Chris Powell: Merchants are more honest than Sen. Blumental about debt

In the early 20th Century, the National Consumers League promoted the “Shop Early Campaign". This systematic multi-year publicity campaign used cartoons, letters, editorials, articles and advertisements, sending materials to hundreds of newspapers and retailers across America.

MANCHESTER, Conn.

What would the holidays be in Connecticut without U.S. Sen. Richard Blumenthal warning his constituents about the perils of the season -- dangerous toys, fraudulent business practices, Republicans, and the like? (Poking the Russian bear on its own doorstep has yet to make the senator's list.)

Last week the senator affected alarm about merchants who advertise products available for purchase with deferred payments -- “buy now, pay later" promotions. People who purchase something by agreeing to pay in the future may find that when the bill comes due that their financial situation has deteriorated. Worse, the senator notes, being late with a deferred payment may trigger penalty interest charges.

Of course, anyone who has graduated from high school might suspect these risks. But then maybe the senator understands that many Connecticut high-school graduates can't read, write, and do math at a high school or even an elementary-school level.

In any case the senator overlooks an argument in favor of “buy now, pay later" purchases, an argument that members of Congress especially should understand: inflation and the decline of the value of the U.S. dollar and wages paid in dollars. Amid inflation certain goods -- if not worn out, damaged, or perishable -- may actually increase in value and, when payment has to be made, may be worth more than their original price.

Indeed, Blumenthal misses the great irony in his warning people against deferred-payment schemes: his having been for the last 15 years an enthusiastic supporter of the federal government's own “buy now, pay later" policy.

For the federal government increasingly finances itself with borrowing, and its total debt now exceeds $38 trillion, an unfathomable number.

Government debt is not necessarily bad; it can be productive. But this is a matter of degree, and in recent years the federal debt has gone wild, as suggested by the country's recent severe inflation and the heavy burden of federal government interest payments, estimated at about a trillion dollars annually and rising.

Most of this debt is not for long-lasting capital projects that will benefit the country for decades but for ordinary operating expenses and income supports, with the interest requiring payment far into the future by people who never benefited from the debt.

This is borrowing for current expenses, which used to be considered immoral. But in national politics today, especially among Democrats like Blumenthal, money is believed to be infinite. (Most Republicans know better without acting much better.)

Today in Congress if any Democrat sees a need, actual or merely political, he'll put it into an appropriations bill, and, if he's friendly enough with the ranking Democrat on the House Appropriations Committee, Connecticut Rep. Rosa DeLauro, she'll put it into the next federal budget with no concern about the federal debt, inflation, or interest burdens.

Members of Congress love this system because it lets them distribute infinite goodies, essential or not, and pay for them indirectly, not with taxes but with inflation, a disguised tax few voters understand or can fix responsibility for.

That's why the merchants promoting deferred payments are actually more honest than the senator who is warning his constituents against them.

Stick to a merchant's deferred-payment plan and you'll pay only as much as you signed up to pay. But with the federal government, whose costs are increasingly financed by borrowing, debt monetization, and inflation, you pay now, later, and -- since the debt is never actually repaid at all, but just keeps rising -- you pay for the rest of your life as well for what you get or once got from the federal government, and for what you didn't get but others get or used to get.

So what's really more dangerous -- the toys Blumenthal is scorning, whose small parts a 2-year-old might pull off and swallow or stick in his nose or ear, or a government that, when the kid turns 18, will welcome him into adulthood largely ignorant and unskilled but, as a taxpayer, already heavily mortgaged?

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Designed to prohibit housing affordability

MANCHESTER, Conn.

Perhaps taking a hint from socialist Democrat Zohran Mamdani's successful campaign for mayor of New York City, whose slogan was “A city we can afford," politicians in both parties in Connecticut are taking “affordability" for their own platforms.

Some Connecticut Democrats, including Gov. Ned Lamont, have even attributed their party's success in this month's municipal elections to a supposed commitment to affordability. This is laughable. Far more votes were probably pushed toward the Democrats by the political chaos in Washington than by any achievement in “affordability" in Connecticut, though the six-week partial shutdown of the federal government was an entirely Democratic stunt, not President Trump's doing.

Yes, Connecticut's Democratic state administration hasn't raised taxes much lately, but municipal property taxes still go up because state law and policy determine much of how municipalities spend their money. These days there's not much difference between state and municipal finance.

Greenwich state Sen. Ryan Fazio, a candidate for the Republican nomination for governor next year, pressed the “affordability" theme in response to Lamont's declaration of candidacy for a third term.

“Governor Lamont's first eight years in office," Fazio said, “have seen Connecticut's electricity rates rise to the third-highest in the nation, and our economic growth plummet to fourth worst in the country. Families are struggling to make ends meet, while people and jobs are leaving our state. … I am running for governor to make our state more affordable and safe and create opportunities for all."

Connecticut's increasing unaffordability has been caused to a great extent by the explosion of federal spending and debt, for which the state's members of Congress, all Democrats, share responsibility.

But much of Connecticut's unaffordability is also caused by the state's own law and policy. Indeed, state law and policy virtually prohibit affordability by preventing ordinary efficiency in government, and affordability will never be achieved if this isn't spelled out.

For example, Connecticut didn't enact collective bargaining for government employees and binding arbitration for their union contracts in pursuit of affordability. Collective bargaining and binding arbitration for government employees had the effect of driving up government's costs, relieving elected officials of difficult responsibility, and sustaining a powerful special interest that serves as the army of the majority party, the Democrats.

These laws forbid ordinary democratic control and accountability in public administration.

Connecticut didn't enact its minimum budget requirement for school systems in pursuit of affordability. The minimum budget requirement, which virtually prohibits economizing in school systems even if student enrollment falls substantially, was enacted to ensure that any financial savings in schools would be transferred to school employees, particularly teachers, rather than refunded to taxpayers.

Nor did Connecticut enact its “public benefits charges" -- essentially taxes on electricity -- to make life in the state more affordable but to conceal the costs of welfare and “green" energy programs in electricity bills so people would blame the electric utilities for electricity's high cost, though the utilities, at the command of state law, stopped generating electricity years ago and now only distribute it.

At least Republican state legislators, a small minority in the General Assembly, recently made an issue of the “public benefits charges" and the majority Democrats found them hard to defend, so some were removed from electric bills. But they were not eliminated. Instead state government now is paying for the “public benefits" with bond money, which will cost state residents even more in the long run.

The “public benefits charges" were an easy target. The special interests dependent on them, welfare recipients and self-styled environmentalists, are not so influential. But collective bargaining and binding arbitration for state and local government employees have huge special-interest constituencies, as does the minimum budget requirement for schools.

Those anti-affordability laws are far more expensive than the “public benefits charges," and no politician is likely to criticize them, though there will be little affordability in the state until they are repealed or reduced in scope.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Of teachers’ salaries, per-student parenting and generational poverty in Connecticut

Fancy Staples High School, in rich Westport, Conn.

MANCHESTER, Conn.

Will Connecticut ever realize that two of what it professes to be its highest ideals of public policy, local control and equality of opportunity, are contradictions?

State government was reminded of this again the other day by another report

Connecticut's teacher pension system perpetuates inequity in student tes...

from the Equable Institute, a nonprofit organization that seeks to improve government employee pensions. Connecticut's state teacher- retirement system, the institute notes, does much better by teachers in wealthy municipalities than those in poor ones, because teacher pensions are calculated from their salaries. Wealthy municipalities pay more so their teachers get bigger pensions.

Indeed, Equable says state government pays twice as much for the pensions of teachers in some wealthy municipalities than it pays for the pensions of teachers in some poor ones.

Additionally, because of the higher salaries they pay, wealthy municipalities suffer less turnover in their teaching staffs and retain better teachers longer than poor municipalities do.

