Grace McCormack/Melissa Garrido: Beware Medicare Advantage scams

BOSTON

The 67 million Americans eligible for Medicare make an important decision every October: Should they make changes in their Medicare health insurance plans for the next calendar year?

The decision is complicated. Medicare has an enormous variety of coverage options, with large and varying implications for people’s health and finances, both as beneficiaries and taxpayers. And the decision is consequential – some choices lock beneficiaries out of traditional Medicare.

Beneficiaries choose an insurance plan when they turn 65 or become eligible based on qualifying chronic conditions or disabilities. After the initial sign-up, most beneficiaries can make changes only during the open enrollment period each fall.

The 2024 open enrollment period, which runs from Oct. 15 to Dec. 7, marks an opportunity to reassess options. Given the complicated nature of Medicare and the scarcity of unbiased advisers, however, finding reliable information and understanding the options available can be challenging.

We are health care policy experts who study Medicare, and even we find it complicated. One of us recently helped a relative enroll in Medicare for the first time. She’s healthy, has access to health insurance through her employer and doesn’t regularly take prescription drugs. Even in this straightforward scenario, the number of choices were overwhelming.

The stakes of these choices are even higher for people managing multiple chronic conditions. There is help available for beneficiaries, but we have found that there is considerable room for improvement – especially in making help available for everyone who needs it.

The choice is complex, especially when you are signing up for the first time and if you are eligible for both Medicare and Medicaid. Insurers often engage in aggressive and sometimes deceptive advertising and outreach through brokers and agents. Choose unbiased resources to guide you through the process, like www.shiphelp.org. Make sure to start before your 65th birthday for initial sign-up, look out for yearly plan changes, and start well before the Dec. 7 deadline for any plan changes.

2 paths with many decisions

Within Medicare, beneficiaries have a choice between two very different programs. They can enroll in either traditional Medicare, which is administered by the government, or one of the Medicare Advantage plans offered by private insurance companies.

Within each program are dozens of further choices.

Traditional Medicare is a nationally uniform cost-sharing plan for medical services that allows people to choose their providers for most types of medical care, usually without prior authorization. Deductibles for 2024 are US$1,632 for hospital costs and $240 for outpatient and medical costs. Patients also have to chip in starting on Day 61 for a hospital stay and Day 21 for a skilled nursing facility stay. This percentage is known as coinsurance. After the yearly deductible, Medicare pays 80% of outpatient and medical costs, leaving the person with a 20% copayment. Traditional Medicare’s basic plan, known as Part A and Part B, also has no out-of-pocket maximum.

Traditional Medicare starts with Medicare parts A and B. Bill Oxford/iStock via Getty Images

People enrolled in traditional Medicare can also purchase supplemental coverage from a private insurance company, known as Part D, for drugs. And they can purchase supplemental coverage, known as Medigap, to lower or eliminate their deductibles, coinsurance and copayments, cap costs for Parts A and B, and add an emergency foreign travel benefit.

Part D plans cover prescription drug costs for about $0 to $100 a month. People with lower incomes may get extra financial help by signing up for the Medicare program Part D Extra Help or state-sponsored pharmaceutical assistance programs.

There are 10 standardized Medigap plans, also known as Medicare supplement plans. Depending on the plan, and the person’s gender, location and smoking status, Medigap typically costs from about $30 to $400 a month when a beneficiary first enrolls in Medicare.

The Medicare Advantage program allows private insurers to bundle everything together and offers many enrollment options. Compared with traditional Medicare, Medicare Advantage plans typically offer lower out-of-pocket costs. They often bundle supplemental coverage for hearing, vision and dental, which is not part of traditional Medicare.

But Medicare Advantage plans also limit provider networks, meaning that people who are enrolled in them can see only certain providers without paying extra. In comparison to traditional Medicare, Medicare Advantage enrollees on average go to lower-quality hospitals, nursing facilities, and home health agencies but see higher-quality primary care doctors.

Medicare Advantage plans also often require prior authorization – often for important services such as stays at skilled nursing facilities, home health services and dialysis.

Choice overload

Understanding the tradeoffs between premiums, health care access and out-of-pocket health care costs can be overwhelming.

Turning 65 begins the process of taking one of two major paths, which each have a thicket of health care choices. Rika Kanaoka/USC Schaeffer Center for Health Policy & Economics

Though options vary by county, the typical Medicare beneficiary can choose between as many as 10 Medigap plans and 21 standalone Part D plans, or an average of 43 Medicare Advantage plans. People who are eligible for both Medicare and Medicaid, or have certain chronic conditions, or are in a long-term care facility have additional types of Medicare Advantage plans known as Special Needs Plans to choose among.

Medicare Advantage plans can vary in terms of networks, benefits and use of prior authorization.

Different Medicare Advantage plans have varying and large impacts on enrollee health, including dramatic differences in mortality rates. Researchers found a 16% difference per year between the best and worst Medicare Advantage plans, meaning that for every 100 people in the worst plans who die within a year, they would expect only 84 people to die within that year if all had been enrolled in the best plans instead. They also found plans that cost more had lower mortality rates, but plans that had higher federal quality ratings – known as “star ratings” – did not necessarily have lower mortality rates.

The quality of different Medicare Advantage plans, however, can be difficult for potential enrollees to assess. The federal plan finder website lists available plans and publishes a quality rating of one to five stars for each plan. But in practice, these star ratings don’t necessarily correspond to better enrollee experiences or meaningful differences in quality.

Online provider networks can also contain errors or include providers who are no longer seeing new patients, making it hard for people to choose plans that give them access to the providers they prefer.

While many Medicare Advantage plans boast about their supplemental benefits , such as vision and dental coverage, it’s often difficult to understand how generous this supplemental coverage is. For instance, while most Medicare Advantage plans offer supplemental dental benefits, cost-sharing and coverage can vary. Some plans don’t cover services such as extractions and endodontics, which includes root canals. Most plans that cover these more extensive dental services require some combination of coinsurance, copayments and annual limits.

Even when information is fully available, mistakes are likely.

Part D beneficiaries often fail to accurately evaluate premiums and expected out-of-pocket costs when making their enrollment decisions. Past work suggests that many beneficiaries have difficulty processing the proliferation of options. A person’s relationship with health care providers, financial situation and preferences are key considerations. The consequences of enrolling in one plan or another can be difficult to determine.

