‘The mirror we are in’

“September Light,’’ by Susan Lirakis, in her show “Past and Future Memory,’’ at AVA Gallery and Art Center, Lebanon, N.H., through Aug 9.

The gallery says:

“Susan Lirakis elevates ordinary moments with a sense of reverence. She presents her photographic images using various techniques, including gelatin silver prints, cyanotypes, pigment prints, and some adorned with gold or silver leafing…. Several images incorporate a mirror in the camera, allowing us to look forward while simultaneously reflecting backward, capturing a sense of being in the present moment. Does this dual perspective change our view of the present or how we perceive time? Does it illustrate how the past influences our understanding of the present and our outlook on the future? The use of blurred and interpretive imagery prompts us to contemplate the kind of mirror we are in this context.’’

Chris Powell: Does Trump’s budget doom Conn.?

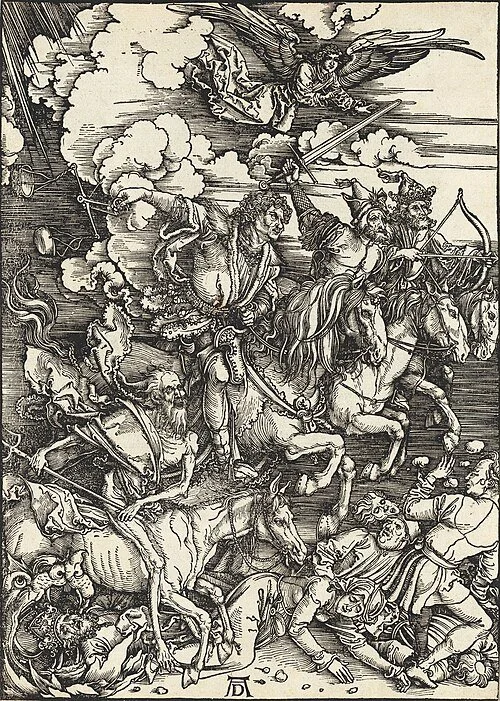

“Four Horsemen of The Apocalypse” (woodcut print), by Albrecht Dürer (1461-1529)

MANCHESTER, Conn.

According to Connecticut Gov. Ned Lamont, the federal budget just enacted by the Republican majority in Congress and President Trump is nearly the end of the world.

The governor says the budget will have “devastating impact on millions of Americans for years to come and was passed for the sole purpose of giving tax cuts to millionaires and billionaires. It will amount to a massive income transfer from the poorest and most vulnerable Americans to the wealthiest."

But Dan Haar of the Hearst Connecticut newspapers reports that, by quadrupling to $40,000 the federal income tax deductibility of state and local taxes -- the “SALT" deduction, which Democratic leaders in Connecticut and other high-tax states long have supported -- the new budget will substantially reduce federal income taxes for hundreds of thousands of middle- and upper-middle class Connecticut households.

As for the “massive income transfer from the poorest and most vulnerable Americans to the wealthiest," the poor don't pay federal income taxes, nor, in Connecticut, state income taxes. The “income" for the poor about which the governor is worried is actually what in a less politically correct era was called welfare.

The governor says the new budget will “bankrupt" the federal government by running a deficit in the trillions of dollars, requiring borrowing to cover the gap. But the federal government has long run huge deficits under Democratic administrations as well, which never bothered Democrats in Connecticut. Besides, since the government can create money out of nothing, it can never go bankrupt; it can only continue to devalue the dollar -- something else that has never bothered Connecticut Democrats.

The new budget, the governor says, “slashes critical safety-net programs, particularly Medicaid and SNAP" -- food subsidies -- "that so many hard-working American families need for their health and survival."

Yet in recent days there have been reports from all around the country about massive fraud in the Medicaid, Medicare, and SNAP programs -- some involving providers in Connecticut.

Indeed, a few months ago the governor's own public health and social services commissioner retired after it was disclosed that she had countenanced the termination of an audit of Medicaid fraud in which the governor's former deputy budget director and a former Democratic state representative have been indicted and a Bristol doctor has pleaded guilty.

Just the other week state prosecutors charged an acupuncturist from Milford with defrauding Medicaid of $123,000.

All this fraud doesn't mean that the Republican administration in Washington or the Democratic administration in Connecticut will be competent and determined enough to substantially reduce fraud in Medicaid, Medicare and food subsidies. But maybe a reduction in those appropriations is necessary to provide some incentive to look harder.

“With a federal administration insistent on eliminating critical safety nets," the governor said, “it is going to be nearly impossible for any state to backfill the billions in federal cuts we are going to face. … We will be meeting with our colleagues in the General Assembly to discuss next steps."

Those next steps may be interesting.

Will the federal cuts in Medicaid and food subsidies be so compelling as to cause the governor and legislators to cancel any of the grants they grandly announce practically every week for all sorts of inessential projects around the state?

Will the cuts be so compelling as to cause the governor to reconsider the blank check his administration has issued for illegal immigration?

Will the cuts be so compelling as to cause the governor to reconsider the pledge he made to the state employee unions in April? “Every year that I've been here you've gotten a raise," he told the unions, “and every year I'm here, you're going to get a raise."

Raises despite the cuts in the safety net? Despite natural disasters? Despite plague? Despite nuclear war?

Or will the cuts prompt the governor to call the legislature into special session, proclaim that state government simply can't economize, and propose to raise taxes going into an election year?

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Llewellyn King: How crowdfunding brought a new wind technology to market

WEST WARWICK, R.I.

A California company, Wind Harvest, is in high gear to change the dynamics of wind energy and to vastly improve the economics of wind farms.

But the company wouldn’t be marketing to large energy users and wind farm operators today if it hadn’t used crowdfunding for its recent rounds of financing. Crowdfunding can get a startup over the hill.

Kevin Wolf, Wind Harvest co-founder and CEO, explained that developers of hardware face a double problem when it comes to financing: The banks won’t finance their customers’ projects until the technology has been certified and, in Wind Harvest’s case, dozens of their unique wind turbines have been operating for at least a year which requires money.

Wolf said, “It takes about two years to complete a ‘technology readiness level,’ unless a company is well-funded. Six months to have all the components arrive, six months to a year to install and fully test the prototype, and then another six months to complete the new design.” Meantime, a team of engineers and the bills have to be paid.

Venture capitalists have shown a decided disinclination to finance hardware, preferring computer-related software products, he said.