Equable says the disparity in pension contributions is responsible for some of the disparity in student performance between wealthy and poor municipalities. That stands to reason, but pension disparities surely matter far less to educational results than the disparities in the household wealth of students and the amount of parenting they get.

As usual, liberals and teachers unions like to attribute all the deficiencies of public education to inadequate spending, even though Connecticut has been raising education spending steadily for almost 50 years, improving teacher salaries and pensions without improving student performance.

Per-pupil parenting has always been the main determinant of student performance, but politics prohibits addressing the parenting problem. No elected official or candidate dares to note the strong correlation between single-parent households and child neglect and abuse, student educational failure, poor physical and mental health, and general misbehavior. Acknowledging that correlation would impugn the entire welfare system and the perverse incentives it gives the poor, and it would show where so much social disintegration is coming from.

But everyone admires teachers as individuals, so finding public money for satisfying them and their unions is easy and doesn't cause the political problems that examining the causes of poverty would.

It's no wonder that teachers prefer to teach well-parented, well-behaved, attentive, and curious kids rather than poorly parented, ill-behaved, and indifferent or demoralized kids. It's no wonder that teachers in impoverished cities, like police officers there, can get worn down quickly and seek to pursue their careers in municipalities with less poverty and dysfunction. This is just another aspect of the flight to the suburbs, which has been caused by government's failure to solve poverty in the cities.

Maybe state law should arrange for all teachers to be paid directly by state government according to the same salary schedule so their pensions would be equalized. No adjustments for union contracts or individual merit could be permitted, since they would generate inequality.

Such an egalitarian system likely would reduce salaries and pensions in wealthy and middle-class municipalities and increase them in poor ones. But of course teacher unions would never give up bargaining power over wages and benefits, not in the pursuit of equality or anything else.

Or maybe teachers in the poorest municipalities should be paid at least $100,000 per year more than teachers in the highest-paying municipalities. They might not all be good teachers but most might deserve more money just for having to deal with so many indifferent and misbehaving students.

While that might be fairer to those teachers, who are part of the constituency the Equable Institute is trying to help, Connecticut's long experience would still be that school spending is almost irrelevant to educational performance, and the presumption of increasing teacher salaries and pensions would still be that the job satisfaction of teachers is more important than education itself and ending generational poverty.

But even the long failure to end generational poverty isn't the biggest problem here. The biggest problem here is simply Connecticut's failure to care much about it. As a political matter, paying off the teachers is the most we can do.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Bears more likely to triumph in Conn. than ‘affordable’ housing’

A Black Bear, of the species found in New England.

MANCHESTER, Conn.

With Connecticut Gov. Ned Lamont's veto of the wide-ranging housing bill recently passed by the General Assembly, the state’s towns aren't likely to reach the ‘‘fair share" quotas of ‘‘affordable" housing the bill set for them. But the legislature's failure to approve other legislation may ensure that each town ends up with another quota -- a quota of bears.

Confrontations with bears in Connecticut have been increasing rapidly, and according to the state Department of Energy and Environmental Protection, there were more than 3,000 last year. These included two attacks on people and 67 of what might be called ‘‘bearglaries," in which the hungry creatures broke into people's houses. Bear attacks on livestock are up too.

A few days ago a bear attacked a man as he walked with his dog on his property in North Canaan. He escaped with scratches.

According to the environmental department, Connecticut has far more bear confrontations than neighboring states, though neighboring states are estimated to have more bears than Connecticut's 1,200 or so. Maybe Connecticut has so many more bear confrontations because, except for Rhode Island, Connecticut's neighbors allow bear hunting while Connecticut doesn't.

The increasing conflicts with bears prompted some legislators in the recent session to propose authorizing bear hunting. But the bears have a lobby organization as influential as the government employee unions, and it also frightened the legislators out of protecting the public.

The bear lobby argues that people who put bird feeders in their yards or fail to secure their trash barrels are to blame for the increasing confrontations. Certainly bird feeders and trash barrels are attractions, but as the many “bearglaries" show, removing feeders and securing trash barrels has little deterrent value.

Providing access to bird feeders and trash barrels may actually discourage bears from breaking into houses for food.

In any case, the bears are already rampant in Connecticut and won't be going away on their own. Unmolested and having no natural predators, they will reproduce at an estimated rate of more than two cubs per year per mother. A doubling of the state's bear population every three years seems possible, with the population pushing steadily into the eastern part of the state. As long as Connecticut's feckless policy toward bears is only to shoo them into a neighbor's yard, more confrontations are inevitable, with or without bird feeders and trash cans, and within a decade every town in Connecticut could have a dozen bears as permanent residents.

Unlike housing developers, bears don't observe zoning regulations. So odds are that, if state law doesn't change, bears will be disrupting many suburbs and rural towns long before those towns get their first “affordable" housing.

It's understandable why government employees come first in Connecticut, far ahead of the public interest. They are numerous and politically organized and have their own political party, so politicians are afraid of them. But why do bears have to come second, still far ahead of the public interest?

Unlike taxpayers, bears are not an endangered species. Other states manage to stand up to them. Except for the political timidity of the state's elected officials, why should bears be any more protected in Connecticut than coyotes and poisonous snakes?

WHO NEEDS “BABY BONDS”? A month ago Hartford Mayor Arunam Arulampalam announced he had rounded up an extra $3 million in city funds and various grants for the city's ever-dysfunctional school system.

Aleysha Ortiz wants that money instead. She's the recent graduate of Hartford Public High School who is suing the city because, despite the diploma the school gave her, she was illiterate. She's suing for damages, and last month her lawyers offered to settle for ... $3 million.

If Ortiz wins she'll have invented a great racket for indifferent students and their neglectful parents. Fail to learn in school, say nothing about it publicly until social promotion graduates you, and then sue and cash in for life. By comparison the “baby bonds" about which state government is so proud will be chump change.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Illegal-immigration backers in Conn. don’t get critical questions

MANCHESTER, Conn.

Immigration-law enforcement agents must be compelled, by congressional action or court order, to identify themselves conspicuously during arrests, to display their badges, and to make prompt public reports identifying the people they have detained, why they have been detained, and where they are being held. A free country cannot allow secret arrests. The necessity of such accountability in government goes back centuries to the Magna Carta.

Democrats in Congress should press this issue instead of simply decrying all immigration-law enforcement. Most of the country will agree, and Republicans in Congress who disagree will risk being exposed as totalitarians.

Police in Connecticut already are obliged by law to follow similar procedure, though they sometimes neglect to report arrests promptly and news organizations fail to notice.

But the greater failure of Connecticut journalism lately involves its reporting of complaints against immigration law enforcement. Reporters can't be blamed when they can't reach or get responses from immigration law enforcers, but they can be blamed when they quote officials, activists, and others in the immigration controversy without posing critical questions.

The recent arrest by immigration agents of a woman as she was driving her children to school in New Haven provoked outrage. Some of it verged on hysteria, like the statement issued by Mayor Justin Elicker.

"To arrest a mother in front of her two young children while taking them to school is simply unconscionable," the mayor said.

So what is the appropriate time to arrest and detain someone with children who is suspected of being in the country illegally? Will such a suspect necessarily cooperate in scheduling her arrest and detention, or might she flee instead? Do New Haven's own police always give notice to the targets of their arrest warrants?

Mayor Elicker wasn't asked.

He continued: "We condemn this deplorable act of family separation and call upon the Trump administration to stop its inhumane approach and cruel tactics."

But don't arrests in New Haven and elsewhere routinely separate people from their children, or are children brought to jail with their parents?

The mayor wasn't asked.

"New Haven," the mayor said, "is a welcoming city for all, and our immigrant neighbors are a part of our New Haven family."