The trap: Locked out

At 65, when most beneficiaries first enroll in Medicare, federal regulations guarantee that anyone can get Medigap coverage. During this initial sign-up, beneficiaries can’t be charged a higher premium based on their health.

Older Americans who enroll in a Medicare Advantage plan but then want to switch back to traditional Medicare after more than a year has passed lose that guarantee. This can effectively lock them out of enrolling in supplemental Medigap insurance, making the initial decision a one-way street.

For the initial sign-up, Medigap plans are “guaranteed issue,” meaning the plan must cover preexisting health conditions without a waiting period and must allow anyone to enroll, regardless of health. They also must be “community rated,” meaning that the cost of a plan can’t rise because of age or illness, although it can go up due to other factors such as inflation.

People who enroll in traditional Medicare and a supplemental Medigap plan at 65 can expect to continue paying community-rated premiums as long as they remain enrolled, regardless of what happens to their health.

In most states, however, people who switch from Medicare Advantage to traditional Medicare don’t have as many protections. Most state regulations permit plans to deny coverage, impose waiting periods or charge higher Medigap premiums based on their expected health costs. Only Connecticut, Maine, Massachusetts and New York guarantee that people can get Medigap plans after the initial sign-up period.

Deceptive advertising

Information about Medicare coverage and assistance choosing a plan is available but varies in quality and completeness. Older Americans are bombarded with ads for Medicare Advantage plans that they may not be eligible for and that include misleading statements about benefits.

A November 2022 report from the U.S. Senate Committee on Finance found deceptive and aggressive sales and marketing tactics, including mailed brochures that implied government endorsement, telemarketers who called up to 20 times a day, and salespeople who approached older adults in the grocery store to ask about their insurance coverage.

The Department of Health and Human Services tightened rules for 2024, requiring third-party marketers to include federal resources about Medicare, including the website and toll-free phone number, and limiting the number of contacts from marketers.

Although the government has the authority to review marketing materials, enforcement is partially dependent on whether complaints are filed. Complaints can be filed with the federal government’s Senior Medicare Patrol, a federally funded program that prevents and addresses unethical Medicare activities.

Meanwhile, the number of people enrolled in Medicare Advantage plans has grown rapidly, doubling since 2010 and accounting for more than half of all Medicare beneficiaries by 2023.

Nearly one-third of Medicare beneficiaries seek information from an insurance broker. Brokers sell health insurance plans from multiple companies. However, because they receive payment from plans in exchange for sales, and because they are unlikely to sell every option, a plan recommended by a broker may not meet a person’s needs.

Help is out there − but falls short

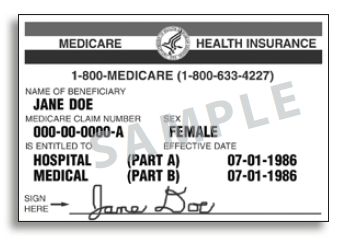

An alternative source of information is the federal government. It offers three sources of information to assist people with choosing one of these plans: 1-800-Medicare, medicare.gov and the State Health Insurance Assistance Program, also known as SHIP.

The SHIP program combats misleading Medicare advertising and deceptive brokers by connecting eligible Americans with counselors by phone or in person to help them choose plans. Many people say they prefer meeting in person with a counselor over phone or internet support. SHIP staff say they often help people understand what’s in Medicare Advantage ads and disenroll from plans they were directed to by brokers.

Telephone SHIP services are available nationally, but one of us and our colleagues have found that in-person SHIP services are not available in some areas. We tabulated areas by ZIP code in 27 states and found that although more than half of the locations had a SHIP site within the county, areas without a SHIP site included a larger proportion of people with low incomes.

Virtual services are an option that’s particularly useful in rural areas and for people with limited mobility or little access to transportation, but they require online access. Virtual and in-person services, where both a beneficiary and a counselor can look at the same computer screen, are especially useful for looking through complex coverage options.

We also interviewed SHIP counselors and coordinators from across the U.S.

As one SHIP coordinator noted, many people are not aware of all their coverage options. For instance, one beneficiary told a coordinator, “I’ve been on Medicaid and I’m aging out of Medicaid. And I don’t have a lot of money. And now I have to pay for my insurance?” As it turned out, the beneficiary was eligible for both Medicaid and Medicare because of their income, and so had to pay less than they thought.

The interviews made clear that many people are not aware that Medicare Advantage ads and insurance brokers may be biased. One counselor said, “There’s a lot of backing (beneficiaries) off the ledge, if you will, thanks to those TV commercials.”

Many SHIP staff counselors said they would benefit from additional training on coverage options, including for people who are eligible for both Medicare and Medicaid. The SHIP program relies heavily on volunteers, and there is often greater demand for services than the available volunteers can offer. Additional counselors would help meet needs for complex coverage decisions.

The key to making a good Medicare coverage decision is to use the help available and weigh your costs, access to health providers, current health and medication needs, and also consider how your health and medication needs might change as time goes on.

This article is part of an occasional series examining the U.S. Medicare system.

Grace McCormack is a postdoctoral researcher of Health Policy and Economics, at the University of Southern California

Melissa Garrido is a research professor, Health Law, Policy & Management, at Boston University.

google.com, pub-7774877255191227, DIRECT, f08c47fec0942fa0Sonali Kolhatkar: Why not control all drug prices?

Food and Drug Administration inspectors at a drug company.

Headquarters of Biogen, the big drug company, in Cambridge, Mass. Greater Boston, primarily Boston and Cambridge, hosts more than 1,000 biotechnology companies, ranging from small start-ups to billion-dollar pharmaceutical companies.

Major pharmaceutical companies in the United States are battling with Vermont Sen. Bernie Sanders over an issue that is at the heart of whether we value human wellbeing over corporate profits. As chairman of the Senate Committee on Health, Education, Labor, and Pensions (HELP), Sanders has vowed to force CEOs of pharmaceutical companies to publicly answer for why their drug prices are so much higher than in other nations. He plans to bring a committee vote to subpoena them. The subpoenas are necessary because—brazenly—the CEOs of Johnson & Johnson and Merck have simply refused to testify to the HELP committee. What are they afraid of?