But with crowdfunding, often through a special-purpose company, thousands of individuals have become venture capitalists in companies like Wind Harvest. Many of those investors have hit it big.

Two standout companies which grew into multi-billion dollar ones: Oculus VR and Peloton.

Oculus, the virtual-reality technology company, used crowdfunding to raise $250,000 in 2012. Two years later, it was acquired by Facebook for $2 billion.

Peloton, the fitness company, started with crowdfunding of $307,000, achieved a valuation of $8.1 billion its initial public offering, and rose to astronomically high valuations during the Covid pandemic. It has now fallen back considerably, after many difficulties in the fitness industry.

Wind Harvest is essentially offering new infrastructure which, should it catch on, would give it a steady and fairly predictable path forward as both a wind turbine Original Equipment Manufacturer and as a renewable energy project developer.

The company’s product, trademarked as Wind Harvester, is a vertical-axis wind turbine (VAWT): The drive shaft and the electrical generator are aligned vertical to the ground. In traditional wind turbines, those components are horizontal to the ground.

The most famous vertical-axis wind turbine is the Darrieus, named after a French engineer who patented it in 1926. It has an elegant, eggbeater shape almost like a fine outdoor sculpture. But it ran into problems with vibration and other technical drawbacks and wasn’t a commercial success.

At the outset of the 1973-1974 energy crisis, in 1973, Sandia National Laboratory in New Mexico, one of the jewels in the crown of the national laboratory system, did considerable theoretical work on wind turbines, concentrating on vertical-axis designs. But when the research was moved to another laboratory, the horizontal-axis wind turbine (HAWT) became the focus.

The codes developed at Sandia are foundational to the Wind Harvest design. Wolf explained that the choice between VAWTs and HAWTs isn’t an either-or choice, except where wind shears are high and wind near the ground slows down. Then tall, horizontal-axis wind turbines have the advantage.

Wind Harvest turbines are designed to capture the wind on ridgelines, hills and mountain passes where wind funnels and accelerates turbines under the tall horizontal-axis turbines. VAWTs can take advantage of the powerful wind that swirls around near the ground. This turbulent wind at the surface is an unused resource now.

With the bottom of their blades between 25 feet and 50 feet off the ground and installed in pairs 3 feet apart from each, Wind Harvest turbines can double the output of electricity from a wind farm while still leaving enough clearance for agriculture, whether it is grazing animals or growing crops. So, add efficiency to the virtues of these turbines: better use of the wind resources, land and infrastructure.

Thanks to crowdfunding in four tranches, Wind Harvest is now ready to go to market with utility scale installations.

Wolf listed these additional virtues for VAWTs:

They can be entirely made in America. Right now their blades are extruded by Step-G in Germany.

They are designed to withstand the 180 mph wind gusts from a Category 5 hurricane.

Because they are short, they can use larger permanent magnet generators (PMGs) not made of rare earth magnets. For example, their PMGs can use ferrite magnets which are iron-based.

Wind Harvest installations have a fatigue life of 75 years with maintenance and periodic refurbishment. Most turbines now in use must be replaced after about 25 years.

The first Wind Harvesters to be put into service are planned for a dredge-spoil-created peninsula on St. Croix, the largest of the U.S. Virgin Islands, in the Caribbean Sea. The entire output of the first phase of the project will be bought by the oil refinery adjacent to the project site and replace the burning of costly propane for generation.

Big ideas now have funding sources besides “Shark Tank,” venture capital and the banks.

On X: @llewellynking2

Bluesky: @llewellynking.bsky.social

Subscribe to Llewellyn King's File on Substack

Llewellyn King is executive producer and host of White House Chronicle, on PBS. He’s based in Rhode Island.

Plant Kingdom

“A Prickly Situation” (archival chromagenic pigment print), by Bob Stegmaier, in the group show “Flora,’’ at the Arts League of Lowell, through Sept. 7.

—Image courtesy of the Arts League of Lowell.

The curator explains:

The exhibition features the works of 45 artists, “shining a light on all types of flora. There is no end to how artists can interpret and depict the natural world. Some, like Bob Stegmaier, use photography and specific printing techniques to create interesting compositions, while others like Mary Hart and her sculptural piece “Flourish" (mixed recycled board and materials) take a more abstract and interpretive approach.’’

Looking back can be dangerous

‘‘the shape of memory’’ (installation image), by Carlie Trosclair, at the Maine Center for Contemporary Art, Rockland. through Sept. 7.

—Photo by Dave Clough

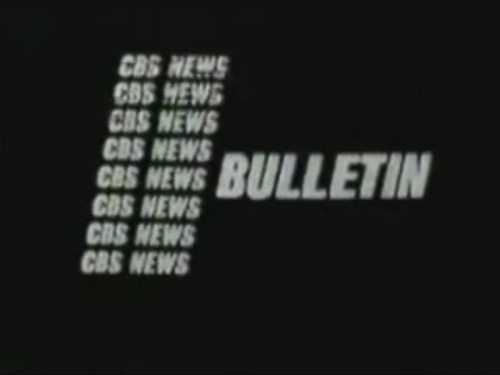

Michael J. Socolow: Will networks let autocratic Trump become their editor?

Michael J. Socolow is a professor of communication and journalism at the University of Maine.

His father, Sanford Socolow, worked for CBS News from 1956 to 1988.

ORONO, Maine

It was a surrender widely foreseen. For months, rumors abounded that Paramount would eventually settle the seemingly frivolous lawsuit brought by President Trump concerning editorial decisions in the production of a CBS interview with Democratic presidential nominee Kamala Harris in 2024.

On July 2, 2025, those rumors proved true: The settlement between Paramount and Trump’s legal team resulted in CBS’s parent company agreeing to pay $16 million to the future Donald Trump Library – the $16 million included Trump’s legal fees – in exchange for ending the lawsuit. Despite the opinion of many media law scholars and practicing attorneys who considered the lawsuit meritless, Shari Redstone, the largest shareholder of Paramount, yielded to Trump.

Redstone had been trying to sell Paramount to Skydance Media since July 2024, but the transaction was delayed by issues involving government approval.

Specifically, when the second Trump administration assumed power, on Jan. 20 2025, the new Federal Communications Commission had no legal obligation to facilitate, without scrutiny, the transfer of the CBS network’s broadcast licenses for its owned-and-operated TV stations to new ownership.

