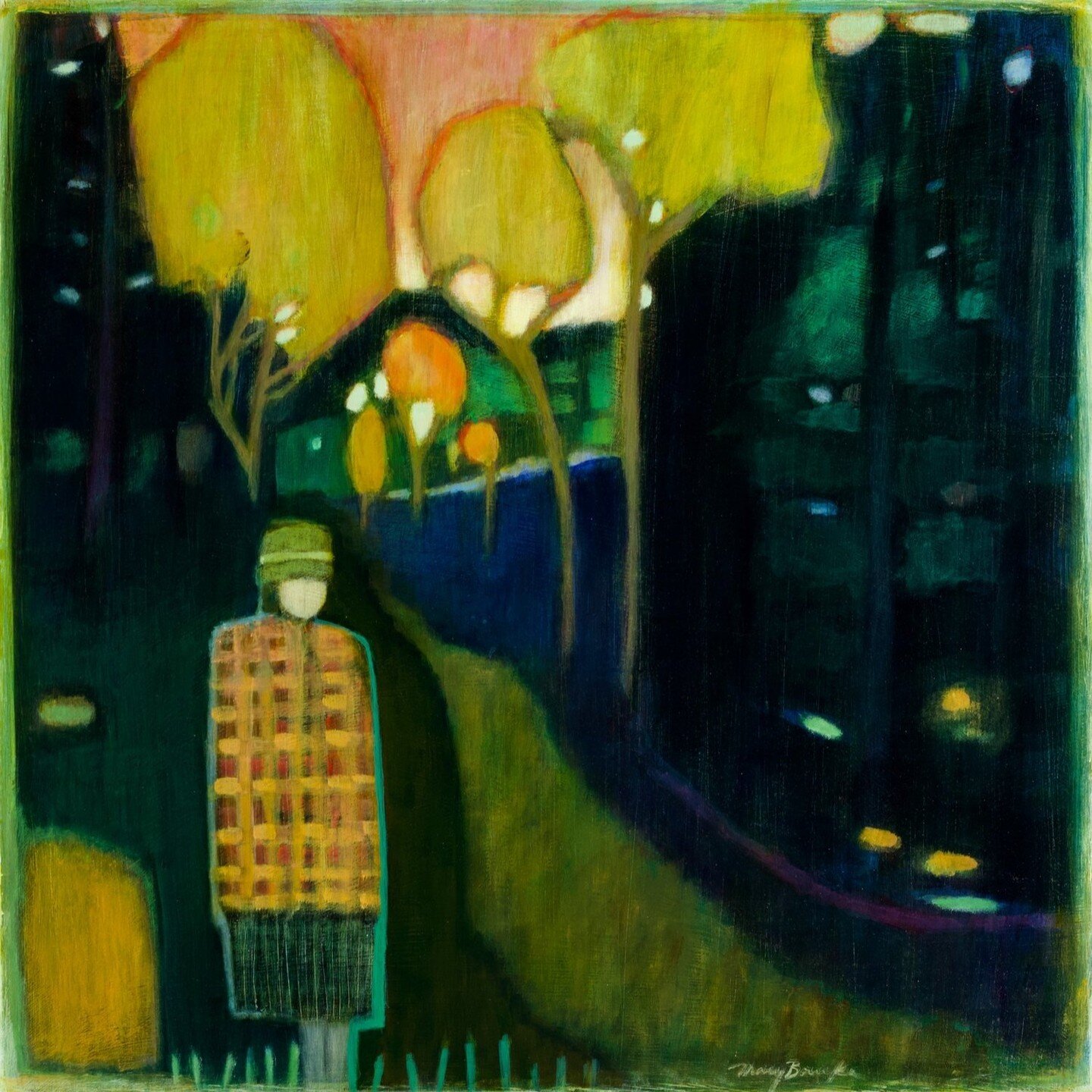

The headquarters, in New York, of Lehman Brothers, whose collapse ignited the Panic of 2008.

— Photo by David Shankbone

SOMERVILLE, Mass,.

When John Authers departed the Financial Times for Bloomberg News earlier this autumn, he left behind a couple of bombshell articles that my friends still haven’t stopped talking about. After 29 years as one of the FT’s most admired commentators, the former editor of the paper’s vaunted Lex page, proprietor of the “Short View” column, was leaving Britain for the United States.

In the first article, under a headline “In a crisis, sometimes you don’t tell the whole story,” he wrote:

It is time to admit that I once deliberately withheld important information from readers. It was ten years ago, the financial crisis was at its worst, and I think I did the right thing. But a decade on from the 2008 crisis (our front pages during the period are at ft.com/financialcrisis), I need to discuss it.

