There were no such metaphors in economics – an outgrowth of the conviction summed up by Alfred Marshall’s motto, Natura non facit saltum – Nature makes no leaps. For economists educated in marginalism and the differential calculus, it was an entirely natural way of thinking of the world.

Thus the news from China barely made a dent in the U.S. in 1976. The Cultural Revolution was said to be winding down. Zhou Enlai died in February; an earthquake in Tangshan in July killed as many as 650,000 people; Mao Zedong died in September. The Mandate of Heaven, an ancient governing concept in Chinese civilization, had, it was said, perhaps been lost. Americans were preoccupied with recovery from a recession, a presidential election, the bicentennial celebration of their Declaration of Independence;, Europeans with their record-breaking hot summer.

Barely two years later, the Communique of the Third Plenum of the Eleventh Central Committee announced a plan to “shift the emphasis of our party’s work and the attention of the people of the whole country to socialist modernization.” People’s material lives must be improved, it declared; bureaucratic self-indulgence would not be tolerated. A “new Long March” would make China “a great modern socialist power” by the end of the twentieth century.

Six months later a highly promising Republic of China (Taiwanese) army captain named Justin Zhengyi Lin slipped out of his uniform on the island of Quemoy in the middle of the night and swam a mile to the mainland port of Xiamin. Reunification was both inevitable and desirable, Lin had concluded and, as one of Taiwan’s most celebrated young citizens, he wanted to express his conviction as dramatically as possible, leaving behind a large family whom he loved.

It took the mainland authorities a little while to assess his motives – was he a double-agent? He wasn’t. By 1980, calling himself Yifu Lin (“Persistent man on a long journey”), he was studying political economy at Beijing University. Assigned to translate that spring for visiting Nobel laureate Theodore Schultz, Lin impressed the visitor.

By 1982, on a scholarship arranged by Schultz and approved by the authorities in Beijing, he was pursuing a Ph.D. at the University of Chicago. And 25 years after that, Yifu Lin became chief economist of the World Bank, the highest-ranking Chinese citizen yet to serve in that body. (All this is to be found in Evan Osnos’s excellent Age of Ambition: Chasing Fortune, Truth, and Faith in the New China, (Farrar, Straus, and Giroux, 2014.).

Lin was one of the very first movers in the epochal events that followed the third Plenum in December 1978. Millions followed, high and low, in accordance with Deng Xiaoping’s mantra, “Let some people get rich first.” By the end of the 20th Century, China was on the verge of becoming the second largest economy in the world. Average annual growth of 10 percent for 20 years had lifted half a billion people out of poverty and changed the lives of countless others around the world.

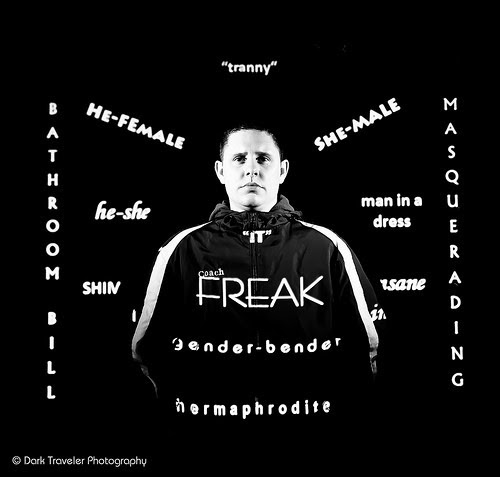

Entry of China into the world trading system was only one of those once-small clouds to have swiftly grown into all-encompassing developments in the ’90s and ’00s. The advent of the computer was another; financial deregulation after Mayday 1975 was a third. These are the changes we are concerned with here. Still others – gender convergence, for example – have only just begun to have their impact gauged.