In a defensive-sounding letter to Sanders, a lawyer for Johnson & Johnson accused the senator of using committee hearings to “punish the companies who have chosen to engage in constitutionally protected litigation.” The letter does not specify the litigation in question—perhaps because it would sound so ridiculous and would reveal the company’s real agenda. Last July, the company, along with Merck and Bristol Myers Squibb, sued the Biden administration for allowing the Medicare program to regulate prescription-drug prices.

It appears that Johnson & Johnson and Merck are indeed afraid of being questioned by lawmakers about drug-profiteering in the U.S.

One pharmaceutical expert, Ameet Sarpatwari, of the Harvard Medical School, explained to The New York Times that, “The U.S. market is the bank for pharmaceutical companies…. There’s a keen sense that the best place to try to extract profits is the U.S. because of its existing system and its dysfunction.” Another expert, Michelle Mello, a professor of law and health policy at Stanford university, told The Times, “Drugs are so expensive in the U.S. because we let them be.”

In other words, it’s been a free-for-all for pharmaceutical companies in the U.S. In 2003, then-President George W. Bush signed a Medicare reform bill into law, promising help for seniors struggling to pay for medications, but that law stripped the federal government of its power to negotiate drug prices for Medicare’s participants. It was a typically Republican, Orwellian move: Promise help to ordinary people and deliver the exact opposite.

Nearly two decades later, the Inflation Reduction Act (IRA), which Biden signed into law in 2022, tied Medicare drug prices to inflation and required companies to issue rebates if prices rose too fast. It was the first time since Bush’s 2003 law that drug manufacturers were subject to any U.S. price regulations. Pharmaceutical companies aren’t having it, and not only did they sue Biden over the IRA, they don’t seem to want to answer for their actions publicly.

It’s not enough for Medicare to be able to cut drug prices. There needs to be nationwide regulation on all drug prices for all Americans. After all, American taxpayers generously subsidize the research and development of most drugs. A report by Sanders’s staff explained that “[w]ith few exceptions, private corporations have the unilateral power to set the price of publicly funded medicines.” The report’s authors chided that “[t]he government asks for nothing in return for its investment.”

What’s more, the report rightly points out that people in other nations benefit from having access to lower-cost drugs that Americans have paid global pharmaceutical companies to develop. For example, SYMTUZA, an HIV medication that scientists at the U.S. National Institutes of Health helped to develop, is available to U.S. patients for a whopping $56,000 a year, while patients in the UK pay only $10,000 a year for the same drug purchased from the same company.

It’s not as if such companies as Johnson & Johnson have some perverse preference for European patients over American ones. It’s merely that their prices are regulated by most other advanced industrial nations. The U.S. “happens to be the only industrialized nation that doesn’t negotiate” drug prices, explained Merith Basey, executive director of Patients For Affordable Drugs NOW, in an interview on Rising Up With Sonali last fall.

Indeed, countries like the UK, France and Germany, offer models for the U.S. in drug-price controls and much has been written about what works best. Further, there is—unsurprisingly—a strong public desire for price controls. According to a Kaiser Family Foundation poll in August 2023, “[m]ajorities across partisans say there is not enough regulation over drug pricing.” Moreover, a whopping 83 percent of those polled “see pharmaceutical profits as a major factor contributing to the cost of prescription drugs.”

There is no shortage of ideas for specific price-control regulations that could work in the U.S. For example, the Center for American Progress’s October 2023 report “Following the Money: Untangling U.S. Prescription Drug Financing’’ delves deep into how market prices are determined for medications and suggests interventions at every stage of drug price setting.

Frankly, such complex solutions would not really be necessary if all Americans could simply join Medicare health coverage and if Medicare’s bargaining power to negotiate drug prices could be applied to all drugs. But, in the absence of this commonsense holistic approach to healthcare, even complex price controls would be better than no price controls.

Predictably, conservative capitalist critics have trotted out the same, tired arguments against government price regulations of pharmaceuticals. “Drug Price Controls Mean Slower Cures,” declared a Wall Street Journal editorial headline. The paper’s editorial board called the IRA, “the worst legislation to pass Congress in many years,” and went as far as accusing the Biden administration of “extortion.”

But who is engaging in extortion? Economists studying the pharmaceutical industry have found that for years companies have been so flush with cash that they have spent hundreds of billions of dollars in stock buybacks and exorbitant executive bonuses and pay packages. “The $747 billion that the pharmaceutical companies distributed to shareholders was 13 percent greater than the $660 billion that these corporations expended on research & development over the decade,” wrote William Lazonick and Öner Tulum in a report for the Institute for New Economic Thinking.

Further, The Wall Street Journal’s screed ignores price controls in the U.K., France, Germany and other nations. If those have no bearing on the speed and quality of drug development, why should U.S. price controls have an impact? And if they do have an impact, then Americans are being unfairly required to bear the burden that people all over the world benefit from.

The Journal’s editorial board made one accurate claim, saying that the IRA “will also give companies the incentives to launch drugs at higher prices and raise prices for privately insured patients to compensate for the Medicare cuts.” The paper made this prediction without any comment on unfettered corporate greed. Indeed, if anyone is engaging in de facto extortion, it appears as though pharmaceutical companies may be the guilty parties in punishing Americans for price controls.

Pharmaceutical companies launched the new year with announced price hikes on at least 500 medications—a massive effort at gouging the public. In contrast, the IRA’s drug-price controls apply to only 10 medications so far, and will be expanded to 15 drugs per year for the next four years, and 20 drugs per year thereafter.

Rather than removing price controls on the paltry numbers of medications the IRA can regulate, an easy fix is to apply those same regulations to most or all drugs. Best of all, in order for such a solution to be implemented, pharmaceutical company CEOs wouldn’t even have to drag themselves into committee hearings to explain away their corporate greed.

Sonali Kolhatkar is a multimedia journalist. She is the founder, host and executive producer of “Rising Up With Sonali,” a weekly television and radio show that airs on Free Speech TV and Pacifica stations.

Sarah Jane Tribble: Beware sales pitches — Medicare Advantage can dangerously trap you

From Kaiser Family Foundation Health News (KFF Health News)

“The problem is that once you get into Medicare Advantage, if you have a couple of chronic conditions and you want to leave Medicare Advantage, even if Medicare Advantage isn’t meeting your needs, you might not have any ability to switch back to traditional Medicare.’’

