Llewellyn King: Electrification and the Great American reset

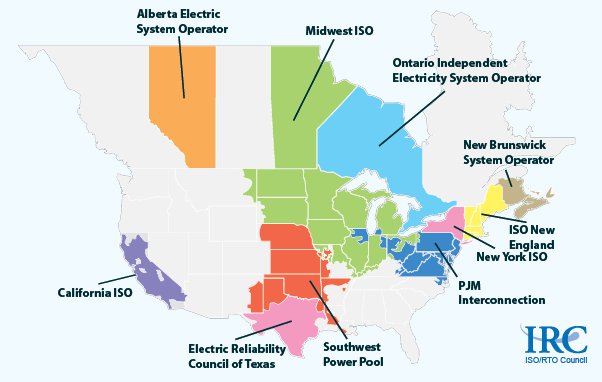

Independent (electric grid) system operators and regional transmission operators

WEST WARWICK, R.I.

It is underway. It has huge momentum, and it will change everything we do — work, leisure, health care, education, use of resources — and, as a bonus, how the world sees us.

It is the Great American Reset, where things will be irreversibly changed. It is a seminal reset that will shape the decades to come, just as the New Deal and World War II shoved the clock forward.

The reset is being driven in part by COVID-19, but in larger part by technology and the digitization of America. Technology is at the gates, no, through the gates, and it is beginning to upend the old in the way that the steam engine in its day began innovations that would change life completely.

Driving this overhaul of human endeavor will be the digitization of everything from the kitchen broom to the electric utilities and the delivery of their vital product. Knitting them together will be communications from 5G to exclusive private networks.

President Biden’s infrastructure proposals could speed and smooth the innovation revolution, facilitate the digital revolution, and make it fairer and more balanced. Biden’s plan will fix the legacy world of infrastructure: roads, bridges, canals, ports, airports, and railroads. It will beef up the movement of goods and services, supply chains, and their security, even as those goods and services are changing profoundly.

But if Biden’s plan fails, the Great American Reset will still happen. It will just be less fair and more uneven — as in not providing broadband quickly to all.

Technology has an imperative, and there is so much technology coming to market that the market will embrace it, nonetheless.

Think driverless cars, but also think telemedicine, carbon capture and utilization, aerial taxis, drone deliveries, and 3D-printed body parts. Add new materials like graphene and nano-manufacturing and an awesome future awaits.

We have seen just the tip of digitization and have been reminded of how pervasive it is by the current chip shortage, which is slowing automobile production lines and thousands of manufactures. But you might say, “You ain’t seen nothing yet.” The future belongs to chips and sensors: small soldiers in mighty armies.

Accompanying digitization is electrification. Our cars, trucks, trains, and even aircraft and ships are headed that way. Better storage is the one frontier that must be conquered before the army of change pours through the breach in a great reshaping of everything.

Central to the future — to the smart city, the smart railroad, the smart highway, and the smart airport — is the electric supply.

The whole reset future of digitization and sensor-facilitated mobility depends on electricity — and not just the availability of electricity going forward, but also the resilience of supply. It also needs to be carbon-free and have low environmental impact.

An overhaul of the electric industry’s infrastructure, increasing its resilience, is an imperative underpinning the reset.

The Texas blackouts were a brutal wake-up call. Job one is to look into hardening the entire electric supply system from informational technology to operational technology, from storm resistance to solar flare resistance (see Carrington Event), from catastrophic physical failure to failure induced by hostile players.

The electric grid needs survivability, but so do the data flows which will dominate the virtual utility of the future. It also needs a failsafe ability to isolate trouble in nanoseconds and, essentially, break itself into less vulnerable, defensive mini-grids.

Securing the grid is akin to national security. Indeed, it is national security.

Electricity is the one indispensable in the future: The future of the great reset.

Klaus Schwab, the genius behind the World Economic Forum, called this year from his virtual Davos conference for a global reset to tackle poverty and apply technology and business acumen to the human problems of the world. We are on the cusp of going it alone.

In the end, the route to social mobilization is jobs. The Great American Reset will throw these off in an unimaginable profusion, as did the arrival of the steam engine a little over 300 years ago.

On Twitter: @llewellynking2

Llewellyn King is executive producer and host of White House Chronicle, on PBS. He’s based in Rhode Island and Washington, D.C.

The New England electric grid is managed by ISO New England from Holyoke, Mass., whose skyline is seen here. Note the clock tower of City Hall and the Mount Tom Range in the background,

Tim Faulkner: Future of region's fossil-fuel plants looks shakier

From ecoRI News (ecori.org)

The latest auction price for the ISO New England electricity contracts dropped to a historic low, signaling an uncertain future for power plants that run on fossil fuels.