Meanwhile, the cutting-edge economic theorists who had recently transformed macroeconomic policy-making by incorporating more psychologically-realistic agents in their models embarked on a new program. Again taking their cue from Robert Lucas, whose influential essay “Understanding Business Cycles” appeared in 1977, these “new classicals” would seek to devise a more satisfying explanation of the pattern of boom and bust that had characterized market economies for centuries.

Since the 1950s, business cycles had been understood mainly in Keynesian terms: small models of loosely-described aggregates, consumption, investment, government spending, inflation and unemployment. These did well enough for short-term forecasting. They had moderated in the years since World War II, of course – economists now spoke of expansion and contractions, or recessions, instead of periods of prosperity and depression. But whatever their sources, alternating bouts of unacceptable levels of inflation and unemployment had become the central problem of economics.

Once economists had accepted the “rational expectations” postulate of forward looking, partially informed economic actors – and taken seriously Lucas’s critique of models that didn’t allow the actors they depict to take account of policy-makers’ intentions – those Keynesian models were useless for evaluating monetary and fiscal policies. Only process-oriented (“dynamic”) models based on the new mathematized understanding of general equilibrium would do.

Over the next 25 years, one candidate for the task seemed to succeed more than any other. The theory of “real business cycles” produced reformulations sufficiently surprising that its enthusiasts routinely described it as “a scientific revolution.” These developments culminated in the award of Nobel Prize, in 2004, to Fynn Kydland, of the University of California at Santa Barbara, and Edward Prescott, then of the University of Minnesota. Within a decade, RBC theory was widely, but not universally, judged to have been discredited by the crisis of 2008.

This is the story of the 30-year boom, told against the backdrop of the development of “real business cycle” theory. The tools used to construct RBC theory were, in due course, employed to build models of other, quite different theories. The class to which they all belonged came to be described for the ambitions that all had in common – they were dynamic stochastic general equilibrium (DSGE) models. Today the field is simply “modern macro.”

The tale of the 3-0-year boom is not the usual one about Margaret Thatcher and Ronald Reagan, though the British prime minister and the American president are certainly part of it. It’s a long story, having to do mostly with how the Practicals of the world got far ahead of its economic theorists. I am going to barely sketch it here. Once again, I reluctantly split in half on the Web what in a better world would be an integral chapter. But it is an important story, critical to understanding what happens next.

. The Three Worlds

Let’s begin by returning to the realm of growth theory, meaning the history of the division of labor. A new chapter in global specialization and interdependence is clearly what the China story is about.

Readers of "Adam Smith, Theorist, '' the fourth episode in this serial, will remember the argument. Smith’s Wealth of Nations contained not one but three “thinking caps,” or paradigms, as we call them now, There was price theory, as represented by the metaphor of the Invisible Hand; growth theory, conveyed by Smith’s disquisition on the pin factory; and monetary theory, symbolized by the metaphor of “Daedalean wings.”

Economists became preoccupied with price theory and left specialization and money to others. Monetary theory remained inside the tent of economics, though in a junior place, with much of its work done by central banking practitioners; growth theory operated at the fringes of the tent, or , more commonly, outside of economics altogether: Charles Babbage, John Rae, Friedrich List, most famously Karl Marx, and his 20th Century epigone Joseph Schumpeter. John Stuart Mill smoothly effected the separation of specialization out of economics when he wrote, in 1848, in Principles of Political Economy:

"In so far as the economical condition of nations turns upon the state of physical knowledge, it is a subject for the physical sciences, and the arts found on them. But in so far as the causes are moral or psychological, dependent on institutions and social relations, or on the principles of human nature, their investigation belongs not to the physical but to moral and social science, and is the object of what is called Political Economy.''

For the next 80 years, as Germany and Japan industrialized, they learned economics from the British, French, Austrians and Scandinavians; economics learned measurement from the Germans. The European powers raced to establish imperial dominion over portions of the Earth not previously claimed. What today we call “development economics” was mostly handled by students of Karl Marx. They took power in Russia, in 1917.