— David Meyers, assistant professor of health services, policy, and practice at the Brown University School of Public Health

In 2016, Richard Timmins went to a free informational seminar to learn more about Medicare coverage.

“I listened to the insurance agent and, basically, he really promoted Medicare Advantage,” Timmins said. The agent described less expensive and broader coverage offered by the plans, which are funded largely by the government but administered by private insurance companies.

For Timmins, who is now 76, it made economic sense then to sign up. And his decision was great, for a while.

Then, three years ago, he noticed a lesion on his right earlobe.

“I have a family history of melanoma. And so, I was kind of tuned in to that and thinking about that,” Timmins said of the growth, which doctors later diagnosed as malignant melanoma. “It started to grow and started to become rather painful.”

Timmins, though, discovered that his enrollment in a Premera Blue Cross Medicare Advantage plan would mean a limited network of doctors and the potential need for preapproval, or prior authorization, from the insurer before getting care. The experience, he said, made getting care more difficult, and now he wants to switch back to traditional, government-administered Medicare.

But he can’t. And he’s not alone.

“I have very little control over my actual medical care,” he said, adding that he now advises friends not to sign up for the private plans. “I think that people are not understanding what Medicare Advantage is all about.”

Enrollment in Medicare Advantage plans has grown substantially in the past few decades, enticing more than half of all eligible people, primarily those 65 or older, with low premium costs and such perks as dental and vision insurance. And as the private plans’ share of the Medicare patient pie has ballooned to 30.8 million people, so, too, have concerns about the insurers’ aggressive sales tactics and misleading coverage claims.

Enrollees, like Timmins, who sign on when they are healthy can find themselves trapped as they grow older and sicker.

“It’s one of those things that people might like them on the front end because of their low to zero premiums and if they are getting a couple of these extra benefits — the vision, dental, that kind of thing,” said Christine Huberty, a lead benefit specialist supervising attorney for the Greater Wisconsin Agency on Aging Resources.

“But it’s when they actually need to use it for these bigger issues,” Huberty said, “that’s when people realize, ‘Oh no, this isn’t going to help me at all.’”

Medicare pays private insurers a fixed amount per Medicare Advantage enrollee and in many cases also pays out bonuses, which the insurers can use to provide supplemental benefits. Huberty said those extra benefits work as an incentive to “get people to join the plan” but that the plans then “restrict the access to so many services and coverage for the bigger stuff.”

David Meyers, assistant professor of health services, policy, and practice at the Brown University School of Public Health, analyzed a decade of Medicare Advantage enrollment and found that about 50% of beneficiaries — rural and urban — left their contract by the end of five years. Most of those enrollees switched to another Medicare Advantage plan rather than traditional Medicare.

In the study, Meyers and his co-authors muse that switching plans could be a positive sign of a free marketplace but that it could also signal “unmeasured discontent” with Medicare Advantage.

“The problem is that once you get into Medicare Advantage, if you have a couple of chronic conditions and you want to leave Medicare Advantage, even if Medicare Advantage isn’t meeting your needs, you might not have any ability to switch back to traditional Medicare,” Meyers said.

Traditional Medicare can be too expensive for beneficiaries switching back from Medicare Advantage, he said. In traditional Medicare, enrollees pay a monthly premium and, after reaching a deductible, in most cases are expected to pay 20% of the cost of each nonhospital service or item they use. And there is no limit on how much an enrollee may have to pay as part of that 20% coinsurance if they end up using a lot of care, Meyers said.

To limit what they spend out-of-pocket, traditional Medicare enrollees typically sign up for supplemental insurance, such as employer coverage or a private Medigap policy. If they are low-income, Medicaid may provide that supplemental coverage.

But, Meyers said, there’s a catch: While beneficiaries who enrolled first in traditional Medicare are guaranteed to qualify for a Medigap policy without pricing based on their medical history, Medigap insurers can deny coverage to beneficiaries transferring from Medicare Advantage plans or base their prices on medical underwriting.

Only four states — Connecticut, Maine, Massachusetts, and New York — prohibit insurers from denying a Medigap policy if the enrollee has preexisting conditions such as diabetes or heart disease.

Paul Ginsburg is a former commissioner on the Medicare Payment Advisory Commission, also known as MedPAC. It’s a legislative branch agency that advises Congress on the Medicare program. He said the inability of enrollees to easily switch between Medicare Advantage and traditional Medicare during open enrollment periods is “a real concern in our system; it shouldn’t be that way.”

The federal government offers specific enrollment periods every year for switching plans. During Medicare’s open enrollment period, from Oct. 15 to Dec. 7, enrollees can switch out of their private plans to traditional, government-administered Medicare.

Medicare Advantage enrollees can also switch plans or transfer to traditional Medicare during another open enrollment period, from Jan. 1 to March 31.

“There are a lot of people that say, ‘Hey, I’d love to come back, but I can’t get Medigap anymore, or I’ll have to just pay a lot more,’” said Ginsburg, who is now a professor of health policy at the University of Southern California.

Timmins is one of those people. The retired veterinarian lives in a rural community on Whidbey Island, just north of Seattle. It’s a rugged, idyllic landscape and a popular place for second homes, hiking, and the arts. But it’s also a bit remote.

While it’s typically harder to find doctors in rural areas, Timmins said he believes his Premera Blue Cross plan made it more challenging to get care for a variety of reasons, including the difficulty of finding and getting in to see specialists.

Nearly half of Medicare Advantage plan directories contained inaccurate information on what providers were available, according to the most recent federal review. Beginning in 2024, new or expanding Medicare Advantage plans must demonstrate compliance with federal network expectations or their applications could be denied.

Amanda Lansford, a Premera Blue Cross spokesperson, declined to comment on Timmins’ s case. She said the plan meets federal network adequacy requirements as well as travel time and distance standards “to ensure members are not experiencing undue burdens when seeking care.”

Traditional Medicare allows beneficiaries to go to nearly any doctor or hospital in the U.S., and in most cases enrollees do not need approval to get services.

Timmins, who recently finished immunotherapy, said he doesn’t think he would be approved for a Medigap policy, “because of my health issue.” And if he were to get into one, Timmins said, it would likely be too expensive.