The cost of $2 per kilowatt-month marks the steady decline of wholesale electricity since it reached a peak of $17.73 per unit in 2015. The price has been in free fall ever since, dropping to $4.63 in 2018 and $3.80 per unit last year.

Rhode Islanders learned about forward capacity auctions during the contentious permitting hearings for the Clear River Energy Center (CREC) proposed for the woods of Burrillville. In 2016, the developer, Invenergy Thermal Development LLC, was awarded an electricity purchase agreement from ISO New England for $7.03.

The capacity supply obligation, or CSO, became a point of debate as Invenergy argued that earning the contract from ISO New England proved the power plant was vital to the region’s energy needs and therefore the project deserved a license to operate.

However, the CSO was awarded to only one of CREC’s two proposed electricity generation units. Project opponents argued that the limited CSO proved that only a portion of the power plant had a place in the regional electric grid and therefore the project was too large to approve.

Invenergy argued that it could still sell the electricity from the second power unit on the open market and earn a profit.

But the Chicago-based company was no doubt in a bind because reducing the size of the project from two power units to one would require a new application, an expensive and time-consuming process.

Problems over cooling water and other setbacks in the application proceedings forced Invenergy to sell its CSO capacity during the years the energy facility was supposed to be producing power. The delays prompted ISO New England to suspend Invenergy from participating in the CSO auctions for its second power unit. In 2018, Invenergy was dealt another blow, when ISO New England rescinded the first CSO contract.

All the while, the CSO unit prices continued to drop as electricity capacity grew and demand held steady, due in part to the success of energy-efficiency programs and new renewable-energy projects feeding into the regional power grid.

The falling auction unit price gave CREC opponents further conviction that the fossil-fuel project was redundant. This reasoning was part of the argument the state Energy Facility Siting Board used to ultimately reject the CREC application in June 2019.

ISO New England, the operator of the six-state power grid, also forecasts energy needs and trends for the region. The nonprofit sees the drop in CSO price as a win for ratepayers.

“New England’s competitive wholesale electricity markets are producing record low prices, delivering unmistakable economic benefits for consumers in the six-state region,” said Robert Ethier, ISO New England’s vice president for system planning.

The pricing also reflects the growing flow of renewable energy into the grid. Of the some 600 megawatts of new electricity approved in the auction, 317 were from land-based and offshore wind, solar, and solar paired with batteries.

Behind-the-meter solar is also reducing demand for utility-scale power. According to the U.S. Energy Information Administration, New England added 493 megawatts of rooftop solar last year.

“This is good news for consumers all over New England,” said Bill Eccleston, a former activist against the Invenergy power plant. The lower auction price “also contradicts the propaganda that we need to be building more fossil-fuel power plants.”

“There’s a glut of (electricity) supply on the market,” said Jerry Elmer, senior attorney for the Conservation Law Foundation (CLF).

Elmer and CLF opposed the Burrillville proposal and as intervenors argued before the EFSB. Elmer and CLF staff are steeped in local energy markets because they serve on ISO New England’s working committees.

“The big lesson there is there no need for new fossil fuel plants and I don't think you’ll see any in the near future,” Elmer said.

New Connecticut solar facility to benefit Ocean State

Rhode Island is fulfilling one of its renewable-energy goals by acquiring power from a Connecticut solar facility.

To help reach 1,000 megawatts of renewable power by 2020, the state is making another deal with New York City-based hedge fund D. E. Shaw & Co. In 2008, D. E. Shaw was the financial backer of Deepwater Wind, the Providence-based developer that won the contract to build the Block Island Wind Farm.

D. E. Shaw sold Deepwater Wind to Danish energy company Ørsted in October 2018 for $510 million.

This time, D. E. Shaw Renewable Investments, a division of D. E. Shaw, has won a contract for a 50-megawatt solar facility at a gravel mine in East Windsor, Conn. The state will not release the precise location of the project, called Gravel Pit Solar II LLC.

Without offering specifics, D. E. Shaw has offered to pay $300,000 for renewable-energy workforce development in Rhode Island.

Although it’s promoted by the state as a deal for Rhode Island’s three electric utilities, the agreement awards 99 percent of the energy generated to National Grid. The remaining 1 percent, or 0.5 megawatts, is credited to the Pascoag Utility District and the Block Island Utility District.

The 20-year contract must be reviewed and approved by Rhode Island’s Public Utilities Commission.

National Grid is asking the state to buy renewable-energy credits (RECs) for 5.3 cents per kilowatt-hour. By comparison, the state is paying between 24 and 50 cents per kilowatt-hour for electricity from the 30-megawatt Block Island Wind Farm.

National Grid selected D. E. Shaw from 41 bids. The Rhode Island Office of Energy Resources and the Rhode Island Division of Public Utilities and Carriers served as advisors for the selection process. Of the 19 projects that offered to sell the electricity below market rates, none were based in Rhode Island.

