracket would only rise from 37 percent back up to 39.6 percent, the Obama-era rate.

But the real “backbreakers” for the rich come elsewhere.

Among the biggest: a new tax treatment for “investment income,” the money that rich people make buying and selling assets.

Most of this income currently enjoys a super-discounted tax rate — just 20 percent, far lower than what most working people pay on their paycheck income. The Biden tax plan ends this favorable treatment of income from “capital gains” for taxpayers making over $1 million. It would also close the loophole where wealthy people simply pass appreciated assets to their heirs.

Biden is also proposing an overhaul of Social Security taxes. The current 12.4 percent Social Security payroll tax — half paid by employers, half by employees — applies this year to only the first $137,700 in paycheck earnings, a figure that gets annually adjusted to inflation.

That means that a corporate exec who makes $1 million this year will pay the same amount into Social Security as a person who makes $137,700.

Biden’s plan would apply the Social Security tax to all paycheck income over $400,000, so America’s deepest pockets would pay substantially more to support Social Security. Meanwhile Americans making under $400,000 would continue to pay at current levels.

Corporations would also pay more in taxes. Biden would raise the standard corporate income tax rate from 21 to 28 percent, set a 15 percent minimum tax on corporate profits, and double the current minimum tax foreign subsidiaries of U.S. companies have to pay from 10.5 to 21 percent.

Among other changes: Big Pharma companies would no longer get tax deductions for what they spend on advertising. Real estate moguls would no longer be able to depreciate the rental housing they own on an accelerated schedule, and fossil-fuel companies would lose a variety of lucrative tax preferences.

Together, these ideas could measurably reduce inequality.

The Institute on Taxation and Economic Policy has crunched the numbers: In 2022, under Biden’s plan, the nation’s top 1 percent would bear 97 percent of the direct tax increases Biden is proposing. The next most affluent 4 percent would bear the remaining 3 percent.

Despite some misleading Republican talking points to the contrary, no households making under $400,000 — the vast majority of Americans — would see their direct taxes rise.

Even if Democrats win the Senate, actually passing this plan will take grassroots pressure — the only force that has ever significantly raised taxes on the rich.

Wealth inequality remains an even greater challenge, and the Biden plan includes no wealth tax along the lines of what Senators Bernie Sanders and Elizabeth Warren, two of Biden’s primary rivals, advocated. But more pressure could also shove that wealth tax onto the table.

If that happens, we might finally begin to reverse the staggering levels of inequality that Ronald Reagan’s 1980 election ushered in.

Sam Pizzigati, based in Boston, is the co-editor of Inequality.org and author of The Case for a Maximum Wage and The Rich Don’t Always Win.

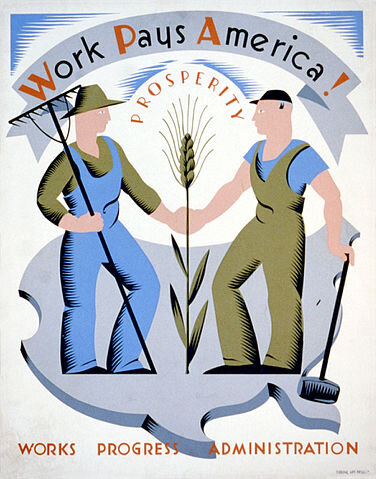

Llewellyn King: To revive America, fix the gig economy and bring back the WPA

McCoy Stadium, in Pawtucket, R.I., was a WPA project….

…and so was this field House and pump station in Scituate, Mass.

The assumption is that we’ll return to work when COVID-19 is contained, or we have adequate vaccines to deal with it.

That assumption is wrong. For many millions, maybe tens of millions, there will be no work to return to.

At root is a belief that the United States -- and much of the world -- will spring back as it did after the 2008 recession: battered but intact.

Fact is, we won’t. Many of today’s jobs won’t exist anymore. Many small businesses will simply, as the old phrase says, go to the wall. And large ones will be forced to downsize, abandoning marginal endeavors.