The FCC, under newly installed Republican Chairman Brendan Carr, was fully aware of the issues in the legal conflict between Trump and CBS at the time Paramount needed FCC approval for the license transfers. Without a settlement, the Paramount-Skydance deal remained in jeopardy.

Until it wasn’t.

At that point, Paramount joined Disney in implicitly apologizing for journalism produced by their TV news divisions.

Earlier in 2025, Disney had settled a different Trump lawsuit with ABC News in exchange for a $15 million donation to the future Trump Library. That lawsuit involved a dispute over the wording of the actions for which Trump was found liable in a civil lawsuit brought by E. Jean Carroll.

GOP presidential nominee Donald Trump said the CBS interview with Democratic nominee Kamala Harris was ‘‘fraudulent interference with an election.’’

It’s not certain what the ABC and CBS settlements portend, but many are predicting they will produce a “chilling effect” within the network news divisions. Such an outcome would arise from fear of new litigation, and it would install a form of internal self-censorship that would influence network journalists when deciding whether the pursuit of investigative stories involving the Trump administration would be worth the risk.

Trump has apparently succeeded where earlier presidents failed.

Presidential pressure

From Jimmy Carter trying to get CBS anchor Walter Cronkite to stop ending his evening newscasts with the number of days American hostages were being held in Iran to Richard Nixon’s administration threatening the broadcast licenses of The Washington Post’s TV stations to weaken Watergate reporting, previous presidents sought to apply editorial pressure on broadcast journalists.

But in the cases of Carter and Nixon, it didn’t work. The broadcast networks’ focus on both Watergate and the Iran hostage crisis remained unrelenting.

Nor were Nixon and Carter the first presidents seeking to influence, and possibly control, network news.

President Lyndon Johnson, who owned local TV and radio stations in Austin, Texas, regularly complained to his old friend, CBS President Frank Stanton, about what he perceived as biased TV coverage. Johnson was so furious with the CBS and NBC reporting from Vietnam, he once argued that their newscasts seemed “controlled by the Vietcong.”

Yet none of these earlier presidents won millions from the corporations that aired ethical news reporting in the public interest.

Before Trump, these conflicts mostly occurred backstage and informally, allowing the broadcasters to sidestep the damage to their credibility should any surrender to White House administrations be made public. In a “Reporter’s Notebook” on the CBS Evening News the night of the Trump settlement, anchor John Dickerson summarized the new dilemma succinctly: “Can you hold power to account when you’ve paid it millions? Can an audience trust you when it thinks you’ve traded away that trust?”

“The audience will decide that,” Dickerson continued, concluding: “Our job is to show up to honor what we witness on behalf of the people we witness it for.”

During the Iran hostage crisis, CBS News anchor Walter Cronkite ended every broadcast with the number of days the hostages had been held captive.

Holding power to account

There’s an adage in TV news: “You’re only as good as your last show.”

Soon, Skydance Media will assume control over the Paramount properties, and the new CBS will be on the airwaves.

When the licenses for KCBS in Los Angeles, WCBS in New York and the other CBS-owned-and-operated stations are transferred, we’ll learn the long-term legacy of corporate capitulation. But for now, it remains too early to judge tomorrow’s newscasts.

As a scholar of broadcast journalism and a former broadcast journalist, I recommend evaluating programs like 60 Minutes and the CBS Evening News on the record they will compile over the next three years – and the record they compiled over the past 50. The same goes for ABC World News Tonight and other ABC News programs.

A major complicating factor for the Paramount-Skydance deal was the fact that 60 Minutes has, over the past six months, broken major scoops embarrassing to the Trump administration, which led to additional scrutiny by its corporate ownership. Judged by its reporting in the first half of 2025, 60 Minutes has upheld its record of critical and independent reporting in the public interest.

If audience members want to see ethical, independent and professional broadcast journalism that holds power to account, then it’s the audience’s responsibility to tune it in. The only way to learn the consequences of these settlements is by watching future programming rather than dismissing it beforehand.

The journalists working at ABC News and CBS News understand the legacy of their organizations, and they are also aware of how their owners have cast suspicion on the news divisions’ professionalism and credibility. As Dickerson asserted, they plan to “show up” regardless of the stain, and I’d bet they’re more motivated to redeem their reputations than we expect.

I don’t think that reporters, editors and producers plan to let Donald Trump become their editor-in-chief over the next three years. But we’ll only know by watching.

New England’s only lizard

Juvenile Five-Lined Skink

Excerpted from an article by Frank Carini in ecoRI News in his series on threatened New England wildlife

“The five-lined skink is the only lizard found in New England, even though there are about 5,000 different species of lizards worldwide, according to the Connecticut Department of Energy & Environmental Protection….’’

“The small size and fragmented nature of skink populations leaves them vulnerable to ecological catastrophes, according to state officials. It’s listed as a threatened animal in Connecticut.

“The range of this species corresponds closely with the eastern deciduous forest. The Five-Lined Skink is found in southwestern New England — currently, parts of Vermont and Connecticut and historically in Massachusetts — south to northern Florida, west to Wisconsin, and in eastern Kansas, Oklahoma, and Texas. The species is at its northeastern range limit in southwestern New England.’’