Then came the Great Depression. John Maynard Keynes, though he had as a young man worked on Indian currency problems, was thoroughly Eurocentric. Schumpeter, Hayek and Irving Fisher were hardly less so. H.W. Arndt, of Oxford University, later summarized James Meade’s overview of “business activity” for the 1938 World Economic Survey of the League of Nations this way:

"Developments in the United States, Western Europe, and Japan, were covered in some detail in twenty-six pages; the “primary producing countries” (Australia, Canada, New Zealand, Argentina, Brazil, Chile; Hungary, Rumania, Yugoslavia) rated one paragraph and a table; the Balkans, the Dutch East Indies, one sentence each; South America, one paragraph; all the rest, including all of Asia (except Japan), Africa, and the USSR, were completely ignored.''

With the end of World War II approaching, U.S. President Franklin Roosevelt insisted that the European nations must give up their colonies. Decolonization eventually happened, by fits and starts. The climactic Chinese Revolution in 1949 accomplished the rest: the division of the world into three great blocs of nation-states – the so-called First World (the industrial market economies), a Second World (the communist nations), and a Third World of new countries in Africa and Asia, known as “less developed countries,” or LDCs.

These were the circumstances that obtained after 1945. For the communist nations there would be central planning, a discipline known in the Soviet Union as mathematical cybernetics; for the Third World, development economics. Economists in the West would pursue the “Keynesian Revolution. In the story I’ve been telling in this serial, that was only the beginning of “the New Economics.”

. Solow – Establishing the Trend

From the outset, Keynesian economists had been preoccupied with preventing the recurrence of massive, involuntary unemployment. Gradually it grew apparent that the industrial economies, the U.S. economy in particular, were more robust and stable than had been expected. By the early 1950s, the new National Income and Product Accounts made it clear that the U.S. economy was growing more swiftly than others. How to account for national growth rates became one of the outstanding problems.

It fell to Robert Solow, of MIT, to sort out the issue. He had inherited a pair of models constructed by two older Keynesians, one by Roy Harrod, from 1939; the other by Evsey Domar, from 1946. Both depicted growth as a very fragile process, prone to runaway booms and interrupted by long depressions. That didn’t seem to be the case with the U.S. economy in the post-war world.

A gifted craftsman in the new techniques of mathematical model-building, Solow solved the problem through the simple expedient of permitting substitution. In place of the fixed capital/output ratios of the earlier models, he adopted an equation known as a production function, one that allowed for substitution between capital and labor. He illustrated the relationship with a simple graph, relating changes in capital intensity to the savings rate. The model was sleek and simple and old-fashioned; just population growth, capital formation and productivity growth. It had little in common with the attempts to relate consumption and investment and government expenditure that dominated the Keynesian agenda of the ’50s.

The next year Solow tested it empirically, using U.S. GNP data for the period 1909-1949. After he estimated the production function by which workers in factories turned capital investment in machinery into output, he found that he had only explained about 15 percent of the reported growth of output for those years. Something like 85 percent of growth had to be imputed to the broad concept of technical progress.

This was “the Residual”—the portion of increased GDP unexplained by capital accumulation and population growth. There now began a series of efforts to refine measurement, mostly through the then-new concept of human capital, meaning investment in education. None of this altered the basic finding very much at all. New technology, including improvements in organization and the like, account for 60 or 70 percent of growth. .

Solow experimented with various improvements. Gradually he returned to macroeconomics and, in particular, the Phillips Curve. For more than a decade, growth seemed to be a settled topic. By the time that Solow received the Nobel Prize for his work, though, in 1987, Paul Romer, 32, had brought interest in growth back to a boil.

. Romer – opening things up

Romer had been, like Lucas, a University of Chicago undergraduate. Like Lucas, he had gone away to graduate school, before returning to Chicago to complete his graduate work: Lucas to the University of California at Berkeley, where he had studied history for a term with David Landes; Romer, to MIT where, after two years, he passed his economics field exams. After a year auditing courses at Queens University in Kingston, Ontario, while his wife completed her medical training, Romer returned to Chicago and wrote a dissertation supervised by José Scheinkman and Lucas.When he went on the job market in 1982, Solow and others sought to persuade him to return to MIT. He took a job teaching at the University of Rochester instead.