Does New Haven really welcome legal and illegal immigrants, the well-intentioned and the ill-intentioned, and the self-supporting and the dependent alike? Does New Haven distinguish among them, or is that properly the work of immigration authorities? Or should no one do that work and should the nation's borders be opened again?

Mayor Elicker concluded: "New Haven will continue to stand up for our residents and our values, and we will continue fight back with every resource available to us against the Trump administration's reckless immigration policies."

What exactly does "every resource available" mean? Even as the mayor was so upset about that immigration arrest, New Haven's school system was facing a deficit of $16.5 million and was preparing to lay off scores of employees, and the chronic absenteeism rate of its high school students stood at 50 percent.

Since New Haven can hardly take care of itself, how can it afford to be a "sanctuary city," accepting, housing, concealing, and trying to educate unlimited numbers of illegal immigrants? And since state government covers so much of New Haven's expenses, how can Connecticut afford to let the city assume unlimited liabilities like these?

Nor were compelling questions posed the other week amid outrage in Meriden about the immigration agents’ arrest and detention of a city high school student and his father a few days before the boy's graduation.

The two were reported to have been arrested at a scheduled meeting with immigration authorities, so presumably they knew there was something wrong about their presence in the country.

Protesters in Meriden chanted that they want immigration authorities to get out of Connecticut. But wouldn't that leave the borders open again? Is that what the protesters want?

Though they were surrounded by journalists, the protesters were never asked.

Chris Powell has written about Connecticut government and politics for many year (CPowell@cox.net).

Chris Powell: Look for places with good parenting

MANCHESTER, Conn.

Anyone asked to guess the 10 best public high schools in Connecticut would probably select some of those chosen by the Internet site Niche, which connects high school graduates with colleges.

Nine of the 10 high schools chosen by Niche are in Westport, New Canaan, Darien, Greenwich, Wilton, Ridgefield, Avon, Farmington, Glastonbury and Norwalk. All but Norwalk are prosperous communities that spend a lot of money on their schools and get good results. The high school in Norwalk cited by Niche is a regional school drawing especially motivated students, many from outside the city.

According to Niche, all 10 of the best public elementary schools in the state are in three of the towns with the best high schools -- Greenwich, New Canaan and Westport -- and nine of the 10 best middle schools are in the towns with the best high schools.

Of course educators will conclude from these rankings that per-pupil spending correlates with student performance -- spending up, education up. This is self-serving and wrong.

For while not everyone in the towns with the supposedly best schools is rich, most people there are at least middle class and most children there have two parents, either living with them or otherwise involved in their lives. Their parents spend time with them. Most know their letters, numbers, and colors when they first arrive in school. They know how to behave. They have some interest in learning. Their attendance is good because their parents see to it.

Most such children are easy to teach -- not because per-pupil spending is high but because per-pupil parenting is.

Of course circumstances are much different in high schools in municipalities with terrible demographics, municipalities with high poverty and low parenting. Here many children live in fatherless homes, homes with only one wage earner and a smattering of welfare benefits, homes over which a stressed, exasperated, and sometimes addicted mother presides. These children get much less attention and many are frequently absent from school.

In New Haven, the city that is always lecturing Connecticut about how to live, high schools have a chronic absenteeism rate of 50 percent, highest in the state. Good luck to teachers and administrators trying to educate children who frequently don't show up and, when they do, often disrupt classes, get into fights, or suffer mental breakdowns, but whose general discipline or expulsion is forbidden.

That's why the Niche school rankings are so misleading.

For schools and teachers play the hands they are dealt by community demographics.

Any school dealt four aces is almost certain to win regardless of its resources and the competence of its staff. Any school dealt mostly jokers will resort to clamoring at the state Capitol for more money, as if the great increase in state financial aid to schools since the Education Enhancement Act was passed in 1986 has made any difference in education results, and as if the clamor for more money isn't just an excuse for ignoring the parenting problem, which seldom can be discussed in polite political company.

Connecticut's best schools are actually the ones that get the best results from the students who are hard to teach -- the students neglected at home -- not those who are easy to teach. Nobody seems to compile such data, perhaps because it would impugn the premise of education in Connecticut -- that only spending and teacher salaries count and educational results are irrelevant.

For many years in Connecticut the only honest justification for raising teacher salaries has been to induce teachers to stick around with the demoralized, indifferent, and misbehaving kids about whom nothing can be done until government finds the courage to restore academic and behavioral standards. These days teachers are given raises mainly to secure labor peace and union support for the Democratic Party.

It's the same with police departments. Cities, where poverty is worst, struggle to keep officers not so much because suburbs often pay better but because, like city teachers, city cops increasingly want to escape the worsening social disintegration and depravity around them.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Conn. devalues education while throwing more money at it

MANCHESTER, Conn.

Except to the teacher unions, Connecticut's Linda McMahon is a big relief as secretary of the U.S. Education Department, mainly because her predecessor, Connecticut's Miguel Cardona, was such a disaster.

Cardona spent most of his time pandering to the unions. In contrast, the other day McMahon celebrated National Charter Schools Week, applauding competition among schools and the reduction of union influence, which has dumbed down education while inflating its costs.

As long as the teacher unions have so much power in the Democratic Party, and are the foremost special-interest in politics in most states, as in Connecticut, there's no chance of saving public education, and alternative schools may be the only way of preserving any education at all.

Still, it would be nice if somebody tried to restore public education. For public education often used to accomplish what private education seldom could and usually didn't even try to do: integrate society comprehensively -- racially, ethnically, religiously, economically, and by all levels of student intelligence.

Of course, children would and will always be bratty, snobby, cruel, and cliquish much of the time, but even then public schools still can introduce them to different kinds of people and force them to deal with differences and thereby get a hint of the need to unify the country.

Regional “magnet’’ schools in Connecticut and elsewhere were meant to increase racial integration by putting city and suburban students together across municipal boundaries. But there aren't enough “magnet’’ schools to achieve much integration, and, as Hartford's experience has shown, the integration achieved by “magnet’’ schools has led to greater segregation of the urban underclass. For the "magnet" schools have drawn the more parented and engaged students out of neighborhood schools in the city, leaving the students in those schools even more indifferent and demoralized.

The urban underclass is the essence of the education problem. Many people naturally want to escape it and place their children in schools that aren't dragged down by their demographics. That means “magnet’’ or charter schools or, most of all, fleeing the city for the suburbs, not that all suburban schools are so much better.

The only way to recover the integrative influence of public education may be to try to improve public education everywhere at once, first by recognizing that student learning correlates far more with parenting than with school spending. Parenting has declined not just because welfare policy is so pernicious, subsidizing fatherlessness and child neglect, but also because government and schools have let parenting decline by eliminating behavioral and academic standards for both parents and students.

There are no penalties for parents who fail to see that their children get to school reliably. There are no penalties for parents who avoid contact with their children's teachers when something is wrong. There are no penalties for parents or students when students fail to learn.

Indeed, Connecticut's only comprehensive policy of public education -- social promotion -- destroys behavioral and academic standards. It proclaims to parents and students alike that there is no need to learn and that school isn't important. Thus Connecticut devalues education even while increasing its cost.

Connecticut's underclass has figured this out. The underclass knows that no student needs to earn a high school diploma, and that people who have children they are unprepared to support will be subsidized extensively by the government in a fatherless home -- subsidized enough to avoid starvation but not enough to get a proper upbringing.

But if even ignorant students must be graduated from high school, at least their dismal academic records could be printed on their diplomas so a diploma might mean something again, if only a horror story.

Making failing students repeat grades, as was done before self-esteem trumped learning, would have even more impact. Limiting students to two repeated grades before graduating them early but ignorant would have still more.

