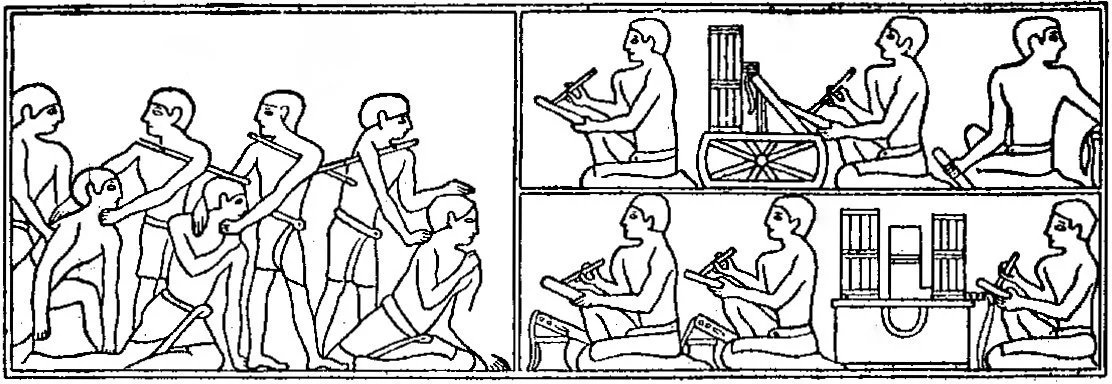

Egyptian peasants seized for non-payment of taxes at the time of the pharaohs.

From The Outline of History (1920), by H.G. Wells

MANCHESTER, Conn.

Liberal Democratic members of the Connecticut General Assembly again are pursuing what they call fairness in taxation, their euphemism for state government's raising and spending a lot more money. Gov. Ned Lamont, a Democrat, opposes increasing taxes while state government has a lot of emergency federal cash on hand. But the governor may be glad of the tax- fairness clamor, since it emphasizes his moderation in his party as he seeks re-election in a campaign that increasingly seems competitive.

According to the tax-fairness clamor, the poorest people in Connecticut pay a bigger percentage of their income in taxes than the state's rich do. But then the poor also receive more in direct government benefits than nearly everyone else and cause far more problems than most other people. Poverty hasn't yet become a civic virtue, even if few people remember Teddy Roosevelt's contention that the first duty of the citizen is to pull his own weight.

That so many able-bodied people in Connecticut can't pull their own weight has not prompted the tribunes of liberalism to ask why, though some questions are elementary. How does the welfare system's depriving so many children of fathers help them grow up able to pull their own weight? How does social promotion in the schools incentivize them to learn what they need to pull their own weight?

Instead these government policies proletarianize children to grow up to be dependent on government.

The country's tax structure is set up to make state and municipal taxation less progressive -- to be much less geared to personal income. Federal income taxes are heavier than state and municipal income taxes and produce far more revenue. Since the federal income tax is so heavy, states and municipalities don't tax income as much, relying instead on sales and property taxes, which tend to be regressive.

But citizenship requires even the poor to feel some of the burden of government, and in its totality the tax system is more progressive than its seems at a glance. After all, states and municipalities receive, especially now, enormous amounts of financial aid from the federal government and the federal government finances the bulk of assistance to the poor through medical insurance, housing and food programs.

More progressive taxation on the state level is never advocated for progressivity's sake alone but always as a more tolerable mechanism for increasing government revenue and spending.

For state government easily could achieve more progressivity in taxation without raising taxes on anyone and without spending more -- just by reallocating appropriations.

For example, state government could end the priority given to government employee raises and benefits and use the savings to reduce the sales tax, a regressive tax. State government could use the savings to assume the full cost of “special education” in municipal schools, thereby enabling reduction of the municipal property tax, another regressive tax, especially damaging in the cities, where most of the poor live.

Indeed, if more progressive taxation is a matter of justice, why do Connecticut's liberal Democrats seek repeal of the $10,000 limit on the federal income tax deduction for state and municipal taxes? Nearly all the tax benefit of lifting the cap would go to wealthy people, but in high-tax states like Connecticut, many wealthy people are Democrats and major political donors.

Liberalism in Connecticut sees fairness in taxation as little more than compelling someone else to pay for what you get, with government employees taking a cut as the money is moved around.

xxx

Connecticut shouldn't be done with the issue of police accountability.

The recent legislation that appears to remove the “qualified immunity” enjoyed by police officers against damage lawsuits should be reconsidered, since no one is sure how it will be construed.

And a new legislative proposal should be enacted: to prohibit police departments from hiring officers who, after due process, have been fired for misconduct or malfeasance by other departments.

It's bad enough that Connecticut school systems trade teachers who have performed poorly or engaged in misconduct, a practice facilitated by the state law preventing disclosure of teacher evaluations.

But at least teachers don't carry guns at work.

Chris Powell is a columnist for the Journal Inquirer, in Manchester.