For now, Timmins said, he is staying with his Medicare Advantage plan.

“I’m getting older. More stuff is going to happen.”

There is also a chance, Timmins said, that his cancer could resurface: “I’m very aware of my mortality.”

Sarah Jane Tribble is a reporter for KFF Health News

Judith Graham: In Maine and elsewhere, many elderly struggle to pay for basic necessities

Farmer's market in Monument Square, downtown Portland

— Photo by vBd2media

Townhouses in Portland’s West End, completed in 1835

— Photo by Motionhero

PORTLAND, Maine

Fran Seeley, 81, doesn’t see herself as living on the edge of a financial crisis. But she’s uncomfortably close.

Each month, Seeley, a retired teacher, gets $925 from Social Security and a $287 disbursement from an individual retirement account. To make ends meet, she’s taken out a reverse mortgage on her home here that yields $400 monthly.

So far, Seeley has been able to live on this income — about $19,300 a year — by carefully monitoring her spending and drawing on limited savings. But should her excellent health worsen or she need assistance at home, Seeley doesn’t know how she’d pay for those expenses.

More than half of older women living alone — 54% — are in a similarly precarious financial situation: either poor according to federal poverty standards or with incomes too low to pay for essential expenses. For single men, the share is lower but still surprising — 45%.

That’s according to a valuable but little-known measure of the cost of living for older adults: the Elder Index, developed by researchers at the Gerontology Institute at the University of Massachusetts at Boston.

A new coalition, the Equity in Aging Collaborative, is planning to use the index to influence policies that affect older adults, such as property tax relief and expanded eligibility for programs that assist with medical expenses. Twenty-five prominent aging organizations are members of the collaborative.

The goal is to fuel a robust dialogue about “the true cost of aging in America,” which remains unappreciated, said Ramsey Alwin, president and chief executive of the National Council on Aging, an organizer of the coalition.

Nationally, and for every state and county in the U.S., the Elder Index uses various public databases to calculate the cost of health care, housing, food, transportation and miscellaneous expenses for seniors. It represents a bare-bones budget, adjusted for whether older adults live alone or as part of a couple; whether they’re in poor, good or excellent health; and whether they rent or own homes, with or without a mortgage.

Results from the analyses are eye-opening. In 2020, according to data supplied by Jan Mutchler, director of the Gerontology Institute, the index shows that nearly 5 million older women living alone, 2 million older men living alone, and more than 2 million older couples had incomes that made them economically insecure.

And those estimates were before inflation soared to more than 9% — a 40-year high — and older adults continued to lose jobs during the second and third years of the pandemic. “With those stressors layered on, even more people are struggling,” Mutchler said.

Nationally and in every state, the minimum cost of living for older adults calculated by the Elder Index far exceeds federal poverty thresholds, which are used to calculate official poverty statistics. (Federal poverty thresholds used by the Elder Index differ slightly from federal poverty guidelines. Data for each state can be found here.)

One national example: The Elder Index estimates that a single older adult in good health paying rent needed $27,096, on average, for basic expenses in 2021 — $14,100 more than the federal poverty threshold of $12,996. For couples, the gap between the index’s calculation of necessities and the poverty threshold was even greater.

Yet eligibility for Medicaid, food stamps, housing assistance and other safety-net programs that help older adults is based on federal poverty standards, which don’t account for geographic variations in the cost of living or medical expenses incurred by older adults, among other factors. (This isn’t an issue for older adults alone; the poverty measures have been widely critiqued across age groups.)

“The poverty rate just doesn’t cut it as a realistic look at the struggles older adults are having,” said William Arnone, chief executive officer of the National Academy of Social Insurance, one of the new coalition’s members. “The Elder Index is a reality check.”

In April, University of Massachusetts researchers showed that Social Security benefits cover only a fraction of what older adults need for basic living expenses: 68% for a senior in good health who lives alone and pays rent and 81% for an older couple in the same situation.

“There’s a myth that Social Security and Medicare miraculously take care of all of people’s needs in older age,” said Alwin, of the National Council on Aging. “The reality is they don’t, and far too many people are one crisis away from economic insecurity.”

Organizations across the country have been using the Elder Index to convince policymakers that older adults need more assistance. In New Jersey, where 54% of seniors are economically insecure according to the index, advocates used the data to protect property-tax relief programs for older adults during the pandemic. In New York, where nearly 60% of seniors are economically insecure, advocates persuaded the legislature to raise the Medicaid income eligibility threshold.

In San Diego, where as many as 40% of seniors are economically insecure, Serving Seniors, a nonprofit agency, persuaded county officials to use pandemic-related stimulus payments to expand senior nutrition programs. As a result, the agency has been able to double production of home-delivered meals, to more than 1.5 million annually.

Officials are often wary of the financial impact of expanding programs, said Paul Downey, president and CEO of Serving Seniors. But, he said, “we should be using a reliable measure of economic security and at least know how well the programs we’re offering are doing.” By law, California’s Area Agencies on Aging use the Elder Index in their planning process.

Maine is No. 5 on the list of states ranked by the share of seniors living below the Elder Index, 56%. For someone in Fran Seeley’s situation (an older adult who is in excellent health, lives alone, owns a house, and doesn’t pay a monthly mortgage), the index suggests $22,560 a year is necessary — $3,200 more than Seeley’s annual income and $9,500 above the federal poverty threshold.

Fran Seeley’s income — from Social Security, a retirement account, and a reverse mortgage — comes to about $19,300 a year. With inflation increasing, “it means I have to cut back in any way I can,” Seeley says.

A look at Seeley’s budget reveals how quickly necessary expenses accumulate: $2,041 annually for Medicare Part B (this is deducted from her Social Security check), $4,156 for property and stormwater taxes, $390 for home insurance, $320 for furnace cleaning, $1,440 for heat, $125 for water, $500 for gas and electricity, $300 for property maintenance, $1,260 for phone and Internet, $150 for car registration, $640 for car insurance, $840 for gasoline at current prices, $300 for car maintenance, and $4,800 for food.

The total: $17,262. And that doesn’t include the cost of medications, clothing, toiletries, any kind of entertainment, or other incidentals.