When we think of small businesses, we think of franchised shops or restaurants and manufacturers that sell through giants like Amazon and Walmart. But the shrinkage certainly goes further and deeper.

Retailing across the board is in trouble, from the big-box chains to the mom-and-pop clothing stores. The big retailers were reeling well before the coronavirus crisis. Neiman Marcus, an iconic luxury retailer, has filed for bankruptcy. All are hurt, some so much so – especially malls -- that they may be looking to a bleak future.

The supply chain will drive some companies out of business. Small manufacturers may find that their raw material suppliers are no longer there or that the supply chain has collapsed – for example, the clothing manufacturer who can’t get cloth from Italy, dye from Japan or fastenings from China. Over the years, supply chains have become notoriously tight as efficiency has become a business byword.

Some will adapt, some won’t be able to do so. A record 26.5 million Americans have sought unemployment benefits over the past five weeks. Official unemployment numbers have always been on the low side as there’s no way of counting those who’ve given up, those who work in the gray economy, and those who for other reasons, like fear of officialdom or lack of computer skills, haven’t applied for unemployment benefits.

To deal with this situation the government will have to be nimble and imaginative. The idea that the economy will bounce back in a classic V-shape is likely to prove illusory.

The natural response will be for more government handouts. But that won’t solve the systemic problem and will introduce a problem of its own: The dole will build up dependence.

I see two solutions, both of which will require political imagination and fortitude. First, boost the gig economy (contract and casual work) and provide gig workers with the basic structure that formal workers enjoy: Social Security, collective health insurance, unemployment insurance and workers’ compensation. The gig worker, whether cutting lawns, creating Web sites, or driving for a ride-sharing company, should be brought into the established employment fold; they’re employed but differently.

Second, a new Works Progress Administration (WPA) should be created using government and private funding and concentrating on the infrastructure. The WPA, created by President Franklin D. Roosevelt in 1935, ended up employing 8.5 million Americans, out of a total population of 127.3 million, in projects ranging from mural painting to bridge building. Its impact for good was enormous. It fed the hungry with dignity, not the soup kitchen and bread line, and gave America a gift that has kept on giving to this day.

Jarrod Hazelton, a Rhode Island-based economist who’s researched the WPA, says the agency gave us 280,000 miles of repaired roads, almost 30,000 new and repaired bridges, 600 new airports, thousands of new schools, innumerable arts programs, and 24 million planted trees. It also enabled workers to acquire skills and escape the dead-end jobs they’d lost. It was one of the most successful public-private programs in all of history.

As the sea levels rise and the climate deteriorates, we’ll need a WPA, tied in with the Army Corps of Engineers, to help the nation flourish in the decades of challenge ahead. The original was created by FDR with a simple executive order.

Llewellyn King is executive producer and host of White House Chronicle, on PBS. His e-mail address is llewellynking1@gmail.com and he’s based in Rhode Island and Washington, D.C.

Chris Powell: Social Security benefits can and should be expanded

How disappointing that the leadership of the Republican minority in the U.S. House has dismissed peremptorily Connecticut Rep. John B. Larson's legislation to keep Social Security solvent for a century while improving benefits. Though the bill seems likely to pass the House, given the Democratic majority there, it won't go anywhere in the Senate, where the majority is Republican, unless Republicans in the House support it.

Republicans complain that Larson's bill costs too much. But the increases that the bill would make in Social Security taxes are small and gradual, and much of the new revenue would come from higher incomes that now escape Social Security taxation. Besides, if taxing too much for Social Security is a problem, why do the Republicans seem to think that the forever war in Afghanistan is a necessity and a bargain?

Yes, as the Republicans complain, under Larson's bill poorer people would receive more in benefits than they contributed in Social Security taxes. But so what? Social Security is already largely a matter of income redistribution, just as all government itself in a progressive tax framework is redistribution. All private forms of insurance are redistribution, too. But few things government does are as compelling as Social Security.

