More efficient and more expensive?

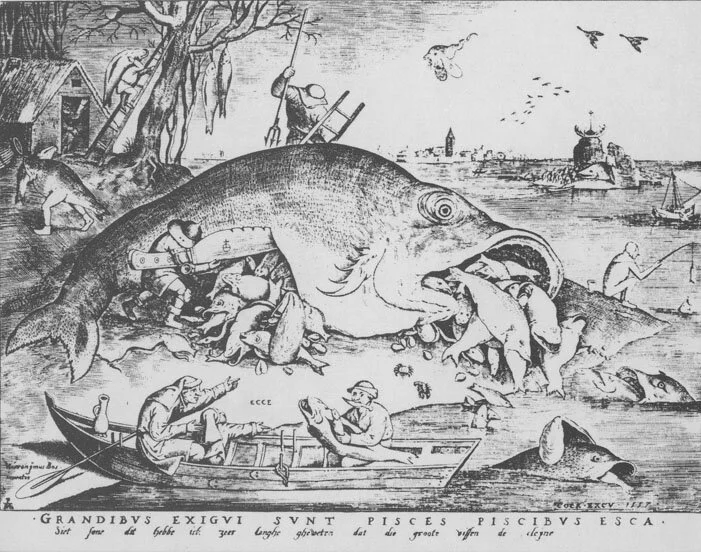

“The Big Fish Eat the Small Ones,’’ by Peter Brueghel the Elder (1556).

From Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

“The sooner patients can be removed from the depressing influence of general hospital life the more rapid their convalescence.’’

-- Charles H. Mayo, M.D. (1865-1939), American physician and a co-founder of the Mayo Clinic, in Rochester, Minn.

The plan for Lifespan and Care New England (CNE) to merge, if regulators approve it, would probably make Rhode Island health care more efficient. It would do this through integrating their hospitals and other units. That would do such things as speeding the sharing of patient information among health-care professionals and streamlining billing. Further, it would probably strengthen medical research and education in the state, much of it through the new enterprise’s very close links with the Alpert Medical School at Brown University, which, indeed, has pledged to provide at least $125 million over five years to help develop an “academic health system’’ as part of the merger.

The deal, by reducing some red tape (with the state having just one big system instead of two), might make health care in our region more user-friendly for patients, dissuading more of them from going to Boston’s world-renowned medical institutions, thus keeping more of their money here.

The best example of where the merger could improve health care would be in better connecting Lifespan’s Hasbro Children’s Hospital with Care New England’s Bradley Hospital, a psychiatric institution for children, and Women & Infants Hospital.

But would the huge (especially for such a tiny state) new institution have such power that it would impose much higher prices? Studies have shown that hospital mergers almost inevitably mean higher prices. So insurance companies, as well as poorly insured patients, may eye a Lifespan-CNE merger with trepidation.

And expect job losses, at least for a while, given the need to eliminate the administrative redundancies created by mergers. Meanwhile, senior- executive salaries in the new entity would probably be even more stratospheric than they are now at the separate “nonprofit” companies, and I imagine the golden parachutes for departing excess senior execs would blot out the sun.

Meanwhile, Boston will remain a magnet for health care, and so it’s conceivable that the behemoth and very prestigious Mass General Brigham hospital group would end up absorbing the Lifespan-CNE giant in the end anyway.

Health-care behemoth coming for a tiny state?

Behemoth as depicted in the Dictionnaire Infernal

From Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

Good out of bad? Lifespan and Care New England, Rhode Island’s two big “nonprofit’’ hospital systems, have had to tightly coordinate their responses to the COVID-19 crisis – an experience that has led them to revive merger or at least “collaboration’’ plans. A merger might save on administrative and other costs borne by the public and enable the state to have a system big and strong enough to compete with the Boston health-care behemoth by maintaining a full-range of medical services and research in the Ocean State and by strengthening its only schools of medicine and public health, at Brown University. A merger might preserve a lot of jobs in Rhode Island. But at the same time, many jobs would presumably be lost as the merged company eliminated redundancies.

Of course, such a large and powerful merged entity would have to be carefully regulated. As Michael Fine, M.D., warned last week in GoLocal, such mergers have tended to raise health-care consumers’ costs because of the monopoly pricing-power created. And I wonder what gigantic golden parachutes, paid for indirectly by the public, would go to Lifespan and Care New England senior executives in a merger.

To read Dr. Fine’s comments, please hit this link.

Let behemoths bargain with behemoths

Behemoth and Leviathan, watercolor by William Blake from his Illustrations of the Book of Job.

From Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

So consolidation of New England’s health-care biz continues apace. Two big Massachusetts-based health insurers – Harvard Pilgrim Health Care and Tufts Health Plan -- plan to merge. This follows Beth Israel Deaconess Medical Center and Lahey Hospital merging this year into the very big Beth Israel Lahey Health, and Rhode Island-based CVS taking over health insurer Aetna. And huge Partners HealthCare, the Boston-based hospital and physicians network group (Massachusetts General Hospital, etc.), made a run this year at taking over Rhode Island-based Care New England. And the latter outfit was in failed talks to merge with Lifespan, a merger that economics might still force – to be followed by that merged creature being eaten by a Boston group, producing a flock of golden parachutes for redundant executives?

The economics of the health-care business mean that there will be more such mergers. Big will get bigger. This may include Partners coming back to Rhode Island to try to gobble up Care New England or Lifespan or both. Or maybe Beth Israel Lahey Health will try to invade the Ocean State.

With the huge economic power – especially pricing power – and lobbying clout of the new insurance behemoths, state regulators will have their hands full trying to regulate them. Still, the merger, which would affect several million New England customers and their families, would create an entity with impressive bargaining weaponry to curb the very high prices enabled by the size and global prestige of the hospital behemoths. So let ‘em merge.

Boston gobbling up Providence

The Warren Alpert Medical School at Brown University, in Providence's old Jewelry District. The building used to be a factory.

Adapted from Robert Whitcomb's "Digital Diary,'' in GoLocal24.com

Brown University says it will continue its links with Care New England (CNE), which has medical school teaching hospitals, even if Boston-based behemoth Partners HealthCare takes it over. Well, of course Brown would have to: It needs nearby teaching hospitals!

The PR on this is that the medical school would remain Care New England’s primary research and teaching affiliate. Well, maybe. The financial and research clout of Partners (with such world-renowned hospitals as Massachusetts General and Brigham and Women’s hospitals) is such that that we can expect a lot of CNE stuff now being done in Rhode Island – much of it administrative but some of it clinical work and research -- will end up being done in Boston. A lot of jobs will disappear around here, but some might be added, too, maybe even from Boston:

Greater Providence will continue to have the advantages of being a cheaper and easier place to work in.

Next stop: Partners might also buy Lifespan, the biggest Rhode Island hospital system, thus becoming a statewide monopoly. An alluring opportunity to jack up prices.

Boston sucking in the health-care biz; better trains, please

Main entrance of Massachusetts General Hospital, in Boston. MGH is the flagship of Partners HealthCare.

It’s unclear what precisely is going on with the new talks among Partners HealthCare, the giant Boston-based hospital system, and Rhode Island’s Care New England (CNE) and Lifespan. Partners of course has been trying to take over CNE, and now it may be trying to take over Lifespan, too. The participants’ statement that they are assessing how “they might work together to strengthen patient care delivered in Rhode Island’’ is smoke that may camouflage what might really be going on: a plan for Partners to take over most of the Ocean State’s hospitals. (Who knows what might happen with South County Hospital, which is still independent. Westerly Hospital is part of the Yale New Haven Health System.)

The effect of a takeover by Partners would be that much (most?) of Rhode Island’s health care would be run from Boston, one of the most important medical centers on Earth. It would mean that, more and more, complex procedures for Rhode Islanders’ very serious illnesses and injuries would be performed in Boston, because of the efficiencies of scale and the density of specialists there, and not in Rhode Island, which would offer mostly primary and behavioral- and mental-health care.

It’s unclear what the impact would be on the Brown Medical School. Butler, Bradley, Hasbro Children’s, Miriam, Rhode Island and Women & Infants’ hospitals, as well as the VA Medical Center in Providence, are all teaching institutions for Brown. Partners’ facilities are teaching hospitals for the behemoth Harvard Medical School. Tough competition.

A Partners takeover of CNE and Lifespan, besides providing very lucrative golden parachutes for CNE and Lifespan executives – bosses of enterprises being acquired love mergers because they make a personal killing -- would leave an enterprise with huge pricing power. You can be pretty sure that it would take full advantage of this by jacking up prices, just as Partners has done in Greater Boston. That has drawn much scrutiny from Massachusetts regulators and long investigative pieces from The Boston Globe.