Seeley’s great luxury is caring for four cats, which she describes as “the light of my life.” Their annual wellness checks cost about $400 a year, while their food costs about $1,080.

With inflation now making her budget even tighter, “it means I have to cut back in any way I can. I find myself going into stores and saying, ‘No, I don’t need that,’” Seeley said. “The biggest worry I have is not being able to afford living in my home or becoming ill. I know that medical expenses could wipe me out in no time financially.”

Judith Graham is a Kaiser Health News Reporter.

James P. Freeman: Will we actually see a predicted generational wealth transfer of $70 trilllion?

"The Young Heir Takes Possession Of The Miser's Effects,’’ from William Hogarth's “A Rake's Progress’’.

One Financial Center and nearby buildings in Boston’s financial district. The city is a national center for investing for retirement.

I was invited recently to an online seminar with this title: “Preparing for the Great Generational Wealth Transfer.”

As a financial professional -- with experience as a private wealth advisor -- I found the subject matter to be particularly intriguing. After all, as a marketer and thought leader today, I look at emerging trends -- behavioral, demographic, and technological, among others -- as a means by which to foster and sustain long-term relationships with clients and prospective clients, alike. All of the looming changes articulated during the webinar (and others I have seen on the horizon) will certainly provide challenges and opportunities in the financial advice business for both the consumer and advisor. But the changes herewith will be seismic.

The webinar presentation was inspired by research conducted by Boston-based Cerulli & Associates, a firm which delivers financial market intelligence to the industry. Cerulli projects that, in the greatest intergenerational reallocation of wealth ever, $70 trillion will be transferred between generations (Silent Gen and Baby Boomers to Gen X and Millennials) by the year 2042. That prediction alone is worthy of our collective attention.

But will that happen? I have my doubts.

Surely, retirement for today’s younger generations will be vastly different from retirement experienced by today’s older generations. But the dollar volume estimated to be passed down seems to me to be fantastically overcooked. Expect the expected. Let me give you my unified field theory.

First, it is important to look at the emerging demographic patterns for a sense of perspective.

Strength in numbers

While the Silent Gen (1928-1945) still plays a role in this “great transfer,” the focus here remains on Baby Boomers. Boomers were born between 1946 and 1964 -- at one point seventy-six million strong. The first Boomer reached the age of 65 -- commonly called “retirement age” -- in early 2011. Today, 10,000 Boomers are turning 65 every single day. Beginning in 2024, however, that figure accelerates to 12,000 per day, in what is being called “Peak 65.” The pace will decline markedly as the last Boomer turns 65 in December 2029. Even more incredibly, sometime during the next decade, one in five Americans will be over the age of 65. That has never happened before.

Gen X members (sometimes referred to as the “MTV Generation”) were born between 1965 and 1980. Today they are between the ages of 41 and 56 and are in the peak earnings years of their careers; the oldest are just starting to contemplate retirement. According to 2019 U.S. census data, they are 65.2 million strong. The oldest Gen Xer has more in common with the youngest Boomer while the youngest Gen Xer has more in common with the oldest Millennial. Arguably, Gen X is a shadow generation given that it is smaller than the Boomer generation preceding it and the Millennial generation following it. And notably, Millennials have eclipsed all other generations for sheer size. So, the attention paid to them is warranted.

Millennials were born between 1981 and 1996. In 2016, Millennials became the largest generation in the U.S. labor force. With 87 million members, Millennials also now represent the largest demographic group in America, surpassing the Boomer generation. In fact, Millennials are the largest adult cohort in the world. Right before their eyes, Boomers are ceasing to be the most influential generation. More than half of Americans are now Millennials or younger, reports brookings.edu

Nonetheless, as the greying of America continues, the median age is now just over 38. Fifty years ago, it was closer to 28 and has been rising ever since.

Adrian Johnstone, president, and co-founder of Practifi, a business management platform for financial advice, was the featured webinar speaker. He delivered examples of the stark contrasts between the generations in how they view the future and view retirement. As you can imagine, there are big cultural differences between these generations. It literally is a generation gap

Understandably, then, Boomers and Millennials have different objectives. At least as understood right now.

Demographics is destiny

Boomers more or less created the financial retirement business. As I like to say it was “of Boomers, by Boomers, and for Boomers.” Not too long ago, a Boomer was likely to measure success in a retirement portfolio by “benchmarking.” For example, this meant comparing the performance of an individual investment portfolio to something like the Standard & Poor’s 500 Index, a broad market index that measures performance. It was an accomplishment if you beat a given index in a given year. But defining success has evolved over time.

Smart people began saying this about benchmarking: “So what?”

Retirement planning was more than just investment performance. Industry leaders started looking at planning in a much more holistic way. Soon, business models would build around a “process” to drive success based on “goal setting.” The thinking was that you had a greater probability of achieving your goals if you followed a process. That concept changed the mindset from the short-term to long-term. Indeed, retirement planning was a long-term journey. The rationale was that retirees should consider whether or not they were achieving their goals as the best way to effectively measure progress in retirement. “Goals” was a much broader concept than “benchmarks,” yet it was much more focused, too -- buying a second home, taking annual vacations, investing in long-term care, setting up gifting, losing weight, etc. Markets go up and go down. But if you could achieve your overall goals despite inevitable market turbulence that was the new paradigm for defining success in retirement.

My sense, however, is that this current model is beginning to change as well. While goals will always be part of retirement planning, I question if setting lofty, long-term goals (even if practical) may prove to be elusive for many retirees going forward. My reasoning is straightforward.

The youngest Boomer and oldest Gen X have had to weather three once-in-a-lifetime events that affected retirement planning and saving in just the last twenty years. (Dotcom in 2000, Great Recession in 2009, COVID-19 in 2020). Combine these events with future funding issues for Social Security, Medicare, and Long-Term Care needs, it paints a less certain financial picture. Throw in the fact that this demographic carve-out is more in debt than older retirees and the relative financial future seems even less assured for them. Goals, then, seem illusory.

Given these realities, I believe that financial planning will once again morph into a new realm. Discussions will center more on “lifestyle” (or standard of living) and less on goal setting. Maintaining -- if not improving -- one’s lifestyles is a more focused conversation than goals; it’s much more tangible than goals, too. Telling clients they will not be able to maintain a given lifestyle is much more powerful than telling them they can not reach a goal.