Until society forcefully demonstrates its respect for education and realizes that just throwing more money at it doesn't work, the underclass won't respect it either.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Illegal-immigration backers ignore its enormous costs

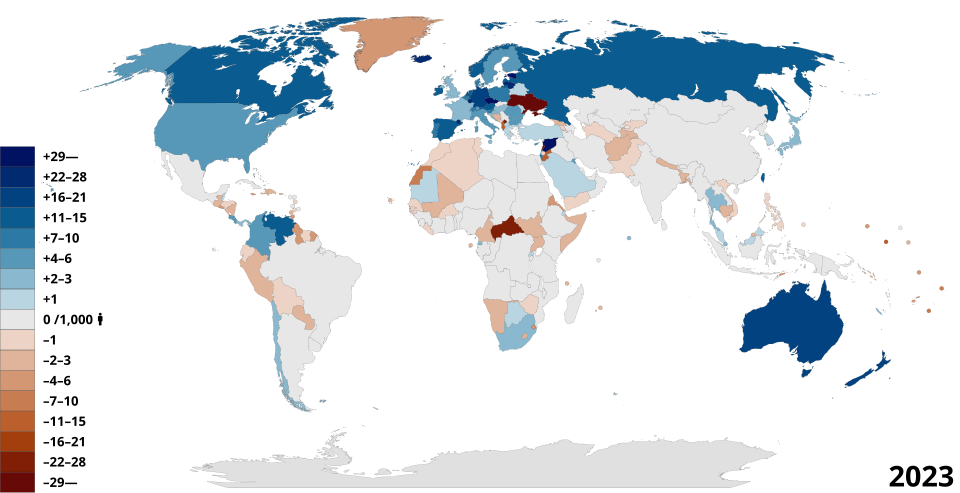

Net migration rates per 1,000 people in 2023, showing flows to more affluent nations, in blue, from poorer nations.

MANCHESTER, Conn.

Last week two groups supporting illegal immigration, Connecticut Voices for Children and the Immigration Research Initiative, issued a report warning that mass deportation of the state's illegal-immigrant population -- estimated at as many as 150,000 people -- would be disastrous for the state's economy and state government. The report claimed that illegal immigrants pay more than $400 million in state taxes each year.

This was at best a dodgy estimate. Many illegal immigrants are children and are not employed. The adults among them cannot work legally and so most of their earnings cannot be tracked. While anyone who spends money in Connecticut is likely to pay sales taxes, the report acknowledges that nearly all illegal immigrants who work in Connecticut hold low-wage jobs.

So what they buy is mainly for subsistence, like food, which is exempt from sales tax.

But the bigger flaw in the report is that it omits anything about the costs of illegal immigration in Connecticut, which are huge and increasing, particularly on account of the state government medical insurance being extended to them and the education of their children, most of whom don't speak English and enter the state's schools without providing any record of their education elsewhere and so need to be laboriously evaluated for placement. These students have exploded expenses in the schools of Connecticut's “sanctuary cities," which in turn seek much more financial support from state government.

In February the Yankee Institute, drawing on estimates from the Federation for American Immigration Reform, contended that illegal immigration costs Connecticut more than $1 billion a year.

Whatever the true cost, that it likely weighs heavily against illegal immigration became clear when Governor Lamont, a supporter of the state's “sanctuary’’ policies, disputed the Yankee Institute estimate even as he conceded to a journalist that he had no idea what illegal immigrants cost state government. The governor referred the journalist to the state budget office, which said it had no idea of the cost either and wasn't going to find out.

That is, advocates and apologists for illegal immigration in Connecticut don't want to know its costs, and, worse, don't want the public to know either.

The report from Connecticut Voices for Children and the Immigration Research Initiative is defective in other ways. It asserts that if Connecticut lacked illegal immigrants it would experience a severe shortage of workers for the low-wage jobs they hold -- especially in construction, restaurants, agriculture, janitorial work, and beauty shops.

This is the cliche that illegal immigrants do jobs citizens won't do, and it is nonsense.

Citizens will do almost any job if wages are high enough and can compete with the welfare benefits available to them. Indeed, the jobs held by illegal immigrants are so poorly paid in large part precisely because illegal immigrants are available to do them without the wage,

benefit and labor protections required for citizens. Raise agricultural salaries enough and even some teachers, charity organization workers, and journalists in Connecticut may be tempted to return to picking shade tobacco as many did as teenagers.

Connecticut is full of low-skilled citizen labor. With its social-promotion policy, public education makes sure of that.

For years the state's manufacturers have lamented that they can't find skilled workers for tens of thousands of openings. Meanwhile, middle-aged single mothers are not working at fast-food drive-through windows because they are so highly skilled. But jobs requiring lesser skills are where young people are supposed to start, not remain as adults.

So Connecticut doesn't need to import more low-skilled workers, especially since the state has failed so badly with its housing supply. The state needs to find ways of raising skills and wages and reducing the cost of living, especially the cost of housing, for its legal residents.

But the report from the apologists for illegal immigration sees the path to prosperity as a matter of legalizing all illegal immigrants, in effect reopening the borders. It didn't work the first time.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: What’s lurking Ahead for Conn.?

MANCHESTER, Conn.

In an interview the other week, Connectitcut Gov. Ned Lamont sounded unenthusiastic about seeking a third term.

He complained that legislators and municipal officials parade through his office asking for goodies at state government expense even as the Trump administration is slashing away at financial aid to Connecticut, punching big holes in state government's finances.

The aid cuts don't seem well-reasoned, or reasoned at all. They may be merely malicious. But having long been persecuted by Democrats, even as Democrats concealed and dissembled about the corruption and incompetence of their own national administration, Trump now can exact enormous revenge.

Just as Democrats long have thrived on the patronage power they invested in the presidency, losing that power is going to hurt.

A national recession and even a worldwide one may be coming, possibly triggered by Trump's leap into tariffs.

As a “sanctuary" state with several sanctimonious “sanctuary" cities, including New Haven, Connecticut may expect special hostility from the Trump administration, especially since the hostility is mutual here, as with the three Yale University professors who recently publicized their departure for Canada and attributed it to their detesting Trump. (Since Yale long has propelled Connecticut toward the looney left, these departures may be a good start.)

Lamont keeps saying he thinks that Connecticut is in good shape, but developments contradict him.

Remarking the other week on the human needs that state government addresses, the governor noted that about 40 percent of the babies born in Connecticut are born to mothers on Medicaid, which, among other groups, provides medical insurance for the indigent. But he didn't grasp the bigger significance of that data.

That is, people who can't support themselves shouldn't be having children -- or else these are people who recently have fallen out of the middle class as times get harder.

Homelessness in Connecticut is rising again along with rents and housing prices, which have been driven up by inflation and state government's failure to clear the way for less-expensive housing.

Connecticut's food pantries are experiencing much heavier demand.

Student proficiency in the state keeps declining as schools graduate illiterates and near-illiterates without prompting concern from many in authority. The failing, insolvent and poorly managed school systems in Hartford and Bridgeport are undergoing financial audits by a state education bureaucracy that seems almost as large, inscrutable, and disconnected as the failing school systems themselves. But the educational results of those school systems are not being audited.

These developments don't suggest that Connecticut is in good shape. They suggest that parts of the state are sliding deeper into poverty and ignorance.

The more that the Trump administration slashes federal financial aid to state government, the more cautious the governor properly becomes about state spending. But the legislators, municipal officials and special interests parading through his office with their hands out still can't imagine financial restraint. They think that state government has a large budget surplus and they want to spend it regardless of whether big cuts in federal aid will have to be covered. But they refuse to see that the surplus is only technical, the flip side of state government's still grossly overcommitted pension funds.