Rich and powerful Greater Boston often seems to suck up a lot of oxygen in New England. Still, overall, Rhode Island benefits from being so close to a world city, with its massive wealth creation and cultural richness. Indeed northern Rhode Island is increasingly part of Greater Boston – a cheaper residential and workplace option for people who need to be close to, especially, downtown Boston/Cambridge. Consider that Rhode Islanders will soon be able to apply for some of the 2,000 jobs that the increasingly monopolistic Amazon has just announced it will add in Boston, which is also still a candidate for the company’s much-hyped “second headquarters.’’ (Will the massive coastal flooding that seems to be an increasing threat to Boston’s Seaport District scare them away?)

The improvements in Boston-Providence MBTA commuter rail service promoted by a group called TransitMatters would improve the benefits to Greater Providence of being close to Boston. Few if any projects enrich a metro area like good mass transit.

To read the TransitMatters.org on this, please hit this link:

http://transitmatters.org/regional-rail-doc

Among the organization’s many recommendations is for trains on the Boston-Providence line to run every 15 minutes at peak times and every half hour in off-peak times, as well as free transfers among commuter trains, buses and subways. The aim is also to cut the MBTA train time between Providence and South Station, in Boston, by, say 20 to 25 minutes.

This may all seem pie in the sky until you see that Europe and East Asia already have such service – actually, some of it is even better. A major reason is that they see state-of-the-art passenger train service as crucial for the socio-economic health of their metro regions and are willing to levy the taxes needed to provide it, unlike in private-opulence-public-squalor America.

Brown U. tries to fend off expansionist Partners HealthCare

Part of the Warren Alpert Medical School, aka the Brown Medical School, in Providence.

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com:

Brown University’s plan to join with for-profit Prospect Medical Holdings to buy Care New England to fend off Partners HealthCare’s bid for CNE is motivated by a very reasonable fear. Partners is joined at the hip with the Harvard Medical School. Letting the Partners behemoth into Rhode Island would result in many patients and clinicians who might otherwise stay in Rhode Island going to Partners’ famous Harvard-affiliated hospitals in Greater Boston, perhaps ravaging the small Brown Medical School in the process.

Indeed, Partners would suck a lot of oxygen out of the Ocean State’s health-care sector. But the takeover looks full-steam ahead. Partners’ Massachusetts General Hospital and Brigham and Women’s Hospital may well already be planning to welcome many new patients from Little Rhody.

2 N.E. healthcare leaders warn of effects of ACA repeal

Adapted from an entry on the Cambridge Management Group (cmg625.com) Web site:

The Republicans’ promise to repeal the Affordable Care Act not only threatens to deprive millions of people of their health insurance; it could drive many hospitals deep into debt and destroy innovative programs created by the ACA aimed at improving patient care, two New England healthcare leaders say.

Timothy Ferris, M.D., an internist and medical director of the Mass General Physicians Organization, told FierceHealthcare that he worries that the “progress we’ve made over the past five years would be threatened.”

He said that includes programs through the Accountable Care Organization (ACO) at Massachusetts General Hospital, including experiments with video consultations and home hospitalization.

Dennis Keefe, head of Care New England, in Rhode Island, told NPR that he is concerned about the future for Integra, an ACO that includes primary- care physicians, specialists, urgent-care and after-hour providers, clinics, laboratories and inpatient facilities.

Hospitals and healthcare systems that have spent the last six years trying to create new value-based, patient-centered models as part of the ACA. And so 120 organizations sent a letter to President Trump and Vice President Pence urging them to not roll back progress they have made.

To read more, please hit this link.

Will hospital merger mania continue?

Excerpted from Robert Whitcomb's "Digital Diary,'' in GoLocal24.

The collapse of affiliation talks between Care New England, the Rhode Island hospital chain, and Southcoast Health, in southeastern Massachusetts, as did the collapse of Lifespan and Care New England talks a few years back, raises the question of when we’ll see another hospital chain merger around here, given the inevitable turf battles.

With the drive for economies of scale and for sharing access to the best care and research, will the latest collapse lead to a big Boston-based chain coming in and taking over? Partners HealthCare, whose hospitals include Massachusetts General Hospital and Brigham & Women’s, might eye expansion in these parts because Massachusetts regulators think that it has gotten too big and powerful in Greater Boston. The Brown Medical School would presumably not like a Partners invasion because Partners is joined at the hip with the Harvard Medical School behemoth. Maybe given the size and executive salaries of hospitals these days, affiliating with the Harvard Business School would be appropriate.

Many hospital chains want to merge to strengthen their bargaining power with huge insurance companies. Maybe in 10 years, we’ll have “Medicare for all,’’ which will make much of this moot.

In the meantime, we have something to learn from those independent hospitals, such as South County Hospital, in southern Rhode Island, that have maintained their independence and high-quality care in the face of the massive disruption that that healthcare sector is now undergoing.