So, in the span of fewer than forty years, you can see the progression of retirement planning models in how performance is often measured. It began with comparing benchmarks to setting goals and will likely shift even more to living desired lifestyles. Enter Millennials…

Now please fasten your seatbelts before departure

The Practifi webinar suggested even more pronounced changes when Millennials begin serious retirement consideration. According to Johnstone, this generation will be mostly concerned about values -- such as social responsibility and the impact of their decisions on the larger society. In other words, for them, retirement planning must center around their values, with everything else, including, presumably, performance, of less or equal import.

That is a radical shift in priorities.

Additionally, financial advisors should anticipate other changes in how future generations approach retirement. They are just as compelling.

The retirement landscape will probably look unrecognizable after the last Boomer retires in 2029, presenting new complexities for all interested parties.

Surely, there will be a transfer of wealth (more about which anon) and advisors will need to be aligned with the interests of the next generation (values more than goals). Likewise, “NextGen” retirees will have crypto currencies and ESG investments (environment, social, and governance) as staples in their portfolios. They will also be more inclined to make micro loans, a newfangled investment alternative. Fee structures will undoubtedly be altered. Marketing will be impacted by implementing AR (augmented reality) into social media and other platforms. The regulatory apparatus will also look hugely different. And AI (artificial intelligence) software tools will complement human advisors. Finally, future retirees will be more financially literate, more skeptical, and more engaged (via technology) about, well, everything.

Advisors in the future doubtless must change from a Boomer-centric retirement model to a Millennial-centric retirement model not only to accommodate the next retirement class but to prepare for the predicted wealth transfer. For Johnstone, he sees a sea-change from the client point of view, too. He believes that Boomers are “delegators” of their retirement (to advisors). Whereas Millennials will be “validators” of their retirement (from advisors).

Show me the money!

Notwithstanding the extraordinary metamorphosis about to play out in a couple of years in terms of demographics and service delivery models, the real question is about assets. This past June, The Wall Street Journal reported that the great transfer has already begun. It cited Federal Reserve data indicating that Americans over the age of 70 had already accumulated “a net worth of nearly $35 trillion.” That amounts to 27 percent of all U.S. wealth, up from 20 percent three decades ago.

Still, I am not entirely convinced that $70 trillion in assets will ultimately be transferred to heirs and charities, as predicted. That stockpile of money seems high. To better understand that dollar amount, it would mean the transference of roughly $3.3 trillion every year for the next twenty years. Put another way, the total would be the combination of President Biden’s $1.9 trillion Build Back Better Act and $1.2 trillion Infrastructure Investment and Jobs Acts, annually, up to 2042.

Labyrinthine financial trends might well offset the amount substantially.

The real question should be: Will known (and unknown) massive unfunded liabilities eventually absorb much of the $70 trillion because we have simply failed to live within our means today? We have shifted many of today’s financial burdens on younger generations and even generations not yet born. The arithmetic just doesn’t square.

Conceivably, much of these assets would be liquidated -- and hence evaporated -- prior to any transferring or gifting because of future costs. Consider the following four factors: poor savings, rising healthcare costs, Social Security funding concerns, and high personal (not to mention high institutional and governmental) debt loads. It is the liabilities side of the balance sheet that concerns me. Not the assets side.

Something has gotta give

POOR SAVINGS

Despite a staggering amount of cash flooding into the American economy as part of COVID-19 relief (read about the $5.2 trillion in pandemic fiscal stimulus), not to mention an absurdly accommodative monetary policy, America still has a savings problem. (Remember food lines queuing up just a couple of weeks after the first lockdowns in early 2020? We were told people did not have money saved for such “emergencies.”) I don’t subscribe to the idea -- as perpetuated by economists, usually the last group of people “in-the-know” -- that Americans have significantly improved their savings rates. Saving is a behavioral attribute. Have behaviors really changed for the long term? Any built up savings is likely a temporary phenomenon. I write that because much of the chatter we hear from financial commentators centers on all this “pent up demand” stemming from the pandemic. Such demand, we are told, is exacerbating the supply-chain problems. A probable outcome will be all the extra cash will be spent.

Earlier this year the Insured Retirement Institute released the results of a survey conducted on workers between the ages of 40 and 73. Its findings were unsurprising but consistent with many similar studies on worker preparedness for retirement. Two key takeaways were as follows: savings behavior needs to improve, and retirement income expectations are unrealistic. The survey found that 51 percent of respondents had less than $50,000 saved for retirement. Furthermore, the report concluded that “Among savers, savings rates are not nearly high enough for even the youngest respondents to grow their nest eggs to a level sufficient for meeting their income and budget expectations.” The survey was conducted after much of the stimulus was already distributed into personal and small business accounts.

And, perhaps most alarming, the institute wrote that, across several measures of retirement preparedness, “most [respondents] fear they will not have enough income, will not be prepared to transition into retirement, will not have enough money for medical expenses or long-term care should the need arise, and may not be able to live independently for the entirety of their retirement.” A large number of Americans are not putting enough aside to catch up.

Americans’ use of retirement plans has changed dramatically over the last several decades, too. In the past, good-ole-fashion “defined benefit plans” (think pensions) were the norm. They were a stable retirement income source for millions of retirees. But many pension plans -- especially in the public sector -- are grossly underfunded today. The 401(k) was born in 1978 and known as a “defined contribution plan.” Such contribution plans were devised to supplement benefit plans but over time they ended up supplanting those benefit plans. And at their root, 401(k) plans were really DIY plans -- or “do-it-yourself” plans. The result was that the American worker became the principal source of his or her retirement savings, not a corporation or municipality. And the data confirm that Americans are not contributing enough to these plans. Therefore, it is hard to see where additional savings are built into future retirement portfolios -- unless people rely mostly upon enormous equity gains in real estate holdings. Besides, government policy discourages saving (with artificially and historically low interest rates) and encourages speculating (with greater yields in riskier market investments). This is even more outrageous considering higher inflation has returned with gusto.

As 2021 ends, I would imagine that future studies examining the impacts of all this stimulus will confirm that the notion of any substantive increase in savings and savings rates is a grand chimera.