Ratepayers are expected to pay $30.8 million for the electricity over 20 years. Based on energy price forecasting models, ratepayers will save $101 million over the term of the contract.

Gravel Pit Solar II LLC is expected to be commercially operational by March 31, 2023. More details of the project can be found in the PUC docket. The proposed ground-mounted solar facility is estimated to displace 41,000 tons of carbon dioxide annually.

Ferry funds

Rhode Island Fast Ferry Inc. recently received up to $30,000 from the Rhode Island Commerce Corporation to expand its offshore wind shuttle services at the Port of Quonset and along the East Coast.

The grant pays for costs associated with acquiring permits from the Coastal Resources Management Council, the Rhode Island Department of Environmental Management, and the Army Corps of Engineers.

Tim Faulkner is an ecoRI News journalist.

Tim Faulkner: Big weekend in N.E. for dirty fuel

Renewal-energy use in New England last weekend

From ecoRI News (ecori.org)

This past weekend was one of the most energy-intensive in New England history, relying on dirty backup power plants that run on oil and coal to keep up with demand.

According to preliminary data from grid operator ISO New England, July 20 and July 21 were the fourth- and fifth-most energy intensive weekend days on record. On Saturday, electricity demand reached 23,852 megawatts. Sunday peaked at 23,786 megawatts. The highest for any day was set Aug. 2, 2006, a Wednesday, when the energy load reached 28,130 megawatts.

“New England's power system was able to withstand the heat and humidity over the course of this weekend's heat wave and operated under normal conditions,” ISO New England spokeswoman Ellen Foley said.

But on both weekend days coal and oil generated as much as 8 percent of the electricity. New England has three coal-fired power plants: the 440-megawatt Merrimack Station in Bow, N.H.; two 47-megawatt generators at the Schiller Station, in Portsmouth, N.H.; and the 384-megawatt Bridgeport Harbor Generating Station, in Bridgeport, Conn.

While renewables held steady at about 5 percent of the energy mix, about 80 percent of that power came from burning high-polluting wood and trash.

High-polluting trash/wood-fired power plants accounted for most of the renewable energy used on July 20. (ISO New England)

Ratepayers have options to reduce the energy load during high-demand days. The Shave the Peak program run by the Green Energy Consumers Alliance uses text alerts and emails to deliver energy-saving actions during the hottest hours each summer. The goal is to limit the need for energy from high-polluting power plants, which sit idle most of the year.

Typically, New England’s remaining oil and coal power plants run for a few hours each during summer heat waves to meet the spike in electricity demand.

Tips include delaying use of large energy-intensive appliances, such as laundry dryers and electric stoves, until cooler times of day, when air conditioners are turned down and electricity demand falls.

Battery-storage incentive

Homeowners interested in adding backup battery power to their solar panels have a few days to take advantage of an incentive from National Grid.

The ConnectedSolutions program reduces the peak energy load by paying the owner of home battery-storage systems for its stored electricity during periods of high energy demand.

In Rhode Island, National Grid will pay $400 per kilowatt “performed” for electricity it draws from home storage systems during summer energy spikes. The Massachusetts program pays $225 per kilowatt performed during summer heat events and $50 per kilowatt in winter. In both states, the five-year contract promises to draw electricity from no more that 75 events annually.

The deadline to submit an application for both Rhode Island and Massachusetts has been extended to Aug. 1. The battery systems can be installed to new or existing home solar arrays.

Although the battery system is connected to the electric grid it can still provide a backup electricity supply to the residence during a power outage.

According to an article in Bloomberg, a customer with a single Tesla Powerwall battery system could earn up to $1,000 annually from the program. Other eligible battery systems are offered by Pika Energy, Sonnen, and Sunrun. These vendors manage each customer’s storage system using information from National Grid. The battery companies also issue payments to the homeowners.

National Grid hopes to sign up 50 customers in Rhode Island and 230 in Massachusetts.

The estimated cost for a new battery system before tax breaks and incentives is about $8,000. The estimated payback period is about five years.

National Grid benefits by having renewable power to draw from while reducing its need to invest in infrastructure to address spikes in electricity use.

“Calling on batteries to discharge during peak times reduces the loads on the grid when it is most important,” said Ted Kresse, spokesman for National Grid. “It also helps to decrease distribution, transmission, and generation costs. In the future, we hope to also use batteries to help support even more growth of renewable and distributed energy generation.”

Battery-storage systems paired with solar arrays are expected to gain popularity as prices for solar equipment and battery prices drop. There is also a 30 percent federal tax credit for the cost of solar and battery systems.

Tim Faulkner is an ecoRI News journalist.

Tim Faulkner: Would more fossil-fuel plants be redundant in New England?

Via ecoRI News

A key argument against the proposed Burrillville, R.I., fossil-fuel power plant has derailed a similar natural-gas project in nearby Killingly, Conn.

