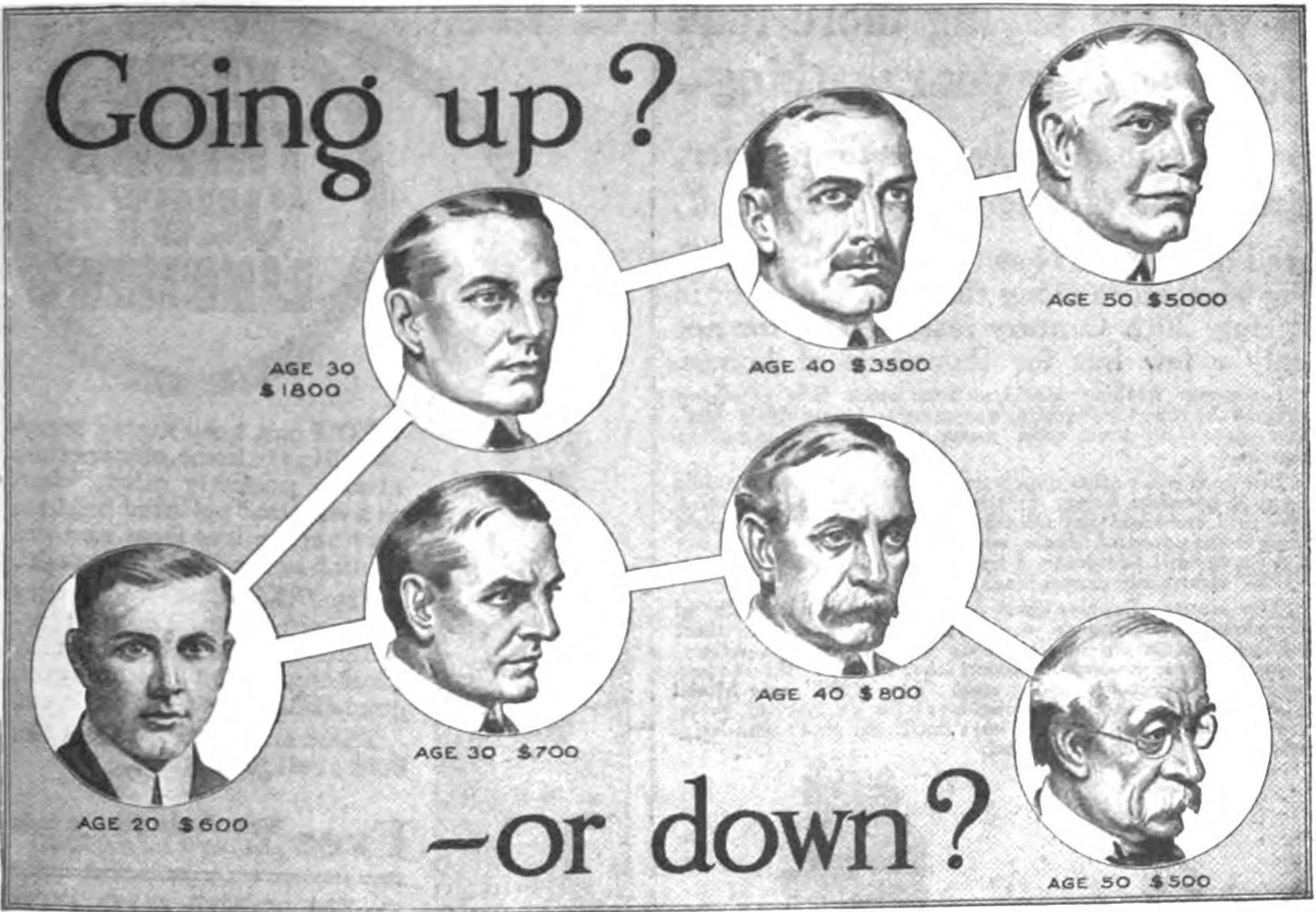

Illustration from a 1916 advertisement for a U.S. vocational school. Education has been seen as a key to higher income, and this advertisement appealed to Americans' belief in the possibility of self-betterment, and addressing the great income inequality existing during the Industrial Revolution.

MANCHESTER, Conn.

While there is a compelling reason to raise taxes on the rich, it's not the reason motivating many Democrats in the Connecticut General Assembly, who would increase both state income and capital-gains taxes on the rich and impose a special state property tax on their expensive homes.

These Democratic legislators want mainly to increase state government's political patronage, the compensation of government employees and the dependence of the poor on government. Connecticut's quality of life seldom improves from their legislation. The state's problems are never alleviated, much less solved, while state government keeps manufacturing poverty.

Besides, state government is already rolling in federal "stimulus" money, with $6 billion of it waiting to be allocated by Gov. Ned Lamont and the legislature. Properly allocated, that largesse should keep state government manufacturing poverty quite without any new taxes for years.

Nor is the reason offered by Democrats in Congress for raising federal taxes on the rich any good -- to increase the government's revenue.

For the virus epidemic already has pushed the federal government into implementing Modern Monetary Theory, which holds that government can create and disburse infinite money without levying taxes, constrained only by depreciation of the currency. The trillions of dollars recently created may go onto the government's books as debt, but that debt will never be repaid and instead will be monetized by the government's purchase of its own bonds. Indeed, as MMT notes, the debt is already treated as money when it is in private hands.

As anyone who goes grocery shopping, puts gasoline in his car and pays electricity, insurance and tax bills knows, inflation is already roaring and making a joke of the official price data.

The single compelling reason to raise taxes on the rich is to diminish income inequality a little after it has been increased so much by the federal government's policy of inflating asset prices during the economic depression caused by the epidemic -- a policy of directing far more money to the financial markets and thus to the ownership class, people who own stocks and bonds, than to the laboring class, tens of millions of whose members lost their jobs because of government policy and crashed into poverty.

But this effort to reduce wealth inequality should be undertaken at the federal level, not by state government in Connecticut -- at least not yet. That's because Connecticut is already a high-tax state whose economy has been weak for many years, and raising state taxes would disadvantage Connecticut even more relative to other states.

Money will go where it is treated best, and until the dislocations of recent months that drove thousands of people out of the New York City area, Connecticut was losing population relative to the rest of the country, losing mainly the prosperous people who pay taxes.

Connecticut's effort to reduce wealth inequality should concentrate on reducing the poverty the state manufactures with its welfare and education policies.

xxx

Many people in Connecticut, including some state legislators, argue that medical care is or should be a human right and that, as a result, state government should extend Medicaid insurance to the tens of thousands of people living in the state illegally. The cost is estimated at nearly $200 million per year.

These people are not entirely without medical care. They can pay for it themselves or present themselves at hospital emergency rooms when they are sick or injured and hospitals must treat them for free if they are indigent.

Of course, such medical care falls far short of comprehensive. But if comprehensive medical care is a human right, is living in Connecticut a human right too? If so, most people in Central America might insist on living in the state. Extending Medicaid to immigration lawbreakers would be a powerful incentive for more lawbreaking, which is already rampant.

So in addressing the Medicaid extension issue, Connecticut can't help addressing the illegal immigration issue as well. Extending Medicaid will be, in effect, more nullification of federal immigration law, just as the state's pending legalization and commercialization of marijuana, sensible as such policies may seem, will be more nullification of federal drug law.

Chris Powell is a columnist for the Journal Inquirer, in Manchester, Conn