It had occurred on Wednesday, Sept. 17, two days after Lehman Brother declared bankruptcy, the scariest day of the crisis, both for Authers, and, to judge from his memoir, for Federal Reserve chairman Ben Bernanke as well. The insurance giant AIG had received an $85 billion government loan the day before. The Reserve Fund, the nation’s largest money market fund, had seen its redemption value dip below $1, thanks to its losses on Lehman bonds. A high rate of withdrawals had begun.

Authers, as it happened, had sold his flat in London not long before. The proceeds were deposited in Citibank, far more than would be covered by government insurance if Citi failed. He went to the bank, intending to withdraw half his money and carry the cash to a rival bank. He found himself standing in a long line. The bank officer he finally reached told him he didn’t need to withdraw his funds in order to protect them. She quickly opened trust accounts for each of his children and a joint account with his wife.

Presto, Authers was insured by the government for the full amount of his deposit. The maneuver had been going on all morning, the officer explained, and the same at Chase bank next door. Neither she nor her competitor had ever performed a single such transaction previously. That day they had undertaken many. Authers wrote,

I was finding it a little hard to breathe. There was a bank run happening, in New York’s financial district. The people panicking were the Wall Streeters who best understood what was going on. All I needed was to get a photographer to take a few shots of the well-dressed bankers queuing to get their money, and write a caption explaining it.

Instead, he went back to his desk and wrote a column about the breakdown of trust among banks, describing the atmosphere as one of panic, but omitting the queue in the bank branch. Authers concluded,

We didn’t do it. Such a story on the FT’s front page might have been enough to push the system over the edge. Our readers went unwarned, and the system went without that final prod into panic…. The right to free speech does not give us the right to shout fire in a crowded cinema; there was the risk of fire and we might have lit the spark by shouting about it.

A month later, in a long contemplative essay headlined “In nothing we trust” ($1 trial subscription may be required), Authers explored the erosion of confidence in the media he had experienced in the thirty years since he had begun. He described the old days of newspapers’ semi-monopoly on advertising and information, the faith invested in the FT’s every word, and the ethic of responsibility that went with it.

He described the stinging backlash to his earlier admission that he and the paper had held back from adding fuel to the fire. There had been hundreds of responses in which opinion was overwhelmingly against him. One reader wrote,

Your decision to save yourself while neglecting your readership is unforgivable and in the very nature of the elitist Cal Hockley of the Titanic scrambling for a lifeboat at the expense of others in need.

He found the feedback “astonishing and wrongheaded.” But gradually he came to view it as a crisis of belief – belief in the news media as an institution that clarifies and sets the agenda. The rise of social media had diluted the privileges of print, including the mystique that relative anonymity conferred. These days his photo accompanied nearly everything he wrote. His mornings turned into a digital talk show with readers. Sometimes they were specialists, thrillingly well-informed. Increasingly they were ignorant and rancorous. Limits on deposit insurance had been raised a few weeks later and the crisis abated, he wrote; ten years later, banks were once again sound, and the threat had moved on to the pension system.

The irony, it seems to me, is that Authers had missed the fact, or at least the significance, of the very real panic already raging thirty floors above that retail branch, and in trading rooms around the world. To judge from the special section devoted to the tenth anniversary of the crisis in which his initial column appeared, so had the FT itself. What would eventually become the Panic of 2008 was not so different from the Panic of 1907, or 1893, as economic historian Gary Gorton wrote a year later, “except that most people had never heard of the financial markets involved.” In Slapped by The Invisible Hand: The Panic of 2007 (Oxford, 2010), Gorton continued,

In the earlier panics, individuals, fearing for their savings and not knowing if their banks would survive the coming recession, rushed to their banks to withdraw their money. Those runs would occur at all banks, usually starting in New York City, and spreading from there. Everyone knew that the panic had happened and then consequences would follow; firms would fail and there would be difficulties making transactions.

The visibility of the earlier panics did not make the event itself explicable, but it did provide clarity about what had happened in a direct sense. In the Panic of 2007 [sic], the “bank run” was invisible to almost everyone because it was a run by banks and firms on other banks. These interbank markets were invisible to the public, journalists, and politicians. Without observing the bank run, what became visible were only the effects of the run and, in many cases, the effects were mistaken for the cause.

Because what happened after Lehman Brothers failed in September 2008 wasn’t framed as a traditional systemic banking panic, the traditional policy response was then widely misunderstood. Instead of being seen as performing their traditional role as “lenders of last resort” (backed by national treasuries), central banks’ emergency loans designed to stem the fear were routinely described as “bailouts,” despite the fact that in most cases loans were fully repaid.

The willingness to engage in self-examination shows why the FT is widely loved, why Authers is respected, at least by most of his readers. By acknowledging the centrality of trust he goes straight to the heart of the matter. But it wasn’t the press that failed to adequately explain the Panic of 2008. It was the economics profession. That story still has a long way to go.

David Warsh, a longtime columnist and an economic historian, is proprietor of Somerville-based economicprincipals.com, where this column first ran.

Da