Romer’s dissertation appeared in 1986 as “Increasing Returns and Long Run Growth.” He had used the Arrow framework of contingent states, embedded in a model developed by Tjalling Koopmans and David Cass, to produce a dynamic account of the growth process. It was close in spirit to the Solow model, but because consumption was decentralized. Instead of being treated as a given, the savings rate thus became a matter of choice for actors within the model. This meant that all manner of policies could influence the outcome. The effect was electric: economists love to manipulate policy levers. Suddenly growth theory was booming again.

Tucked away in Rochester, Romer discovered a problem. He had set out to depict profit-seeking investment in research and development. But there was no reason to undertake it in his model; the math he had employed wouldn’t let him do it: Every new bright idea was instantly copied away before it could earn a return, through the magic of uncompensated “spillovers.” (I do a better job of telling this somewhat complicated story in Knowledge and the Wealth of Nations: A Story of Economic Discovery (Norton, 2006)).

So Romer turned to a bag of tools designed sixty years before to capture just such situations, the convention known as monopolistic competition. He wrote temporary monopolists into his model – holders of trademarks, patents, copyrights, and, most of all, the slowly-wasting secrets we call know-how. Now he had an economy in which there was plenty of reason to invest in new products and new knowledge about how to make more.

But no longer did his model exhibit the kind of perfect competition associated with price system as governed by the Invisible Hand. Now someone would have to make some rules governing intellectual property. This was apostasy, at least in the Chicago tradition. Then in January 1988, the University of Chicago hired him back as a full professor.

. Lucas – emphasizing education

When Romer returned to Chicago from MIT to write his dissertation in 1980, it didn’t take a genius to recognize that vast changes were occurring on the global stage. Japan as Number One, by Ezra Vogel, was on best-seller lists. The economies of Singapore, Hong Kong, Taiwan and Korea were the “East Asian miracles,” The OPEC nations were spending heavily on infrastructure – and arms. Milton and Rose Friedman, who in their highly successful PBS television series Free to Choose had discussed Hong Kong, were invited to lecture in Beijing. Paul Samuelson’s introductory text, which in its first edition, in 1948, mentioned the underdeveloped world precisely twice, and then only in passing, in its 1980 edition dwelt on the topic “from the front flyleaf to its chapter 5, ‘Income and Living Standards,’ to many of its last hundred pages,” as noted by H.W. Arndt in Economic Development: The History of an Idea.

Nevertheless, there was considerable excitement when Robert Lucas delivered his Marshall lectures at Cambridge, in 1984 and chose as his topic “The Mechanics of Economic Development.” Lucas was already recognized in many quarters as the leading macroeconomist of the day; but the University of Cambridge, was not one of them. For 150 years the ancient English university had been the world capital of economics, but by now had been pretty decisively displaced by Cambridge, Mass., and Chicago. It was expected that Lucas would talk about rational expectations and monetary theory.

Instead, he asked to speak about growth. It was a new field for him, he explained, but he didn’t want to spend the second half of his career defending what he had done in the first. He didn’t say that recently, Edward Prescott, the friend and collaborator with whom Lucas had laboriously operationalized Arrow’s apparatus of contingent states, recently had begun a new program of research. Lucas had used the new tools of dynamic programming to put the topic of money at the top of the profession’s docket. Now Prescott was using the same methods in an attempt to take it off again. Lucas decided to spar with Romer instead. The younger man’s work hadn’t been published yet, but the members of the Chicago department had been arguing among themselves about its significance for two years.

By assigning so great a role to “technology” as a source of growth, both Solow and Romer necessarily were assigning too small a role to alternative possibilities, Lucas argued.