That is, the surplus is really just money borrowed from pension obligations, money that, if spent, will increase the heavy tax burden of the pension funds.

Lamont is often portrayed as a moderate Democrat. But he is moderate only insofar as he fears that overspending will produce state budget deficits and tax increases that will alienate voters. He is firmly part of his party's far left in toleration of illegal immigration, transgenderism, racial preferences and manufacturing and coddling poverty.

Other than the blindly ambitious, who would want to be governor amid what lurks ahead?

Even so, Trump's slashing of federal aid just might be the tonic that Connecticut needs to force audits of everything in state government and compel hard but necessary and ultimately beneficial choices. As long as state government remains a pension and benefit society for its employees -- the only people whom state government guarantees to take care of -- it won't even be trying to serve the public.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Conn. insanity Law is Crazy

Depiction of Mongol cannibalism from Matthew Paris's chronicle.

MANCHESTER, Conn.

Having recently shrugged off his inability to get state government employees to return to their normal workplaces, Connecticut Gov. Ned Lamont may have been lucky to be traveling in India the other week when the state Psychiatric Review Board announced it had conditionally released Tyree Smith, a murderous cannibal, back into society, proclaiming him cured of his taste for human flesh.

Members of the Republican minority in the General Assembly exploded with exasperated questions.

Of course, the Democratic majority let the event pass without comment. But at least the Democrats' indifference wasn't caused by what might have been expected -- the political influence of something like the Connecticut Anthropophagist Association. Such a special interest would have to work hard to become as predatory as the primary constituencies of the Democrats, the state employee and teacher unions. No, Democratic legislators ignore everything questionable in state government when their party controls the administration, which is almost always.

The Republican questions were fair: Where is the cannibal living? Does he have roommates? If so, are they aware of his past? If he is in a group home, is the staff aware? Do his neighbors know he is nearby? Who makes sure he takes his medication? How often he is to take it? What are the supervision and mental health regimens imposed on him? What safety protocols surround him?

The Psychiatric Security Review Board's executive director, Vanessa M. Cardella, answered some of the questions. The parolee's medicine will be administered by a visiting nurse. (He or she better be tall, muscular, and heavily armed, or accompanied by several such guards.) The state probation office will supervise him. He will wear an electronic monitoring device, be tested regularly for drug and alcohol use, and keep receiving mental health treatment. If he fails to comply, the board can send him back to Whiting Forensic Institute, Connecticut's euphemistically named prison for the criminally insane.

Cardella said, ‘‘There is a 0% recidivism rate for violent crime for acquittees on conditional release status."

Yes, so far, so good -- or so it may seem. But many ordinary parolees violate their probation, not all crimes are violent, and psychiatric parolees may offend again short of violence and may already have done so.

Now who wants to volunteer to be neighbor to someone acquitted by reason of insanity for murder with a side of cannibalism?

For that matter, where do the governor and legislature find volunteers to serve on the Psychiatric Security Review Board? Those jobs may be as thankless as those of the state auditors, who at least get paid.

But there are fair questions here for legislators too.

The law distinguishes the ordinary criminal from the insane one on the presumption that the latter did not understand the wrongfulness of his actions and so shouldn't be held responsible for them -- shouldn't be punished but just confined, comfortably enough, for the safety of society -- and that he may be restored to sanity and good behavior.

While this may seem sensible and just in principle, it is not persuasive in practice when the crime is murder. For then the law's presumption carries much greater risk. The law assigns the Psychiatric Security Review Board to measure that risk and make a judgment.

That is, state law, not the board itself, already has decided that release should be available to insane murderers judged cured. The board's judgment on the cannibal may be mistaken but appears to have been conscientiously reached.

The problem is that the law itself is crazy.

The best solution here may be to forbid any release of murderers acquitted by reason of insanity, allowing release only for insane people acquitted of lesser crimes, if there are any such offenders.

The cannibal's case provides a strong financial reason for this change in policy. For enforcing all the complicated conditions imposed on his release to protect the public probably will be far more expensive and far less reliable than keeping him at Whiting and continuing to treat him there.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net),

Annual show-off

Western Barndoor Hill, in Granby, Conn.

“It was a radiant October day. Connecticut suggested an outrageous show-off, the low hills overflowing with autumnal brilliance, eruptions of golden leaves, friezes of crimson, the pines maintaining their sober greenness amid the blaze-like sentinels.

“All this last glory of the growing season was nevertheless contained, neat, firmly – for centuries now – under control: This was New England.’’

From the novel A Stolen Past (1985), by John Knowles (1926-2001)

Chris Powell: Connecticut’s public-pension racket

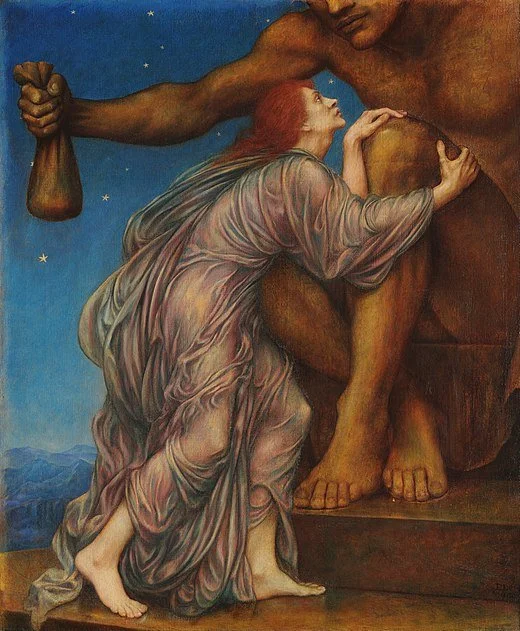

"The Worship of Mammon" (1909), by Evelyn De Morgan.

MANCHESTER, Conn.

An angry reader notes that after 24 years as a judge, the Connecticut Supreme Court’s chief justice, Richard A. Robinson, has just "retired" while joining a big national law firm, Day Pitney, which has five offices in Connecticut. "So now," the reader writes, "he will be getting a full pension from state taxpayers plus another full-time paycheck. Why should the state pay him a pension if he is still working? This is why the state is virtually bankrupt. It’s crazy. How come the press doesn’t report this part of it?"

Maybe what's left of journalism in Connecticut doesn't report the pension angle because it's an old story, not that it ever has been told very well.

Robinson's immediate predecessor as chief justice, Chase T. Rogers, retired six years ago after 20 years as a judge and then went to work at Day Pitney too. She now draws an annual state pension of more than $160,000, quite apart from her salary at the law firm. Since Robinson had four more years as a judge than Rogers, his state pension may be a bit larger. Since both retired judges are in their mid-60s, with continued good health they probably will have quite a few years earning at the law firm at least as much as their pensions.

But such opportunities are not peculiar to retired Connecticut judges. Virtually all retired state employees are eligible to do the same kind of thing -- that is, to collect an excellent retirement pension from state government even as they launch second careers.

The practice is especially popular among state troopers and municipal police officers, who typically can retire with great pensions at a young age -- in their late 40s or early 50s -- and then qualify for other good jobs to take them into their actual retirement.

Sometimes it’s a bit of a racket, as was shown in 2020 by the internationally notorious case of State Trooper Matthew Spina. The trooper was video-recorded by a motorist he stopped in New Haven and the video was posted on the Internet. It showed the trooper hysterical with rage, screaming at the motorist, ordering him out of his car and handcuffing him, bullying and threatening him, searching his backpack, and stomping on his possessions before uncuffing him and letting him go without even ticketing him, since he had done nothing wrong, or at least nothing actionable.

While inflicting this abuse Spina declared that he hated his job and the public and was eager to retire in 14 months.