Only military contractors benefit from Afghanistan. That is income redistribution too but Republicans don't complain about it.

Call Social Security welfare if you want, but it profoundly incentivizes and rewards work, for people earn benefits only through working or their relationship to someone who worked. It is a retirement savings plan and disability insurance policy that cannot fail as long as the United States endures. Larson pointedly asks: "Where in the private sector can you buy this package of benefits that is there for all Americans? You can't. It doesn't exist."

Further, if, as the Larson bill envisions, improved Social Security benefits prevent people from retiring into poverty, money circulating in the economy will increase, because poorer people will spend most of their benefit on necessities. Meanwhile, with fewer people retiring into poverty, fewer people will rely on other welfare benefits.

Of course, details of the Larson bill are arguable, particularly the levels of taxation and benefits. But the aging of the population is expected to make the Social Security Trust Fund insolvent by 2035 if its revenue isn't increased or benefits reduced, and then Social Security will be competing for ordinary appropriations every year with other government functions -- including the usual stupid imperial wars -- even as maintaining the social insurance system should have priority.

There is no disputing the demographics. They will make Social Security insolvent in less than 20 years unless something is done, and doing nothing means cutting benefits even as income inequality worsens. Will that really be the Republican plan?

xxx

WHERE ARE THE LIBERALS?: The office of Connecticut Atty. Gen. William Tong says it is working with the U.S. Justice Department's Antitrust Division to review the planned acquisition of United Bank by People's United Bank, which would sharply reduce competition in banking in central Connecticut and western Massachusetts. At least someone is paying attention.

But Governor Lamont and state legislators, even those who portray themselves as liberals, have nothing to say about this consolidation in the banking industry and the loss of many bank branches and hundreds of jobs. The trivialities liberal legislators applaud have little bearing on Connecticut, but preserving economic competition is vital.

Chris Powell is a columnist for the Journal Inquirer, in Manchester, Connecticut.

Bob Lord: The $170 billion lie in the GOP tax plan

Via OtherWords.org

House Republicans and Donald Trump are ballyhooing the wonders of their new tax plan. It’s called the “Tax Cuts and Jobs Act,” which we’re told will mean “More Jobs, Fairer Taxes, and Bigger Paychecks.”

Hallelujah! We can see the Promised Land!

But before we pop the champagne corks, let’s double-check the sticker price: $1.5 trillion over the next decade. That’s just shy of $5,000 for every man, woman and child in America. For a nation over $20 trillion in debt, that seems pricey.

But that’s only the beginning. The deeper costs of their tax plan are so large and so obvious that the failure of Republican leaders to disclose them is, for all practical purposes, a lie.

The premise of the House plan is, in fact, a $170 billion lie.

The vast majority of these proposed cuts — some 80 percent — go to the top of the income ladder. But to sell the plan as beneficial to the middle class, Republican House leaders included a tax credit of $300 for each family member, plus a larger credit of $1,600 for kids under 17.

Without that “Family Flexibility Credit,” the House plan would be a net benefit to far fewer families. Remarkably, however, the House Republicans crafted the Family Flexibility Credit to expire after only five years — after which middle-class families with college-aged kids will see a big tax hike.

So will the break be extended? Republican leaders promise it will be. But the $170 billion cost of extending the Family Flexibility Credit through 2027 isn’t included in the stated cost of their plan.

It’s worse than just that. The repeal of the federal estate tax, which is exclusively paid by a handful of multimillionaire families, will indirectly allow ultra-wealthy Americans and their heirs to avoid tens of billions in income tax. That lost income tax revenue isn’t reflected in the stated cost of the House plan either.

Nor are the tens, perhaps hundreds, of billions in revenue that will be lost when tax lawyers develop structures to squeeze tax savings out of the new 25 percent tax rate for so-called “business income” — a big discount from the otherwise applicable top rate of nearly 40 percent.