"We say that Japan is technologically more advanced than China, or that Korea is undergoing unusually rapid technical change, and such statements seem to mean something (and I think they do). But they cannot mean that “the stock of useful knowledge” (in Simon Kuznets’s terminology) is higher in Japan or China, or that it is growing more rapidly in Korea than elsewhere. 'Human knowledge' is just human, not Japanese or Chinese or Korean. I think when we talk this way about differences in technology across countries, we are not talking about knowledge in general, but about the knowledge of particular people, or perhaps particular subcultures of people…. We want a formalism that leads us to think about individual decisions to acquire knowledge, and about the consequences for productivity. The body of theory that does this is called the theory of human capital….''

Already Romer was moving in the opposite direction, assigning still more importance to the economics of new goods and services. The formalism he was working on would lead economists to think about IBM, Microsoft, Google, Toyota, Samsung, and the Chinese Academy of Sciences. The excitement would spread. Economists studied Korean chaebol vs Japanese zaibatsu as engines of growth; the significance of banks; patents vs. prizes; the origins of the Industrial Revolution; the impact of various “general-purpose technologies” (steam, electricity, computers, the germ theory and public health); and, perhaps above all, the importance of trade. The world was changing and economics was changing with it.

But the sparring with Lucas didn’t last for very long. After 18 months Romer quit his appointment at Chicago and in 1989 moved to California, where his physician wife enjoyed better employment opportunities. He spent a year at the Center for Advanced Studies in the Behavioral Sciences, at Stanford, taught for six years at the University of California at Berkeley, for 11 more at the Graduate School of Business at Stanford, where he won its distinguished teaching award prize in 1999, but he all but stopped publishing economic research. He founded a publishing company, quit Stanford to run it, sold it, and with the proceeds started a foundation to pursue the founding of “charter cities” in empty spaces in developing nations, loosely based on the concept of charter schools. After two last-minute failures to launch, in Madagascar and Honduras, he is still looking for his first opening.

Romer returned to academia in 2010 as a professor at New York University’s Stern School of Business. In January of this year he

launched an attack ondescribed at as Lucas’s tendency to “mathiness,” an accusation of bad faith which he has since refined in a series of blog posts. He may yet find ways to frame the issues better, but so far Romer’s campaign has mainly elicited curiosity.

. Prescott – maybe money doesn’t matter after all

Let’s go back to that Lucas essay, “Understanding Business Cycles,” in 1977. In the turbulence surrounding everything else Lucas was involved in — the success in reframing monetary theory, the new doctrine of policy ineffectiveness, the beginnings of “new growth theory – it was easy to overlook what happened next.

Before Keynes, Lucas wrote, business cycles had been regarded as one of the main mysteries in all of economics; and incorporating cyclical fluctuations into general equilibrium theory, in which, in principle,they shouldn’t exist, one of its greatest challenges. The Keynesian Revolution had redirected the effort to, as Lucas put it, “an apparently simpler question of the determination of output at a point in time, taking history as given.” Meanwhile, Keynesian macro had enjoyed the fruits of a second revolution (which, Lucas? said, owed more to the Dutch econometrician Jan Tinbergen than to Keynes) in the level of precision and explicitness with which theories were formulated. Business-cycle theory had stagnated all the while.

"The economically literate public has had some forty years to become comfortable with two related ideas: that market economies are inherently subject to violent fluctuations which can only be eliminated by flexible and forceful government responses; and that economists are in possession of scientifically-tested knowledge enabling them to determine, at any time, what these responses should be.''

Never mind that public skepticism about economists’ pretensions had grown sharply in the 1970s. By now, Lucas said, the profession itself had doubts about the validity of the second proposition: it was ready to re-examine the first. The alternative possibility – the view that Lucas shared with Milton Friedman – was that the economy was inherently fairly stable and that clumsy government policies undertaken to offset private-sector instability had been the root cause of the cycles over the years. Lucas wanted to put competing hypotheses to a test. But how?