Spina appeared to be middle-aged and a little journalism revealed that for five years he had been working so many extra hours that his overtime pay exceeded or nearly equaled his base annual salary of almost $100,000. That is, like many other troopers he was risking burning himself out and driving himself crazy to attain the magical threshold of the state pension system -- three extremely high-earning years from which his pension would be calculated.

State police management readily obliged his mad pursuit of a pension bonanza.

Spina indeed retired the next year and now draws an annual state pension of more than $116,000. If he has another job now, his pretend retirement may be almost as comfortable as that of the retired judges.

Of course Connecticut’s state employee pension system isn’t a racket for everyone, but it is often excessively generous. It is a fair question as to why state government should pay large pensions, or any pensions, to people earning substantial amounts in second careers.

But there is a simple explanation. It’s that Connecticut has many more politically active state and municipal government employees and retired employees than it has politically attentive and engaged citizens.

Anyone who sees extravagance here should try putting the pension question to his state legislators. Few legislators are likely to express any criticism, lest they alienate a powerful special interest. If Connecticut is ever to have a better public life, it will need a better public.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Connecticut’s abortion barbarians

U.S. abortions by gestational age in 2016.

MANCHESTER, Conn.

Now that the issue has been returned to the states and democracy, abortion extremism has revived throughout the country. In some states this extremism aims to make abortion virtually impossible, limiting it to the earliest weeks of pregnancy, sometimes before women may realize they are pregnant. But in Connecticut the extremism goes the other way.

A few days ago Connecticut abortion extremism manifested itself at the state Department of Public Health, which held a hearing on its proposal to repeal three state regulations that pose only slight impediments to abortion, regulations that did not bother advocates of "reproductive rights" back when the U.S. Supreme Court's decision in Roe v. Wade was in force. Indeed, for decades Connecticut has modeled its abortion law on the principle proclaimed by Roe -- that abortion should be an individual right prior to fetal viability but subject to state regulation after, because society has an interest in the unborn when they are able to live outside the womb.

As constitutional law Roe was questionable, as even some advocates of abortion rights acknowledged, but it amounted to a political compromise that commanded majority support nationally, though not in all states.

The Supreme Court's reversal of Roe has changed nothing in Connecticut. There is no movement here to outlaw or seriously restrict abortion, though the public probably would support legislation to require parental consent for abortions for minors, since such abortions conceal rape.

To the contrary, as shown by the health department's proposal to repeal those three regulations, the political movement about abortion in Connecticut is, in its own words, to "go beyond Roe" -- to legitimize late-term abortion, abortion of viable fetuses, in all circumstances.

The department would repeal the regulation arising from the Roe principle that authorizes abortion in the last trimester of pregnancy only to protect the mother's life or health.

This regulation is actually only the pretense of concern for unborn life, since no government authority is checking on late-term abortions and since protecting a pregnant woman's health is construed to include her mental health. In advance of childbirth it's impossible to disprove a woman's claim that delivering her child will drive her insane, absurd as such a claim may seem.

But even the regulation's pretense of concern for viable fetuses is too much for Connecticut's abortion extremists.

Another regulation proposed for repeal requires abortion providers to try to save of life of a fetus -- that is, a child -- who survives an abortion. Connecticut's abortion extremists want to erase any hint of an abortion survivor's humanity. An infant bleeding and gasping for breath is to be coldly left to die in the presence of doctors, nurses, the law, and its own mother -- barbarity.

Also proposed for repeal is the regulation that authorizes medical personnel to refuse to participate in abortions for religious reasons. As Connecticut essentially declares abortion the highest public good, all conscience is to be trampled.

The foremost advocate of repealing the regulations, state Rep. Jillian Gilchrest, D-West Hartford, leader of the abortion extremists in the General Assembly -- they style themselves the Reproductive Rights Caucus -- maintains that the regulation protecting the consciences of medical personnel is unnecessary because federal law already protects them. But Gilchrest would not advocate repealing the regulation if she wasn't hoping that someday abortion extremists will gain control of the federal government, repeal the law, and let Connecticut drive anti-abortion doctors and nurses out of their profession.

Gov. Ned Lamont told the Hartford Courant he wasn't fully informed about the move to repeal the abortion regulations and would be looking into it. But he added perceptively, "I hope it's not a solution looking for a problem."

That's just what it is. For the only problem here is that some people think that while Connecticut is more liberal on abortion than all states except Vermont and Oregon, which have no gestational limits, the state still doesn't exalt abortion enough.

Does the governor agree with the barbarians? Since the health department answers to him, it will be answering for him if it decides to "go beyond Roe."

-----

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Too much higher ed?

The precursor to the University of Connecticut in 1903.

MANCHESTER, Conn.

What a wonderfully subversive and politically incorrect idea has exploded from the committee set up by the Connecticut Conference of Municipalities to study the problem of the state's estimated 119,000 "disconnected" and alienated young people.

Meeting last week at New London City Hall, the group heard a vice president of Yale New Haven Health, Paul Mounds Jr., criticize the widespread misimpression that hospitals and other medical companies hire only applicants with college degrees.

Mounds said Connecticut's hospitals have hundreds of openings for people with high school diplomas or the equivalent. He added that employers should reach out to overlooked potential workers, including former convicts. (A decent job is a strong incentive not to return to crime.)

The president of the Connecticut Business and Industry Association, Chris DiPentima, elaborated. He said many of Connecticut's reported 93,000 job openings don't require college degrees and he urged employers to shift from degree-based hiring to skill-based hiring. DePentima scorned what he called efforts to "over-educate the population."

That is, Mounds and DiPentima were lamenting the cost of the credentialism that has been inflicted on society by higher educators, who profit greatly from it, and by society's own vanity. (See "Doctor" Jill Biden.) Credentialism is why millions of Americans are hobbled with billions of dollars of college-loan debt incurred in pursuit of degrees that conferred little in the way of education or job skills.

Of course, credentialism is a big business in itself, as shown by a review of salaries in higher education, especially administrator salaries. Reducing credentialism might cause a fair amount of unemployment, since much of higher education is just unnecessary overhead expense for society.

Higher education isn't useless. But outside highly technical fields, it is grossly overpriced and distracts catastrophically from the country's big education problem, lower education.

A recent survey by the Connecticut Education Association, the state's largest teacher union, illustrated a big part of the lower-education problem.

It wasn't the survey's finding that teachers in Connecticut say they are underpaid. As they are members of unions it's practically their obligation to feel underpaid, just as they felt underpaid in 1986 when the state's Education Enhancement Act became law, leading to decades of steady pay increases for teachers in the belief that student performance was mainly a function of teacher salaries. (There turned out to be no connection, and student performance has declined as teacher pay has risen.)

No, the CEA survey was valuable for showing that teachers are increasingly demoralized by student misbehavior, which is prompting teachers to leave their profession earlier than planned and making it harder for schools to hire good applicants.

This problem is worst where poverty, child neglect, and mental illness among children are worst -- cities and inner suburbs. While Hartford's school superintendent, Leslie Torres-Rodriguez, showed her usual enthusiasm in welcoming children back to school this week, she also acknowledged that the city's schools are still trying to fill 200 vacant positions. As the CEA survey indicated, teachers want to teach, not break up brawls or restrain children who freak out in class and don't know how to behave because they have so little parenting -- and because school administrations prohibit disciplining them.

This social disintegration is part of government's general impoverishment of society but Connecticut's political class remains oblivious to it and busies itself instead with politically correct irrelevance, as New Haven's city council did the other day even as the city's schools are just as dismal as Hartford's.

The council is promoting a resolution that would apologize for New Haven's having blocked the establishment of a college for Black people back in 1831, nearly two centuries ago.

