Chris Powell: Government and other villains in Conn'.s medical-insurance price surge

Logo for Connecticut’s health-insurance marketplace

MANCHESTER, Conn.

Who and what are to blame for the soaring cost of medical insurance in Connecticut? A couple of weeks ago, a hearing held by the state Insurance Department heard opinions in response to more requests from medical insurers for premium increases, this time averaging 20 percent for individual policies and 15 percent for small group plans.

Of course, the country's general inflation rate is a big part of the problem. But the costs of medical insurance are especially complicated, since for many years government's intervention, necessary as it may be, has turned medicine into a carnival of cost-shifting, so much so that people can hardly know the real cost of what they're getting and who is really paying.

Elected officials blame insurers, who blame hospitals and doctors, who blame insurers and government. They're all correct, though exactly how much each is to blame isn't clear.

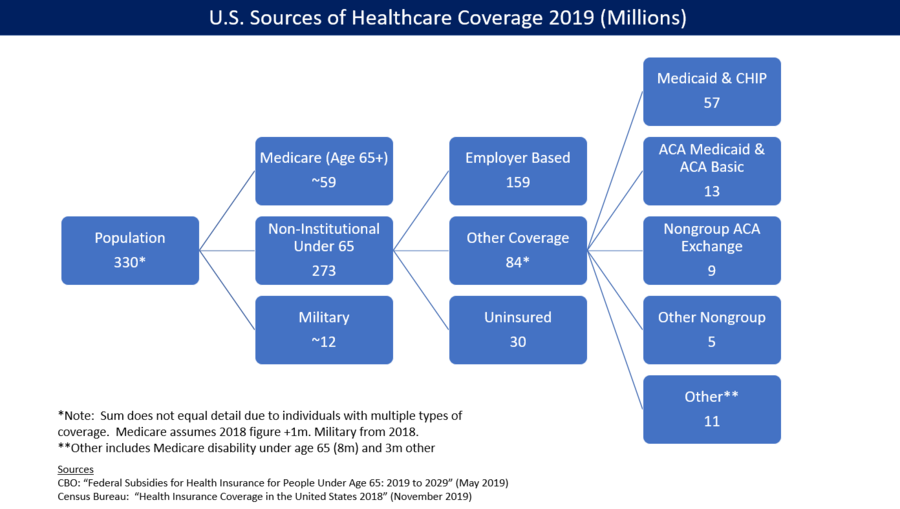

But start with government because of its direct accountability to the public and because government is the biggest purchaser of medical insurance -- for its employees, for the poor via Medicaid and for the elderly via Medicare.

Government's payments for Medicaid and Medicare patients are sharply discounted from rates paid by other patients. The point of this discounting was to shift costs to those other patients and hide them. Exactly how much costs are shifted is debated. But if government paid more for the poor and elderly, hospitals and doctors could charge other patients less and insurers could reduce their rates -- at least theoretically.

But saving money in medicine and medical insurance may require competitive markets even as those sectors have greatly consolidated.

Most Connecticut hospitals are now owned by two chains -- Hartford HealthCare and Yale New Haven Health -- and hospitals have been acquiring or partnering with physician practices, further diminishing competition. This consolidation has been attributed to the growing burden of government regulation and the desire of doctors to do less paperwork and more patient care.

Meanwhile, insurance companies have merged and gotten bigger or left the medical insurance business. Only three insurers are selling individual medical policies on Connecticut’s Affordable Care Act exchange in Connecticut, and one insurer has reported big losses in the last two years. That company may not be looting its customers as much as the haters of insurance companies like to believe. But if medical insurers really have excess profits, government could always tax them away.

How hard are medical insurers negotiating with hospitals and doctors? At the recent hearing, state Atty. Gen. William Tong complained that insurers are not negotiating costs but rather building their rates on mere estimates of annual cost increases. Presumably state law could require insurers to seek specific rates from hospitals and physicians for a year or two in advance, if hospitals and physicians were willing and able to provide them and stick to them. They're probably not.

Also driving up medical-insurance costs are state government mandates for coverage that insurers must provide. Not all are necessities. Many are mainly matters of legislators seeking to gratify one constituency or another. Could state government reduce its medical insurance mandates? Not without a lot of shrieking.

(Meanwhile, state government's medical insurance for its employees and retirees spends $1 million a year for erectile -dysfunction drugs.)

Maybe the best suggestion at thd hearing was made by state government's departing health-care advocate, Ted Doolittle, who said that insurance companies are serving as a "stalking horse for the hospitals," the biggest parties in interest. Doolittle said hospitals should be interrogated just as closely as insurers and the hospitals raising costs most should be identified.

There's a lot of money in medicine and insurance, with many executives paid spectacular salaries, and the search for medical and medical-insurance coverage efficiencies is a largely political matter. So it should be the General Assembly's job more than the Insurance Department's.

Indeed, for just presiding over soaring medical-insurance costs, government is most to blame for them. But then, which legislators have the courage to risk offending not just two huge industries but also their many constituents who are patients?

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net.)