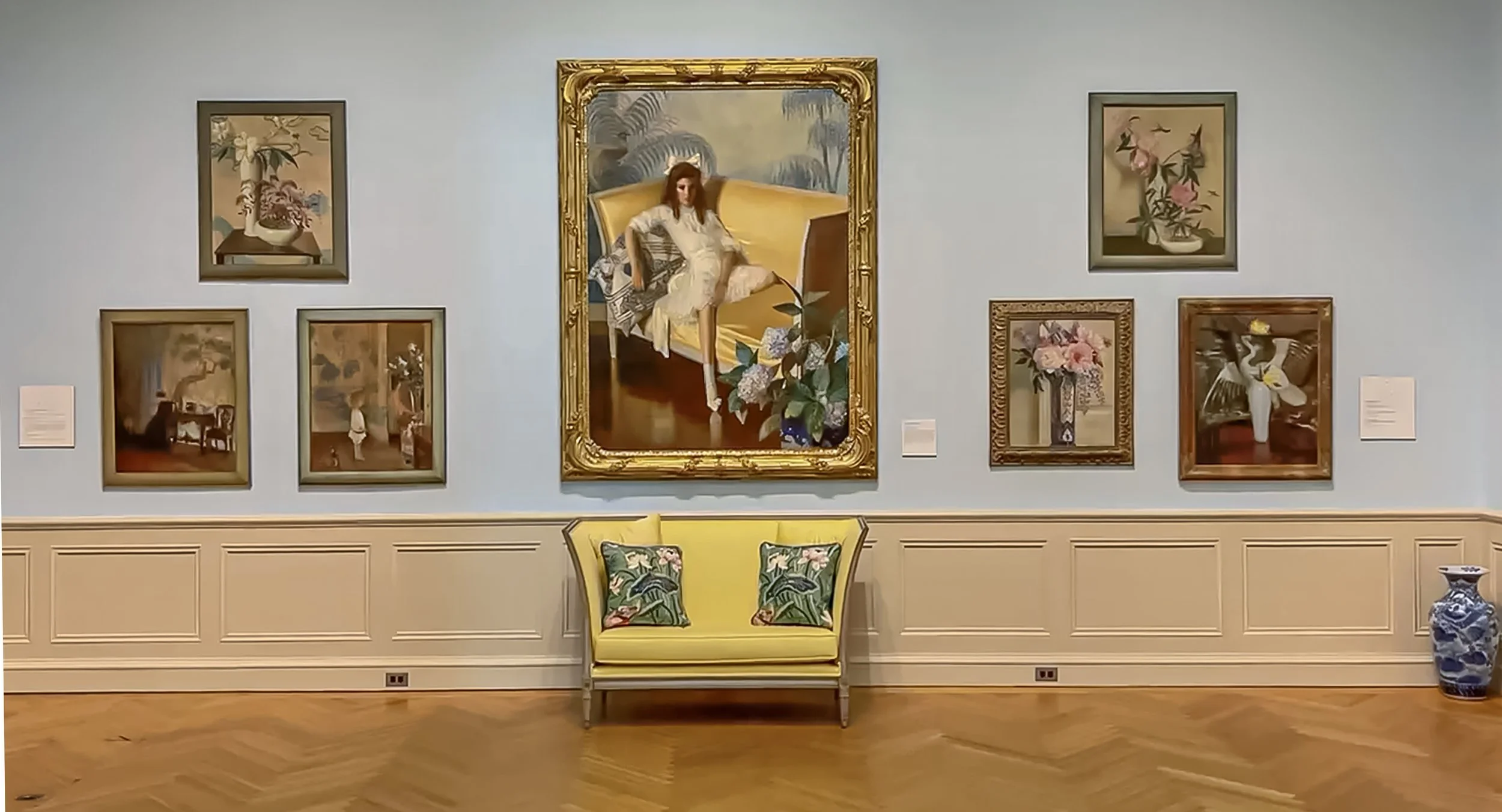

A visionary Gilded Age artist

Above, “Fantasy Landscape (Study for the Whitney Studio Mural,” circa 1911 (0il on canvas), by Howard Gardiner Cushing (1869-1916), in the show “Howard Gardiner Cushing: A Harmony of Line and Color,’’ at the Newport Art Museum, through Dec. 31

— From Private Collection

Below, installation view

— Photos by Sandy Nesbitt

The museum says:

“Curated by Ricardo Mercado and organized in Collaboration with Newport Curates, the show is a landmark exhibition celebrating the life and work of Howard Gardiner Cushing, a dynamic force in American art at the turn of the 20th Century. The exhibition is the first major retrospective in decades of one of the Gilded Age’s most visionary — and overlooked artists.’’

Whither the status of the historic Boston Fish Pier?

(New England Diary’s editor, Robert Whitcomb, is chairman of The Boston Guardian’s board but doesn’t write for the paper.)

A revived petition to grant landmark status to the Boston Fish Pier, at 212-234 Northern Avenue, is sparking debate among city officials, preservationists and business stakeholders.

As part of an effort by the Mayor Michelle Wu’s Office of Historic Preservation to move through a backlog of community- filed petitions that span several decades, a 1995 petition to grant city landmark status to the Massachusetts Port Authority-owned Fish Pier has resurfaced.

“The Fish is Pier is also an architectural treasure,” reads the 1995 petition, “a colorful marriage of Georgian simplicity and proportions and solid Romanesque archways and materials. Above the arches are scrolls and likenesses of Neptune, God of the sea. The smaller of the three buildings has decorated concrete pediments with bas relief sculpture of sea motifs.”

The age of the petition and the pier’s existing status as a state-owned property that is already on the National Register of Historic Places has raised some questions about whether another designation is necessary, and how it could affect the area’s growing businesses.

The Seaport’s city councilor, Ed Flynn, is voicing his opposition both to the potential designation and to how the process has unfolded so far.

“I don't think it’s necessary, Flynn said in an interview. “This is a Massport-owned property. It’s a state asset. It’s under regulations and guidelines established over many years by Massport and the process is working well. We don’t need to add another level of bureaucracy from the city government.”

A listing in the National Register of Historic Places puts no restrictions on what a non-federal owner may do with their property, unless the property is involved in a project that receives public funds.

Because the Fish Pier is owned by the Massport, structural changes made by the state already must go through a process dictated by the Massachusetts State Historic Preservation Office. If added to the city landmarks registry, an additional approval process, as determined by a hearing of the Boston Landmarks Commission (BLC), may need to be met.

“The project is expected to appear on the (BLC) agenda this month without any community process or notifications to neighbors or businesses,” Flynn said. “That’s a problem.”

Under the city’s landmarking procedure, once a petition is accepted, a study report is prepared to assess the historical and architectural significance of the property. The report is posted for a 21-day public comment period before a hearing is held. The BLC said in a statement given over email that the study report has been drafted but is not yet publicly available.

If the BLC votes to approve the designation, the decision then moves to the mayor, who has 15 days to respond. If the mayor signs off, or takes no action, the petition proceeds to the City Council for a final vote within 30 days. In January, Boston City Hall was granted landmark status by default, when the City Council failed to hold a vote within that 30-day period following Mayor Wu’s approval.

Flynn contends that city oversight could interfere with the daily operations of businesses that rely on flexibility to maintain facilities and infrastructure. He added that both governors and mayors have long recognized the pier’s economic value and left it largely untouched by broader redevelopment efforts.

“If one of the seafood companies needs to do some work on their building, what impact would a landmark designation have?” Flynn asked. “Those issues are unclear right now, and that’s exactly why a hearing is needed before we move forward.”

Summer was sensual

Hummock on the coast of Quincy, Mass., the town where Henry Adams grew up. Back then, much of it was semi-rural.