Little noticed was the phrase with which Lucas had defined business cycles as “movements about trend in gross national product in any country…” This was a very different definition from that of the Business Cycle Dating Committee of the National Bureau of Economic Research. The NBER approach is a kind of statistical “thick description” that has evolved over nearly a century of comparing each new recession or expansions to the others. This agnostic index-building was condemned in 1947 as “measurement without theory” by the Cowles Commission, but it has endured, highly valued by those who believe that each bust probably is best understood in terms of the previous boom.

If not from the NBER, where to get a trend from which to discover the cycles to be explained?

In 1982, Edward Prescott, Lucas’s former collaborator, proposed a different way to build an apparatus with which to perform the tests that Lucas wanted. With Fynn Kydland, his former student, he would take their trend from the neoclassical growth model – the Solow model, in the high-tech general equilibrium version fashioned by David Cass and Tjalling Koopmans. They would derive their business cycles from that, using US quarterly data for the period 1950-1979. With his CMU colleague Robert Hodrick, Prescott produced a filter to remove the trend in order to leave the residual data – the cycles. With Kydland, he built a model that seemed to fit. Unemployment in the NBER version became “fluctuations in hours allocated to market activity that are too large to be accounted for by changing marginal pructivities of labor as reflected in real wages.”

It turned out they didn’t need an unsteady hand on the money supply to explain the half-dozen post-war recessions Prescott and Kydland had identified, or even any shock. A constant series of small shocks would do. Prescott called them “technology shocks.” He and Kydland put investment dynamics at the heart of their model. They called it Time to Build and Aggregate Fluctuations. The following year, inReal Business Cycles, John Long and Charles Plosser argued that money tends to simply track these ”variations in the real opportunities of the private economy,” rather than causing them. Economists since David Hume, including Friedman and Lucas, considered that money somehow played a vital role in business fluctuations. Prescott’s argument was, on many levels, a surprising one.

This is no place to go into the intricacies of the new classical view of business cycles In the circles where high macroeconomic theory is done, RBC theory was the straw that stirred the drink after 1982, prompting myriad alternative systems to be created and propounded, gradually forcing the transition to the methodological style known as decentralized stochastic general equilibrium models.

Fortunately,Michel De Vroey, a professor of economics at the University of Louvain, has tracked the debates between the New Keynesians and New Classicals over the years, patiently and dispassionately. His book, A History of Economics: From Keynes to Lucas and Beyond (Cambridge, 2015), promises to be a landmark event in circles extending far beyond the history of thought into the controversies surrounding economics in the present day. For an edifying foretaste, see "What Can Civil Society Expect from Academic Macroeconomics?''

Debates there were, though they remained recondite for the most part. Real Business Cycle Theory met resistance every step of the way from those who considered themselves practical, practicing macroeconomists. Lawrence Summers, of Harvard University, led the way in 1986 with "Some Skeptical Observations on Real Business Cycle History''. N. Gregory Mankiw, also of Harvard University, in "Real Business Cycles: A New Keynesian Perspective,'' pointed out the irony that the theory appeared just as Federal Reserve chairman Paul Volcker demonstrated how powerful an effect monetary policy could have on prices, employment and output. Maurice Obstfeld and Kenneth Rogoff observed, “A theory of business cycles that has nothing to say about the Great Depression is like a theory of earthquakes that explains only small tremors.”

But remember, this was the period that had been dubbed “the Great Moderation,” In 2004, when the Nobel Prize was awarded to Prescott and Kydland, “for their contributions to dynamic macroeconomics: the time consistency of economic policy and the driving forces behind business cycles,” small tremors had been the rule for more than 60 years.

And so it was here that matters stood in 1982 – small clouds of discussion, in Cambridge, in Chicago, in Minneapolis-St. Paul, none bigger than a circle of a few academic economists – when the 25-year boom began.

. xxx