Amendments to address the concerns of powerful interest groups will likely raise the cost further. One example: A concern raised by multinational corporations regarding an excise tax provision was addressed by the House Ways and Means Committee, increasing the cost of the plan by $60 billion.

Even regular people will make adjustments that drive up the cost of the plan.

To minimize the impact of rules reducing the tax benefits they get from charitable contributions, some will bunch several years’ worth of gifts into a single year. If they no longer get a tax benefit from paying mortgage interest, some will forgo other investments that generate taxable income to pay their mortgages down at a faster rate.

None of this is news to Republican House tax writers.

But if their plan becomes law, you can count on those same Republicans to tell us how Social Security and Medicare benefits are driving the national debt too high and must be cut. In reality, they caused the problem themselves, by lying about the costs of their huge giveaway to the rich.

And that stinks.

Bob Lord is a veteran tax lawyer who practices and blogs in Phoenix. He’s an associate fellow of the Institute for Policy Studies.

Triumph of the old

From Robert Whitcomb's "Digital Diary'' in GoLocal24.com

U.S. public policy helps the old far more than the young. Consideran International Monetary Fund study that found that the lifetime net tax benefit in the U.S. – that is, the value of what we receive in government benefits compared to the taxes we pay – is positive for everybody over 18 but with the biggest benefit for those over 50.

But of course deficit spending (i.e., borrowing from the Chinese, etc.) has been paying for much of this. That suggests that eventually, younger people must pay much more in the new few years to cover the cost of old people on Medicare and Social Security.

The attitude of many oldsters is: “Don't cut my Medicare, don’t cut my Social Security; I paid for those benefits!’’ Well, they only paid for part of them. As long as so many young people decline to take 20 minutes to vote, the heavy-voting oldsters will get an ever bigger slice of the pie.

Trump's 'pluto-populism'

Adapted from an item in Robert Whitcomb's "Digital Diary'' in GoLocal24.com

The Trump budget proposal is filled with so many bogus assumptions and so much creative accounting it’s hard to take any of it seriously. Indeed, people in both parties on Capitol Hill are treating it as a joke.

But there is a central, cohering direction – make America’s put-upon rich people even richer while sticking it to poorer people, many of whom, deluded by Trump’s demagoguery and such right-wing propaganda organs as Fox “News,’’ voted for the mogul. (Meanwhile, many Democrat-inclined people were too lazy tomake it to the polls.) You have to give the hateand fake-conspiracy peddlers at Fox credit – the network has very good production values.

Of course, the richer the rich get, the more they control the government and the more that they’re able to further enrich themselves in a vicious or at least lucrative circle.

An essential part of the Trump budget is the assumption, or, rather, assertion, that it will somehow be paid for by increased economic growth – more of what George H.W. Bush used to call “voodoo economics.’’ The promise is that annual gross domestic product growth will rise to 3 percent, even as the nonpartisan Congressional Budget Office projects only a 1.9 percent rate. That’s because the CBO technicians wisely take into consideration, among other things, our aging population and falling productivity.

Most administrations – including Obama’s – havecooked (or massaged?) the books and often projected considerably higher GDP growth than happens. But the assumptions in the Trump plan are particularly egregious given the Niagara of retiring Baby Boomers and the big proposed tax cuts.

For many Boomers, by the way – especially the richer ones -- Trump is relatively kindly. Older white Baby Boomers vote heavily Republican, and he has vowed not to touch gigantically expensive Medicare or regular Social Security – by far the two biggest entitlement programs – which of course benefit them.

He promised in the campaign not to cut Medicaid. Now he wants to slash Medicaid, Food Stamps and Social Security Disability Insurance. That isn’t to say that Medicaid can’t use some major improvements, such as reducing the amount of unnecessary care and in some cases including work requirements for recipients. And Social Security Disability Insurance has long been rife with abuse. But the fact is that most of the people who benefit from these programs are honest and truly needy. Indeed, most are far more honest than Donald Trump.