“Winter and summer, then, were two hostile lives, and bred two separate natures. Winter was always the effort to live; summer was tropical license. Whether the children rolled in the grass, or waded in the brook, or swam in the salt ocean, or sailed in the bay, or fished for smelts in the creeks, or netted minnows in the salt-marshes, or took to the pine-woods and the granite quarries, or chased musk-rats and hunted snapping turtles in the swamps, or mushrooms or nuts on the autumn hills, summer and country were always sensual living, while winter was always compulsory learning. Summer was the multiplicity of nature; winter was school.”

— From The Education of Henry Adams, by Henry Adams (1838-1918), famed writer, most notably as an historian. His paternal grandfather was President John Quincy Adams,who was a son of Founding Father and second President John Adams.

Time to move your car again

“Spring on Beacon,” by Meghan Weeks, at Copley Society of Art, Boston.

Chris Powell: More government and so, of course, more lobbyists

1891 cartoon of a legislator besieged by lobbyists.

MANCHESTER, Conn.

Lobbyists in Connecticut have a bad reputation, and it may get worse with the recent report from the Office of State Ethics that spending on lobbyists exceeded $28 million in the first quarter of this year and may reach a record high by the end of the year.

Why is there so much lobbying?

Mainly because there is so much government.

A telling clue is that that the organization spending the most on lobbyists in the first quarter was the Connecticut Hospital Association, at $1.45 million. Other big spending on lobbyists in the first quarter also involved medicine: the Partnership for America's Health Care Future, representing hospitals, medical insurers and drug manufacturers, at $349,000; Hartford HealthCare, at $248,266; the Connecticut Association of Health Plans, at $230,370; Elevance Health and Affiliates, with $214,940; and Yale New Haven Health System, at $214,447.

Again, this spending was just for the first quarter.

No businesses are more subject to government spending and regulation than hospitals, medical insurers, and drug manufacturers. Modern medicine is now largely a matter of price-fixing and cost-shifting by government, what with Medicare, Medicaid and legislative and regulatory mandates.

Even a small change in law, regulation, or government policy can have huge financial impact on the components of medical case, and, of course, huge impact on patients and policyholders.

Whether these laws, regulations and policies are good or bad, they are pervasive, and so all the entities affected need to watch the government around the clock and intervene urgently on behalf of their interests.

Legislators and governors are supposed to represent the public interest, but the lobbyists work at the state Capitol nearly every day while their constituents are just trying to make a living and to get home in time for dinner and some television. The programs they watch are not about public policy.

Many lobbyists are often well paid for subverting the public interest in favor of a special interest. So special interests sometimes provide disguises for their lobbyists.

That's why the Partnership for America's Health Care Future doesn't call itself what it really is -- the Partnership for the Prosperity of Hospitals, Medical Insurers and Drug Manufacturers -- and why the Connecticut Education Association doesn't call itself the Connecticut Teachers Union.

Even so, lobbyists are crucial for democracy and the legislative process, especially on the state level. For while the governor and legislative committees can draw on expertise from the Office of Legislative Research and state government agencies, lobbyists often have much relevant information that government doesn't have -- and not just information but insight about policies and how they are likely to be received not just by special interests but the public as well.

Thirty-seven years ago, in the aftermath of the Watergate scandal, the General Assembly and Gov. Ella T. Grasso seemed to think that lobbyists were the nexus of political corruption. So a law was enacted requiring lobbyists to register with the Office of State Ethics and wear special badges on the job. The implication was that lobbyists had the plague and legislators shouldn't want to be around them.

Caution was in order but it wasn't because lobbyists had the plague and weren't identifying themselves. It was because legislators had a sort of plague -- the desperate craving for campaign contributions -- and were easily tempted to seek them first from the special interests represented by the lobbyists. Tagged with badges, lobbyists became easier to shake down.

Indeed, years ago neophyte candidates for the legislature who sought advice about raising campaign money were urged to visit the Office of State Ethics, ask for a list of all the lobbyists, and start there.

Things are a bit better now. Campaign contributions from lobbyists are restricted, and the state has a program of public financing of campaigns that diminishes need for special-interest money.

But special-interest money still abounds in politics, and, as always, the best defenses against bad law and corruption are vigorous news organizations and an attentive public. They are much weaker these days.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Gilded Age luminary

From Richard Morris Hunt’s sketchbook of a European trip, July to December 1874, (graphite and watercolor on paper), in the show “Richard Morris Hunt in a New Light,’’ at Newport Mansions.

The curator says:

“Hunt, the premier architect of the Gilded Age, is known for such imposing works as Marble House and The Breakers, in Newport, R.I. This exhibition will take a more intimate look at his life, creativity and ideas. For the first time, the exhibition will bring together Hunt’s personal sketchbooks, scrapbooks, architectural and interior drawings and family objects, drawn from the Library of Congress, Smithsonian National Portrait Gallery, Vermont Historical Society, Bennington (Vt.) Museum, the Preservation Society of Newport County’s collections and more.

Philip K. Howard: Code Red for red-tape America and what to do about it

Politics now has a dizzying quality. The roller-coaster of Trump policies―now we do this, now we do the opposite―is being matched by wild swings in the Democratic positions, led by socialist Zohran Mamdani's victory in the New York City mayoral primary. Just imagine, as liberal columnist Joe Klein mused, the staggering inefficiency of a municipal grocery store operating under union work rules: “Sorry, I only restock on Thursdays."

Centrist Democrats are trying to mobilize an “Abundance’’ agenda to cut through red tape to build housing and infrastructure. That's a step in the right direction, but pruning the red-tape jungle doesn't work by itself. Officials must have authority to make trade-off judgments.

The unimaginable tragedy of the flood in Texas on July 4 probably could have been averted in numerous ways. But several serious mistakes can be traced to the compliance philosophy of the red- tape state. Consider:A firefighter on duty asked dispatch about issuing a CodeRED alert but was told that that couldn’t be done could without a supervisor's approval. Some federal rescue workers weren’t mobilized immediately because of a new edict requiring the approval of the Homeland Security secretary for all expenditures over $100,000.

Nothing works without human judgment. What's missing in the political cacophony is the simple realization that things don't work because Americans are no longer allowed to roll up their sleeves and make things work. This is not a flaw that can be fixed by DOGE's indiscriminate cuts, nor by simply aspiring to Abundance. The red-tape state fails because it is a version of central planning―smothering teachers, principals, doctors, nurses, officials and all of us in red tape everywhere.