Since the Clear River Energy Center (CREC) plan was announced more than two years ago for a forested site in northwest Rhode Island, opponents have argued that the electricity it would generate would be redundant. Power saved through energy efficiency and created by renewable energy, they reason, reduces electric demand and more than offsets the nearly 1,000 megawatts of energy that would be produced by the proposed facility.

This argument of surplus fossil-fuel energy in New England was argued in a 2015 report from Massachusetts Attorney General Maura Healey and subsequently by research groups such as Synapse Energy Economics of Cambridge, Mass.

Synapse principal associate Robert Fagan has provided testimony on behalf of the Conservation Law Foundation (CLF) in the case against the $1 billion CREC proposal, which is being considered by the Rhode Island Energy Facilities Siting Board (EFSB).

Fagan’s testimony to the EFSB states that new solar and wind projects, and increased energy efficiency reduce near- and long-term demand for electricity in southern New England. Fagan submitted similar findings to the Connecticut Siting Council (CSC) in its review of the 550-megawatt Killingly Energy Center.

In a May 5 draft opinion, the CSC ruled that the Killingly natural-gas power plant application met safety and environmental benchmarks, including promises of sharply reducing its greenhouse-gas emissions in future years. But the $537 million project didn't satisfy the benchmark for public need. To be specific, the CSC noted that energy demand over the next three to five years would be met through existing power plants in southern New England. Long-term energy needs are unclear, the CSC stated.

The board offered the developer, NTW Collection LLC, to resubmit an application when and if other power plants announce plans to retire, a process that takes several years.

“The Council finds and determines that the proposed (Killingly) facility is not necessary for the reliability of the electric power supply of the state or for a competitive market for electricity at this time. If there is a future need for additional capacity, the market will respond,” according to the CSC draft opinion.

It’s uncertain whether the Rhode Island siting board will follow the same logic and turn down the CREC application. CLF senior attorney Jerry Elmer is encouraged by the Connecticut ruling and hopes that Fagan’s testimony will convince the EFSB to deny the CREC application.

“This does not mean that we will automatically win the case," Elmer wrote in an e-mail. "But CLF continues to believe that it will be very, very important for CLF to present Bob Fagan’s testimony that the Invenergy plant is just not needed by the ISO."

ISO New England is the operator of the regional power grid. Its energy projections are a central issue in the CREC application. Invenergy Thermal Development LLC, the Chicago-based developer of CREC, says ISO New England believes that 6,000 megawatts of electric power are “at risk” of going off-line after 2019. Therefore, a new natural-gas power plant would fill the electricity supply gap.

The Connecticut siting board, however, noted that auctions to supply electricity from existing power plants to the grid have already committed electricity until 2021. It gave little weight to the “at-risk” power plants that may close between 2025 and 2030. Instead, the CSC referred to ISO New England’s own words in describing those retirements as “hypothetical.”

Complicating the matter is the fact that ISO New England only agreed to buy half of the output of electricity from the Burrillville power plant in auctions for 2019 and 2020. CLF believes that the agreement to purchase half of the power proves that the entire project is unneeded. Invenergy, however, maintains that the forward purchase agreements prove that some of the electricity from its proposed power plant is needed in the near term while the rest will be relied on in future years as older power plants are decommissioned.

The ISO New England agreements to buy future output from power plants, however, doesn't differentiate between what is needed to meet demand and excess power that it may buy as standby power. The Killingly power plant withdrew its application to receive energy contracts because the project wasn't far enough along the permitting process to be operating and therefor provide power by the contract date.

Further complicating the matter is the promise by both Massachusetts and Rhode Island to dramatically increase their use of imported and locally produced renewable energy by 2020. Both energy pledges would add 3,000 megawatts of capacity to the power grid and would supplant the electricity from fossil-fuel and nuclear power plants that may retire in ISO New England's “at-risk” group.

An additional factor is the rapid gain in energy efficiency. Both Massachusetts and Rhode Island are at or near the top of rankings for policies and actions that reduce energy use. Patrick Knight of Synapse said ISO New England chronically underestimates the impact of energy efficiency on reducing energy needs and revises it projected energy reductions every year to show the gains it is making in cutting energy use.

In all, it appears that the demand for new power plants will decline as energy efficiency improves and renewable-energy capacity increase. The question for Invenergy is whether it can make the case to fill shrinking demand for natural-gas power.

“We think that is validation for the idea that we don't need new power plants in New England,” saId Max Greene, CLF staff attorney.

Next for the CREC is a May 31 Superior Court court hearing in a case filed by CLF and the town of Burrillville that seeks to nullify the water agreement between Invenergy and the town of Johnston. The hearing will address a motion to dismiss the case by Invenergy.

The EFSB is creating a schedule for hearings to present updated advisory opinions from town departments and state agencies. Those hearings are expected this summer.