Live off Mass. or tax

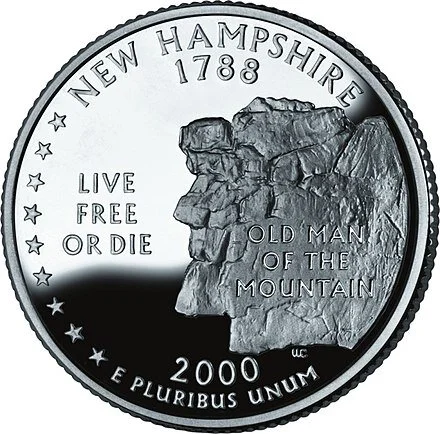

The New Hampshire quarter

From Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

I’m rather sympathetic to Massachusetts on this one.

The U.S. Supreme Court has (surprisingly to me) declined to hear a suit seeking to bar Massachusetts from taxing people employed by Bay State companies but working remotely at home in New Hampshire since the pandemic began.

Still, this is temporary. After Sept. 13, Massachusetts will return to its prior rule, in which it will only tax workers for pay they get as a result of physically working in the state. The temporary tax move was meant to reduce the sudden fiscal hit from COVID-19.

New Hampshire (of which I’m a former resident, as I am of Massachusetts) has long been something of a parasite of the Bay State. While Massachusetts residents pay for the physical and social (especially education) infrastructure that has long made it among the two or three richest states, New Hampshire people who benefit from their proximity to it pay no state income or sales taxes, though the Granite State does have some high property and business taxes. They’re getting a nice ride.

Massachusetts’s investments in infrastructure spill over into the Granite State, whose south has become part of that great wealth-creation machine of Greater Boston, much of it stemming from its higher-education and technology complex. It seems only fair that beneficiaries of that machine who work for Massachusetts firms chip in to help keep it going.