New leaders, new policies and new reforms are not sufficient. American government requires an intervention. Like it or not, the only cure is to transition away from the red-tape megalith to a governing framework activated by human responsibility. This is not radical. It is the founding philosophy of the Constitution, a document of 7,500 words―in contrast to the 150 million words of current federal law and regulation.Honoring human responsibility will also go a long way to overcoming the populist resentment that is fueling political craziness.

Philip K. Howard, a New York-based lawyer and civic leader, is chairman of Common Good, a nonprofit legal-and-regulatory-reform organization.

He describes the principles and framework of what's needed in his forthcoming book: Saving Can-Do: How to Revive the Spirit of America (Rodin Books, Sept. 23).

Writing in The Washington Post, Dominic Pino cited Mr. Howard’s book Not Accountable on why public-employee unions should be considered unconstitutional.

Common Good’s work on why DOGE's cuts are misguided was highlighted in The New Yorker, and in interviews with WORLD and the America Trends Podcast.

Mr. Howard also discussed government reform with Daniel Wiig of the NYCLA Amicus Curiae podcast and on the The Aaron Renn Show.

Marvel at salt marshes

“Messages from the Marsh’’ (Part 5, video still 10, archival exhibition pigment print (Platine)), by Amy Kaczur in her joint show “The Great Muse —Three Artists Working With the Great Muse,’’ at Kingston Gallery, Boston, through July 27.

The gallery says that the show, with Kaczur, Resa Blatman and Max Schenk, is either “inspired by or touches on the beauty and ecological significance of salt marshes.’’

Famous poem confusion

1974 stamp

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

There was an amusing moment at a college reunion I attended the other week in New Hampshire, near the heart of what might be called Robert Frost Country. At one of the events, a class officer dragged in a reference to what is among the most famous poems in English, Frost’s “The Road Not Taken’’. This work is frequently quoted during graduations, reunions and similar events. The MC/class officer, who rambled on far too long, gave it the meaning that we had bravely taken our own unique ways through life and probably come out fine.

But, as has been frequently noted, the poem is often grossly misinterpreted. (Frost himself warned that it’s “tricky.’’) So a college roommate of mine, now a retired cancer surgeon, yelped as the MC finished his reference: “No, no! You’ve got it wrong!’’

“The Road Not Taken’’ is, among other things, about anxiety and indecision, of which most of us old people at reunion had experienced plenty.

Of course, I didn’t recognize most of the several hundred people at the reunion. At the same time, I sometimes found myself being recognized unsettling.

xxx

On the way back home I stopped at one of the two Granite State service plazas in Hooksett to get a sandwich. Such places, which used to be rather sedate, now have loud, boring rock music – to appeal to younger customers? But maybe it will be younger people who lead a revolt against America’s inescapable culture of cacophony.

Edifice complex

“And They Keep Extending That Wing Farther to the Right” (graphite, ink and wax on mounted paper), by Eben Haines, in his show at Corey Daniels Gallery, Wells, Maine, July 19-Aug. 23.

Llewellyn King: The joy of friendship; a very dark Fourth; ‘customer service’ oxymoron; AI in medicine

Masked people wearing this badge made it a less than Glorious Fourth. It’s our new secret police.

WEST WARWICK, R.I.

I treasure the friends who share their friends. One of those friends, Virginia “Ginny” Hamill, has died.

I met Ginny at The Washington Post in 1969, and we became forever-friends.

Ginny had an admirable ascent from a teleprinter operator to an editor in The Washington Post/Los Angeles Times News Service. She was promoted again to the enviable job as the editor of the news service in London, where she bloomed — and met her future husband, John McCaughey.

Ginny brought wealth into my life — and later to that of my wife, Linda Gasparello — through the introductions to her friends from that London period. They included David Fishlock, science editor of the Financial Times; Roy Hodson, also of the FT; Deborah Waroff, an American journalist; and Guy Hawtin, a rakish newspaperman on his way to the New York Post.

They constituted what I called “The Set.” In London, New York and Washington, we worked at the journalism trade on many projects from newsletters to conferences and broadcasts.

We also partied; it went with the territory.

I once wrote to Ginny and told her how instrumental she had been in all our lives through sharing her friends. I am glad I didn’t wait until obituary time to thank her for her generosity in friend-sharing.

******

I think that for many, myself among them, it was a somber July 4. There are dark clouds crossing America’s sun. There are things aplenty going on that seem at odds with the American ideal, and the America we have known.

To me, the most egregious excess of the present is the way masked agents of the state grab men, women and children and deport them without due process, without observance of a cornerstone of law: habeas corpus. None are given a chance to show their legality, call family or, if they have one, a lawyer.

This war against the defenseless is wanton and cruel.

The advocates of this activity, this snatch-and-deport policy, say, and have said it to me, “What do these people not understand about ‘illegal’?”

I say to these advocates, “What don’t you understand about want, need, fear, family, marriage, children and hope?”

The repression many fled from has reentered their luckless lives: terror at the hands of masked enforcers.

I have always advocated for controlled immigration. But the fact that it has been poorly managed shouldn’t be corrected post facto, often years after the offense of seeking a better life and without the consideration of contributions to society.

Meanwhile, the media remain under attack, the universities are being coerced, and the courts are diminished.

America has always had blots on its history, but it has also stood for justice, for the rule of law, for freedom of the press, freedom of speech. Violations of these values dimmed the Fourth.

America deserves better: Think of the Constitution, one of the all-time great documents of history, a straight-line descendant of the Magna Carta of 1215. That was when the noblemen of England told King John, “Cut it out!”

A few noblemen in Washington wouldn’t go amiss.