Martin Wolf, a Financial Times columnist, described Trump’s “ideology’’ well when he called it “pluto-populism” -- “policies that benefit plutocrats, justified by populist rhetoric.”

The GOP eyes gutting Social Security

Adapted From Robert Whitcomb's "Digital Diary'' in GoLocal24.com:

There's a move underway by some Trump advisers and Republican lobbyists to eliminate payroll taxes used to fund Social Security and Medicare Part A. (Medicaid is financed from general budget funds), with the ultimate aim of throwing more people on the tender mercies of Wall Street to finance their retirements.

Associated Press writers Josh Boak and Stephen Ohlemacher reported: “This approach would give a worker earning $60,000 a year an additional $3,720 in take-home pay, a possible win that lawmakers could highlight back in their districts even though it would involve changing the funding mechanism for Social Security, according to a lobbyist, who asked for anonymity to discuss the proposal without disrupting early negotiations.’’

Well, yes, that might be an initially popular way to destroy Social Security. The George W. Bush administration tried to give Wall Street lots of Social Security cash. But the public, understandably doubtful that people in the financial-services industry would put customers’ interests first, pushed back. Then came the Great Crash of 2008….

Jim Hightower: Hypocrite House speaker should spare us his lectures on morality of entitlements

Via OtherWords.org

For nearly half a century now, America’s middle-class working families have been pummeled by corporate greedmeisters and their political henchmen.

Indeed, during the recession, the typical median-income family has lost 40 percent of their wealth. Haven’t they been punished enough?

No, says U.S. House Speaker Paul Ryan.

Along with other top Republican leaders of Congress, he intends to slash the Social Security money that middle-class and low-income workers depend on for their retirement, and he ultimately aims to kill it altogether.

Dependence on such public “entitlements,” he preaches, weakens our nation’s morality.

Entitlements? Social Security isn’t a welfare program — regular working people pay a 12-percent tax on every dime of their wages into this public pension fund year after year. They earn their retirement.

Morality? Social Security embodies America’s core moral value of fairness and our society’s commitment to the common good. And it works: Before it was enacted, half of all Americans spent their “golden years” in poverty.

Social Security has saved the great majority of us from old-age penury. Where is the morality in stealing away this earned retirement — and the modicum of dignity that comes with it — from millions?

Besides, a sermon on the morality of entitlements should never come from a congress critter’s mouth.

Ryan himself wallows in a mud pit of congressional entitlements that working stiffs couldn’t imagine getting: A $223,500 annual paycheck, a free limousine and chauffeur, a maximum-coverage health plan, a tax-paid PR agent, a lavish expense account, free travel — and, of course, a platinum-level congressional retirement program funded by the very taxpayers whose Social Security he’s out to kill.

Yet Ryan wonders why Congress’ public approval rating is plummeting toward single digits.

Jim Hightower is a radio commentator, writer, and public speaker. He’s also the editor of the populist newsletter, The Hightower Lowdown.

More goodies for the elderly

"Untitled,'' by HELEN PAYNE, in the "Helen Payne: Becoming Four Women'' show at the New Art Center, Newtonville, Mass., Nov. 21-Dec. 20.

"Untitled,'' by HELEN PAYNE, in the "Helen Payne: Becoming Four Women'' show at the New Art Center, Newtonville, Mass., Nov. 21-Dec. 20.

Rhode Island politicians are falling over themselves to pander to the high-voting elderly by promising them that they'll pass a law to exempt the old folks (I'm one of them) from having to pay state income taxes on Social Security and pension money.

This means another goodie for the most affluent part of society and another transfer from those who earn their income to those who live on investments of various kinds, in which I'd include pensions and Social Security.

The lost tax revenue will have to be made up by younger, poorer people. If more of the latter bestirred themselves to vote, there would be a lot less of this growing inequity between the age cohorts. Serves them right.

This is what you get in a country where in the election last week, only 36.4 percent of eligible voters bothered to vote and the national outcome was decided by about 20 percent of eligible voters.

-- Robert Whitcomb