Maybe in another two centuries New Haven will apologize for the failure of most of its schoolchildren to perform even close to grade level, for the racial achievement gap in its schools, and for the city's constant crime, most of whose victims are members of minority groups. Maybe in two centuries state government will consider apologizing too.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Conn. isn’t prepared for greater prosperity; sneaky ‘public-benefits’ charges

Millstone Nuclear-Power Plant, in Waterford, Conn.

MANCHESTER, Conn.

When federal census data showed Connecticut's population increasing by about 57,000 in 2021 and 2022, Gov. Ned Lamont construed it as great news, evidence of the state's prosperity under his administration, a remarkable contrast with the population losses of nearby states.

But the other day the U.S. Census Bureau acknowledged that the population increase report was a mistake and that Connecticut probably experienced a population loss of 13,500 during that period.

In a way this may be construed as great too.

For the state has a severe shortage of housing, home prices and rents have been soaring, and homelessness is rising. Experts say the state needs at least 100,000 more housing units just for its current population to be able to live decently. If the state really had gained 57,000 people, it would be under much greater strain.

Connecticut isn't prepared for greater prosperity, and more strain is promised by the increased military contracting coming into the state for which thousands of new workers are needed.

Even if the national economy were entering a recession, Connecticut still would have thousands of inadequately housed people.

Equating construction of inexpensive housing with poverty because of the mess the state has made of its cities, Connecticut has been slow to recognize that its housing policy -- unfriendly if not hostile to new housing -- has been a disaster too.

But the Lamont administration has taken the hint and is proceeding with state government incentives for housing construction. Hartford and New Haven are encouraging apartments and condominiums and are showing that city living can attractive, and a few suburbs are viewing housing proposals more favorably than usual.

It's far from enough but it's a start. If housing initiatives continue for a few more years and state government discourages exclusive zoning and controls spending and taxes, maybe even accurate census data will start showing that more people want to move to Connecticut than leave it for lower-taxed states with milder winters.

xxx

Connecticut has among the highest electric rates in the country, and the big increases imposed last month are painful reminders that the state would have to reduce rates if it would increase its prosperity and population -- or even just maintain its population.

The latest rate increases have two major causes: the decision by the governor and General Assembly to guarantee purchase of the electricity generated by the Millstone nuclear-power plant, in Waterford, as a matter of Connecticut's energy security; and second, the "public benefits" charges that long have been largely hidden in customer electric bills, essentially sales taxes to finance state government programs having little if anything to do with generation and delivery of electricity.

Among the "public benefits" charges is one by which people who pay their electric bills are required to pay as well for people who don't pay but who under state law can't be disconnected during much of the year. Since this charge is a welfare expense, it should be borne by taxpayers generally, not by electricity users particularly.

Indeed, there is no good reason to charge electricity users particularly for any of the "public benefits" hidden in their bills. Insofar as electricity is a necessity of life, taxing it is no more justified than taxing food and medicine would be.

The real justification for financing the "public benefits" from a de-facto sales tax on electricity is that state legislators and governors have liked obscuring the costs of those "benefits" and deceiving the public into thinking that the big, bad electric companies are overcharging. By some estimates 20 percent of the cost of electricity for a typical Connecticut resident results from non-electrical "public benefits" charges.

Members of the General Assembly's Republican minority have been making an issue of this and fortunately have begun pressing it harder. "Public benefits" charges on electricity bills should be eliminated, along with the "public benefits" themselves, or else their costs should be recovered through general taxation or spending cuts elsewhere.

Now who wants to specify the tax increases or spending cuts necessary to get rid of the "public benefits" charges?

Chris Powell has written about Connecticut government and politics for many years(CPowell@cox.net).

Chris Powell: Extending medical insurance to illegal immigrants draws in more of them

MANCHESTER, Conn.

Connecticut's nullification of federal immigration law proceeded this month as state government extended its welfare system's medical insurance to illegal immigrant children by three years, from 12 and under to 15 and under. The children being added will be able to keep their state coverage until they turn 19 -- and maybe, as seems likely, by the time they turn 19 Connecticut will have extended eligibility to a higher age.

Such gradualism is how Gov. Ned Lamont and the Democratic majority in the General Assembly have been handling the issue for years now. They have been maintaining both that decency requires covering all illegal immigrant children and -- in contradiction -- that the state can afford to cover only a few thousand more every year. This gradualism obscures the budgetary and nullification issues enough that most people don't notice and make a fuss about them.

While the policy being pursued by state government may make political sense, it is still mistaken. Its logic is that Connecticut somehow can afford to lift all of Central America and much of the rest of the world out of poverty in the next decade, and it encourages more people to violate federal immigration law.

Advocates of extending the medical insurance to more illegal immigrant children note that even without such insurance Connecticut's hospitals will always have to treat illegal immigrant children when they come to emergency rooms with urgent conditions, and that when such patients or their guardians don't pay, hospitals essentially will transfer the expense to state government and patients who do pay for themselves.

But this rationale does not acknowledge that providing medical insurance to illegal immigrant children rewards and incentivizes illegal immigration to Connecticut and that if the state did not extend the insurance, the parents or guardians of the children being covered might relocate to other states providing coverage. It's not as if illegal immigrants in the United States have no choice but to live in Connecticut. Like everyone else they may look for the place where they are treated best.

While Governor Lamont supported the latest extension of insurance, when it took effect the other day he implied that he had some reservations about it, saying it should be accompanied by "comprehensive immigration reform." But of course it has not been accompanied by "comprehensive immigration reform," and the governor didn't specify what "comprehensive immigration reform" is.

Is it mass amnesty, making all illegal immigrants legal, as many other Democrats want?

Is it deporting all 12 million or so illegal immigrants estimated to be in the country, the objective that has been proclaimed by presidential candidate Donald Trump without an explanation of how the logistical difficulties would be met?

Is it to continue having open borders most of the time, as advocated by Connecticut U.S. Sen. Chris Murphy via the dishonest "compromise" legislation he proposed in February with Sens. James Lankford (R.-Okla.), and Kyrsten Sinema, the former Democrat and now nominal independent from Arizona?

In any case the millions of illegal and unvetted immigrants who have entered the country since President Biden took office are not an accident but policy, a policy of devaluing citizenship and hastening change in the country's demographics and its democratic and secular culture. Extending medical insurance to illegal immigrants -- on top of driver's licenses and other government identification documents, housing, and food subsidies -- is part of that policy. So is forbidding state and municipal police from assisting federal immigration agents, as Connecticut forbids them, thereby making itself a "sanctuary state."

If illegal immigration is never to be simply stopped and immigration law simply enforced, the country won't be a country anymore.

The United States long has welcomed immigration and should continue to do so. But immigration must be limited to what the country can assimilate in normal circumstances. A desperate national housing shortage, strain on hospitals, and schools overwhelmed with students who don't speak English signify the obliviousness to illegal immigration by both the federal government and state government.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: ‘Mansion tax’ wouldn’t help address Conn. housing crisis

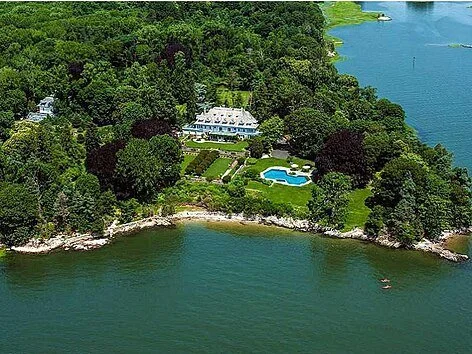

The Lauder Greenway Estate, in Greenwich, Conn.

MANCHESTER, Coon.