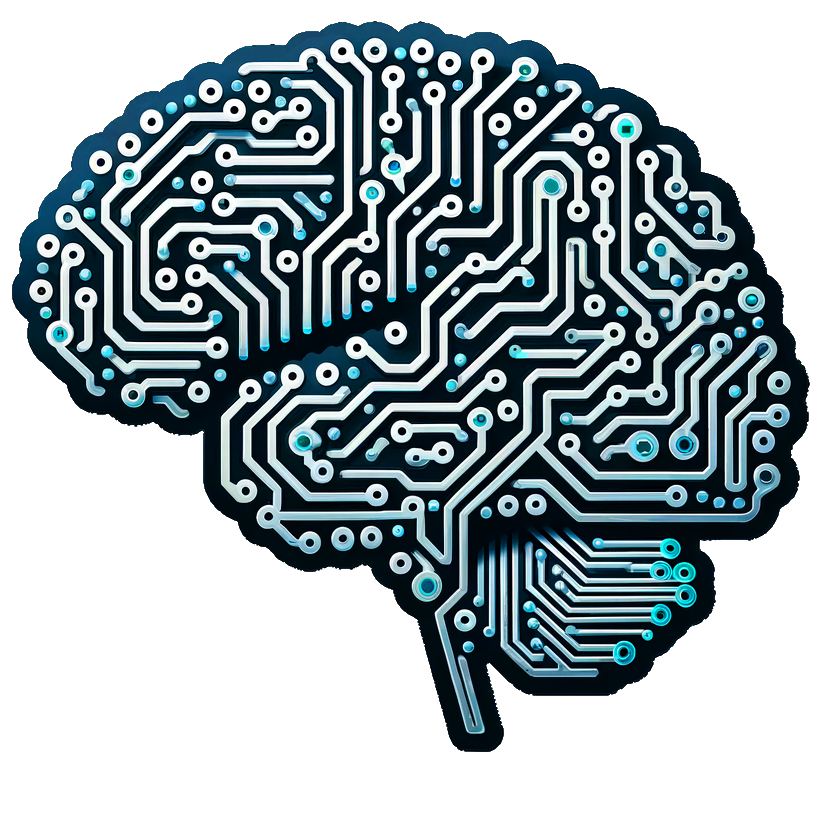

I was fortunate on my syndicated television show, White House Chronicle, along with my co-host, Adam Clayton Powell III, to recently interview Harvey Castro, an emergency room doctor. Castro, from a base in Dallas, has seized on artificial intelligence as the next frontier in health care.

He has written several books and given TEDx talks on the future of AI-driven health care. I have talked to several doctors in this field, but never one who sees the application of AI in as many ways from diagnosing ailments through a patient's speech, to having an AI -controlled robot assist a nurse to gently transfer a patient from a gurney to a bed.

A man with infectious ebullience, Castro says his frustration in emergency rooms was that he got there too late: after a heart attack, stroke or seizure. He expects AI to change that through predictive medicine and early treatment.

His work has caught the attention of the government of Singapore, and he is advising them on how to build AI into their medical system.

******

Like everyone else, I spend a lot of time in frustration-agony on the phone when I need to talk to a bank or insurance company and many other firms that have “customer service.” That phrase might loosely be translated as “Get rid of the suckers!”

I don’t know whether the arrival of AI agents will hugely improve customer service, but maybe you can banter with them, get them to deride their masters, even to tell you stuff about the president of the bank.

It might be easier talking to an AI agent than talking to someone with a script in another country before they inevitably, but oh, so nicely, tell you to get lost, as happened to me recently.

You could enjoy a little hallucinatory fun with a virtual comedic friend, before it tells you to have a nice day, and hangs up.

On X: @llewellynking2

Bluesky: @llewellynking.bsky.social

Subscribe to Llewellyn King's File on Substack

Llewellyn King is executive producer and host of White House Chronicle, on PBS. He’s based in Rhode Island.

Summer days can seem long but the season is short

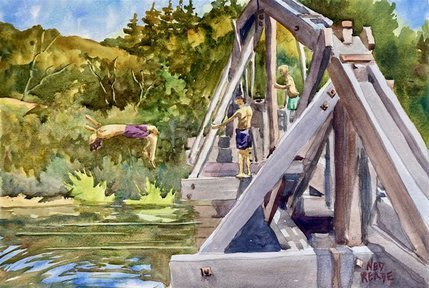

“Boys at the Bridge,’’ by Ned Reade, in the show “From Our Eyes,’’ at the Southern Vermont Arts Center, Manchester.

— Image courtesy of Ned Reade

The show that puts the focus on the Southern Vermont Arts Center's teaching artists. The gallery says “The variety of media they employ—painting, drawing, sculpture, even circus arts—reflects the richness of their perspectives and the breadth of creative exploration they foster in the classroom.’’

Aneri Pattini: Cutbacks at federal agency might undermime workplace mental- health programs

From Kaiser Family Foundation Health News (except for image above).

In Connecticut, construction workers in the Local 478 union who complete addiction treatment are connected with a recovery coach who checks in daily, attends recovery meetings with them, and helps them navigate the return to work for a year.

In Pennsylvania, doctors applying for credentials at Geisinger hospitals are not required to answer intrusive questions about mental health care they’ve received, reducing the stigma around clinicians seeking treatment.

The workplace is the new ground zero for addressing mental health. That means companies — employees and supervisors alike — must confront crises, from addiction to suicide. The two seemingly unrelated advances in Connecticut and Pennsylvania have one common factor: They grew out of the work of a little known federal agency called the National Institute for Occupational Safety and Health.

It’s one of the key federal agencies leading workplace mental health efforts, from decreasing alarmingly high rates of suicide among construction workers to addressing burnout and depression among health care workers.

But after gaining considerable traction during the covid-19 pandemic, that work is now imperiled. The Trump administration has fired a majority of NIOSH staffers and is proposing severe reductions to its budget.

Private industry and nonprofits may be able to fill some of the gap, but they can’t match the federal government’s resources. And some companies may not prioritize worker well-being above profits.

About 60% of employees worldwide say their job is the chief factor affecting their mental health. Research suggests workplace stress causes about 120,000 deaths and accounts for up to 8% of health costs in the U.S. each year.

“Workplace mental health is one of the most underappreciated yet critical areas we could intervene on,” said Thomas Cunningham, a former senior behavioral scientist at NIOSH who took a buyout this year. “We were just starting to get some strong support from all the players involved,” he said. “This administration has blown that apart.”

The National Institute for Occupational Safety and Health is a little-known federal agency that has been central to the nation’s efforts to conduct research into workplace mental health and well-being. Under the Trump administration, NIOSH offices across the country — including this one in Cincinnati — have been gutted by reorganization and staff reductions.

NIOSH, established in 1970 by the same law that created the better-known Occupational Safety and Health Administration, is charged with producing research that informs workplace safety regulations. It’s best known for monitoring black lung disease in coal miners and for testing masks, like the N95s used during the pandemic.

As part of the mass firing of federal workers this spring, NIOSH was slated to lose upward of 900 employees. After pushback from legislators — primarily over coal miner and first responder safety — the administration reinstated 328. It’s not clear if any rehired workers focus on mental health initiatives.

At least two lawsuits challenging the firings are winding through the courts. Meanwhile, hundreds of NIOSH employees remain on administrative leave, unable to work.

Emily Hilliard, a press secretary for the Department of Health and Human Services, asserted in a statement that “the nation’s critical public health functions remain intact and effective,” including support for coal miners and firefighters through NIOSH. “Improving the mental health of American workers remains a key priority for HHS, and that work is ongoing,” she wrote.

She did not answer specific questions from KFF Health News about whether any reinstated NIOSH employees lead mental health efforts or who is continuing such work.

Reducing Suicides and Addiction in Construction and Mining

Over 5,000 construction workers die by suicide annually — five times the number who die from work-related injuries. Miners suffer high rates too. And nearly a fifth of workers in both industries have a substance use disorder, double the rate among all U.S. workers.

Kyle Zimmer recognized these issues as early as 2010. That’s when he started a members’ assistance program for the International Union of Operating Engineers Local 478 in Connecticut. He hired a licensed clinician on retainer and developed partnerships with local treatment facilities.

At first, workers pushed back, said Zimmer, who recently retired after 25 years in the union, many as director of health and safety.

Their perception was, “If I speak up about this issue, I’m going to be blackballed from the industry,” he said.

General contractors and project owners are increasingly incorporating mental health services on-site and as a normal part of their project budgets, says TJ Lyons, a multidecade construction industry safety professional.

But slowly, that changed — with NIOSH’s help, Zimmer said.

The agency developed an approach to worker safety called Total Worker Health, which identifies physical and mental health as critical to occupational safety. It also shifts the focus from how individuals can keep themselves safe to how policies and environments can be changed to keep them safe.

Over decades, the concept spread from research journals and universities to industry conferences, unions, and eventually workers, Zimmer said. People began accepting that mental health was an occupational safety issue, he said. That paved the way for NIOSH’s Miner Health Program to develop resources on addiction and for Zimmer to establish the recovery coaching program in Connecticut.

“We have beat that stigma down by a lot,” Zimmer said.

Other countries have made more progress on mental health at work, said Sally Spencer-Thomas, co-chair of the International Association for Suicide Prevention’s workplace special interest group. But with the growth of the Total Worker Health approach, a 2022 surgeon general report on the topic, and increasing research, the U.S. appeared to finally be catching up. The recent cuts to NIOSH suggest “we’re kind of losing our footing,” she said.

Last year, Natalie Schwatka, an assistant professor at the Colorado School of Public Health’s Center for Health, Work & Environment, received a five-year NIOSH grant to build a toolkit to help leaders in labor-intensive industries, such as construction and mining, strengthen worker safety and mental health.

While many companies connect people to treatment, few focus on preventing mental illness, Schwatka said. NIOSH funding “allows us to do innovative things that maybe industry wouldn’t necessarily start.”

Her team planned to test the toolkit with eight construction companies in the coming years. But with few NIOSH employees left to process annual renewals, the funds could stop flowing anytime.

The consequence of losing such research is not confined to academia, Zimmer said. “Workers’ health and safety is very much in jeopardy.”

Health Care Sector Braces for Fallout From NIOSH Cuts

For a long time, clinicians have had troubling rates of addiction and suicide risk. Just after the height of the pandemic, a NIOSH survey found nearly half of health workers reported feeling burned out and nearly half intended to look for a new job. The agency declared a mental health crisis in that workforce.

NIOSH received $20 million through the American Rescue Plan Act to create a national campaign to improve the mental health of health workers.

The Dr. Lorna Breen Heroes’ Foundation, named after an emergency medicine physician who died by suicide during the covid pandemic, has partnered with NIOSH to improve the mental health of health care workers. Foundation CEO Corey Feist recently appeared on Capitol Hill with Noah Wyle, who plays an emergency medicine doctor on the TV series The Pitt, to advocate for Congress to renew funding for this work.

The results included a step-by-step guide for hospital leaders to improve systems to support their employees, as well as tips and suggested language for leaders to discuss well-being and for workers to advocate for better policies.

Cunningham, the behavioral scientist who left NIOSH this year, helped lead the effort. He said the goal was to move beyond asking health workers to be resilient or develop meditation skills.

“We’re not saying resilience is bad, but we’re trying to emphasize that’s not the first thing we need to focus on,” he said.

Instead, NIOSH suggested eliminating intrusive questions about mental health that weren’t relevant to keeping patients safe from hospital credentialing forms and offering workers more input on how their schedules are made.

The agency partnered on this work with the Dr. Lorna Breen Heroes’ Foundation, named after an emergency medicine doctor who died by suicide during the pandemic. The foundation extended the campaign by helping health systems in four states implement pieces of the guide and learn from one another.

Foundation leaders recently appeared on Capitol Hill with Noah Wyle, who plays an emergency physician on the TV series “The Pitt,” to advocate for renewed federal funding for this work.

Corey Feist, foundation CEO and co-founder, said renewing that funding to NIOSH is crucial to get this guide out to all hospitals.

Without those resources, “it’s just going to really delay this transformation of health care that needs to happen,” he said.

Who Can Fill the Gap?

TJ Lyons, a multidecade construction industry safety professional who has worked at big-name companies such as Gilbane, Turner, and DPR Construction, is confident that workplace mental health will remain a priority despite the NIOSH cuts.

Lyons has worked at big names in the field such as Gilbane, Turner, and DPR Construction. He is confident that such companies will keep workplace mental health front and center, despite cuts to federal agencies and staff.

General contractors and project owners have been incorporating budget lines for mental health support for years, he said, sharing an example of a $1 billion project that included a mental health clinician on call for four hours several days a week. Workers would make appointments to sit in their pickup trucks during lunch breaks and talk to her, he said.

Now when these big companies subcontract with smaller firms, they often ask if the subcontractors provide mental health support for workers, Lyons said.

But others are skeptical that industry can replace NIOSH efforts.

Several workplace safety experts said smaller companies lack the means to commission research studies and larger companies may not share the results publicly, as a federal agency would. Nor would they have the same credibility.

“Private industry is going to provide what the people paying them want to provide,” said a NIOSH employee and member of the American Federation of Government Employees union, currently on administrative leave, who was granted anonymity for fear of professional retaliation.

Without federal attention on workplace mental health, “people may leave the workforce,” she said. “Workers may die.”

Aneri Pattani is a Kaiser Family Foundation Health News reporter.

Aneri Pattani: apattani@kff.org, @aneripattani