Apparently you don't have to do much thinking to run a "think tank" in Washington, or at least not a liberal "think tank." The Connecticut Mirror reports that two such "think tanks" -- the Center on Budget and Policy Priorities and the Institute on Taxation and Economic Policy -- have produced a study concluding that Connecticut could raise tens of millions of dollars every year to spend on reducing homelessness (or spend on something else) by imposing an extra conveyance tax on the state's most expensive homes.

Well, duh! Connecticut could get that kind of money by raising taxes or imposing new ones on nearly anything, not just property transfers.

What is the connection between Connecticut's desperate shortage of housing and its most expensive homes? There isn't one. The mansions of "mansion tax" proposals aren't why the state is short of housing and why housing prices have been rising so fast. While mansions typically occupy larger lots, Connecticut remains full of vacant land and, especially in its cities, decrepit former industrial and residential sites. The state has plenty of room for more housing. Land hogging by the wealthy is not getting in the way.

Connecticut's housing shortage has four major causes.

First is the soaring inflation of the last few years, engineered, in my view, by President Biden and Congress. This has driven up prices and mortgage rates far faster than the incomes of ordinary people. People who own residential and other substantial property, especially the wealthy, profit from inflation, but most others suffer from it.

Another cause is the flood of illegal immigration, a matter of Democratic Party policy on both the federal and state levels. It may be no coincidence that the number of illegal immigrants estimated to be living in Connecticut, more than 100,000, is close to the number of housing units the state is said to lack.

A cause of longer duration is exclusive zoning in suburbs and rural towns, zoning that discriminates against less expensive housing, particularly apartments and condominiums. Such zoning generally has community support, since most people don't want their neighborhoods to become more crowded, though of course their own arrival may have increased the neighborhood's population.

Exclusive zoning has its own cause. In some places exclusive zoning arose long ago from racism or ethnic or religious bigotry. But for many years now exclusive zoning has been sustained mainly by fear of poor people generally, a fear largely justified by the disaster inflicted on the cities, their residents, and everyone else by mistaken state and federal welfare and education policies. People don't want the pathologies of poverty -- fatherlessness, child neglect, crime, ignorance, indolence, and dependence -- imported into their neighborhoods by new housing accessible to the poor. This fear has produced zoning and community opposition that now often obstruct even middle-class, owner-occupied housing.

State government has responded with a law that weakens the use of exclusive zoning against housing, but it hasn't been very effective, and in any case inflation, declining real wages, and illegal immigration still stand in the way.

That's why that Washington "think tank" study on raising taxes on the sale of "mansions" and a similar proposal by state Senate President Martin M. Looney (D.-New Haven), to impose a punitive statewide property tax on "mansions" are so dishonest. While these ideas will raise money, there's no guarantee that much of it will be spent to build housing. More likely the money will be used as most extra tax revenue in Connecticut is used -- to pay the compensation of government's own employees, the Democratic Party's campaign army, while punitive taxes on "mansions" provide camouflage for the real objective.

Housing supply can be increased without punitive taxes on large homes -- by stopping inflation, enforcing immigration law, having state government cover all extra school and police costs of new housing, and revoking the welfare and education policies that manufacture poverty.

But that would take the fun out of blaming "mansions" for the declining living standards caused by elected officials who style themselves defenders of the poor even as they make poverty worse.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: What is ‘enough’? One-man crime wave in Conn.

“The Worship of Mammon,’’ by Evelyn De Morgan

MA NCHESTER, Conn.

Connecticut is not just thrilled that UConn men's basketball coach Dan Hurley has declined a lucrative offer from the Los Angeles Lakers. People are also moved by the expressions of loyalty from the coach and his wife, Andrea -- not just loyalty to the state but, as Mrs. Hurley noted in a television interview, loyalty to the players the coach had recruited and who expected to be playing for him next year.

Of course this loyalty was not exactly reciprocated by some of the players on this year's championship UConn team. They are leaving college early for what will be their own lucrative contracts with the pros.

But there's a big difference between the situations of the players and the coach. The players aren't making much if any money and may suddenly earn millions of dollars for each year of early departure. But the coach already is making millions each year, and for having won consecutive national tournaments he is likely to make millions more from UConn with a big raise that will bring his annual compensation close to what the Lakers were offering him.

When one is already earning big money, loyalty isn't the sacrifice lately imagined and cheered by UConn basketball fans, people for whom a night out with the family for dinner and a game is a substantial expense. Indeed, as F. Scott Fitzgerald wrote, "the very rich are different from you and me."

But then there are differences among the rich too.

A recent essay recounted that two financially comfortable guys were discussing a billionaire who had just undertaken a business plan he expected would bring him even greater wealth. One guy boasted to the other: "I have what he'll never have." The other guy asked: "What's that?" The answer: "Enough."

If Hurley has enough for staying put at UConn -- even if "enough" includes a huge raise -- it still may be considered relative loyalty, and Connecticut may be glad of it all the same, but just shouldn't overdo it.

That wasn't a parody of criminal justice in Connecticut on the front page of The Hartford Courant the other day. It was reality that should have been shocking, except that repeat offenders on the loose are now so numerous in the state that few people -- and apparently none in authority -- are shocked.

State police say a 35-year-old Bozrah man with a long criminal record sped through a stop sign in Griswold, ramming another car and killing one of its passengers, Charlotte Degrado, 96, of Branford. The Courant says the offending driver has at least a dozen criminal convictions, has 10 more criminal cases pending against him, and was free because, after being arrested six times since January, he had managed to post $275,000 in bonds.

State police say the driver and his companions in the speeding car ran away after the crash but the driver was apprehended while hiding in nearby woods with a bag of fentanyl pills and $4,693 in cash.

The driver's convictions, according to the Courant, include larceny, burglary, narcotics possession, and engaging police in pursuit, and he has served three prison sentences since 2016 -- 18 months, a year, 90 days. He repeatedly has violated his probations.

If elected officials in Connecticut were more concerned about public safety than in reducing the state's prison population, they might investigate this situation urgently, interviewing every prosecutor and judge involved with the repeat offender's cases. While individually some of his crimes may seem minor, cumulatively they scream incorrigibility.

Could no one in the criminal-justice system perceive this before the fatality? Could no one note the chronic offender's 10 pending cases and realize that speedy trials and maximum sentences would be necessary to halt his crime wave?

Since Gov. Ned Lamont and state legislators don't seem to be taking note of the atrocity, will anyone in journalism confront them about it?

Or will the always dim prospect of reform be left to any efforts made by the dead woman's grieving family?]

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

A matter of 'marital privacy'

“Late every night in Connecticut, lights go out in the cities and towns, and citizens by the thousands proceed zestfully to break the law.’’

—From the March 10, 1961, issue of Time magazine on the now long gone Connecticut law banning contraceptives. In 1879, Connecticut enacted a statute that banned the use of any drug, medical device or other instrument used to prevent contraception.

In its 1965 ruling Griswold v. Connecticut, the U.S. Supreme Court ruled that the U.S. Constitution protects the liberty of married couples to use contraceptives without government restriction. The Connecticut law, they decided, violated the "right to marital privacy".

Chris Powell: Coaching a college basketball team is easier than legislating

Dan Hurley

MANCHESTER, Conn.

Celebrating Dan Hurley's decision this week to keep coaching the men's basketball team at the University of Connecticut, state House Speaker Matt Ritter confirmed a thought previously reserved for cynics.

That is, UConn's success with basketball is state government's great rationalization for giving the university whatever it wants financially year after year.

Ritter said: "I think there are times when legislators wonder, 'Why UConn? Why higher education?' There were comments about how we were giving so much money to UConn even this year. But Dan Hurley and [women's basketball coach] Geno Auriemma are four million more times popular than the most popular state legislator."

True. But then in a crucial respect the coaching jobs are much easier than those of state legislators -- at least the jobs of legislators who aspire to serve the public interest.