RISING HEALTHCARE COSTS

Nearly ten years ago, in a 2012 speech at the U.S. Naval War College, conservative columnist George Will, then 69, showed those in the audience his Medicare Card. He had also previously shown it to his doctor. To which his doctor said, “That’s wonderful, George, we’ll send your bills to your children.”

Both “Romneycare” (in Massachusetts) and “Obamacare” (at the national level) largely fulfilled their aims of insuring many more of its residents and citizens, respectively, for healthcare. However, neither program did anything to bend the cost curve. In Massachusetts, for instance, healthcare costs now represent 36 percent of total state spending. It was 31.5 percent just three years ago. For fiscal 2008, the figure was approximately 30 percent.

In case you missed it, healthcare costs have been rising and will continue rising, yet few want to pay for spiraling costs. According to healthsystemtracker.org, health spending in America totaled $74.1 billion in 1970. Three decades later, by 2000, health expenditures reached about $1.4 trillion. Put another way, “In 1970, 6.9 percent of the gross domestic product (GDP) in the U.S. was spent toward total health spending (both through public and private funds). By 2019, the amount spent on healthcare has increased to 17.7 percent of the GDP.” It is expected that the number will reach 18 percent soon.

Healthcare costs in this country continue to accelerate because of the intersection of demographics (Boomers retiring in large numbers) and better medicine (diagnostic, therapeutic, pharmacologic). Today, we are consuming $3.8 trillion or $11,582 per person, annually, on healthcare. This is nearly three times what was spent only twenty years ago. And with more Boomers consuming even more healthcare in the future, our healthcare system will strain with greater costs. Spending will sharply hasten.

Data in a 2021 extract provided by the Robert Wood Johnson Foundation reveal that American households paid, on average in 2018, 18.5 percent of their income towards healthcare costs. In addition, “According to Medicare beneficiaries’ data, in 2017, the average total health expenditures in their last year of life was $66,176.”

Medicare currently covers nearly 64 million Americans today. And funding for the program accounted for more than 4 percent of the U.S. GDP in 2020, reports medicareresources.org. Total Medicare spending stood at $917 billion last year, and it is expected to grow to $1.78 trillion in 2031, or two years after the last Boomer retires.

Medicare, established in 1965 as part of The Great Society, has critical funding challenges just like Social Security -- but they are more immediate. It is estimated that the Medicare Trust Fund will be exhausted in 2024 unless Congress acts to implement new reforms. Barring no changes, the Congressional Budget Office projects that following 2024 exhaustion, Medicare will only have sufficient tax receipts to be able to pay 83 cents for every dollar covered. There are three practical solutions to avoid insolvency, concluded forbes.com this past March: “Increase revenues flowing into the trust fund by at least $700 billion to extend solvency to 2036 (experts typically focus on 10-year time horizons); cut spending on Medicare beneficiaries or increase their monthly premiums; or figure out a combination of these two methods.”

All of these challenges were known as far back as twenty years ago. In 2002, Health Services Research issued a study named “The 2030 Problem: Caring for aging Baby Boomers.” Few have paid heed to the warnings that it issued back then. “To meet the long-term care needs of Baby Boomers,” its authors wrote, “social and public policy changes must begin soon.” In 2021, it is obvious that these changes never occurred.\

SOCIAL SECURITY FUNDING

In many respects, healthcare cost concerns are a bigger worry than Social Security because the latter is more manageable and knowable: We have decades of economic data and demographic data to ascertain future costs. We know healthcare costs will rise but it is such a wildcard that it is difficult to enumerate actuarial costs. With Social Security the math is right in front of us, and it is largely predictable. But reforms are needed.

According to the Social Security Administration, the ratio of covered workers to beneficiaries was 159 to 1 in 1940; that figure shrank to 2.8 to 1 in 2013. It is estimated to be 2.7 today. However, when the last Boomers reach age 75, the trustees of the program project that “the ratio will fall to 2.2 to 1 in 2039.”

And unless, in this politically charged environment, changes are made to how Social Security is funded, it will not support paying out 100 percent of benefits beginning in 2034. Barring no change, payroll taxes will only then be able to distribute approximately 75 percent of promised payments. Like Medicare, it would seem that a combination of higher taxes and lower payouts would be the most likely outcome. But that is impossible to predict.

Estimates vary on how much retirees rely entirely on Social Security as a source of income in later years.

The National Institute on Retirement Security (NIRS) in January 2020 reported that, “A plurality of older Americans, 40.2 percent, only receive income from Social Security in retirement.” That analysis was called into question by Andrew G. Biggs, senior fellow at the American Enterprise Institute. Biggs has written extensively on retirement matters. Using different data points collected by other governmental agencies, he found there is not a consensus on the NIRS thesis. Instead, there is evidence that between 12 percent and 20 percent of older Americans rely solely on Social Security for support. Even if those figures are closer to reality, it is a fact that millions of retirees depend on Social Security as a significant source of income. So, this question remains pertinent: What would a potential 25 percent reduction in Social Security benefits do to seniors?

Arguably, in order to finance the current level of Medicare and Social Security benefits for future retirees (will there ever be higher levels of spend?), higher payroll taxes would seemingly be the quickest fix. And it is not too farfetched to reason that inheritance taxes would also rise to address these systemic problems, too. These measures would certainly eat into the great transfer of $70 trillion.

IN DEBT WE TRUST

My favorite website may be debt.org.

The site is really an advocacy platform that wishes to help people who are in debt, but I find it as a reliable financial resource. Its “Demographics of Debt” page is a helpful amalgam of disparate data points that exposes a crisis like an asteroid approaching earth. Recent updates to the page have included debt tabulations made during the pandemic.

American household debt hit a record $14.6 trillion in the spring of 2021, according to the Federal Reserve. (Housing likely accounts for 71 percent of that total.) Furthermore, last year, rather disturbingly, “The total U.S. consumer debt balance grew $800 billion, according to Experian. That was an increase of 6 percent over 2019, the highest annual growth jump in over a decade.” Borrowers have been the beneficiaries of historically low interest rates for over a decade now. This has, in my opinion, been an inducement to borrow more without consequences. But with higher inflation now center stage for an economy that has experienced benign inflation for decades, it would seem that the Federal Reserve would be poised to raise interest rates sooner than later. Such action would make it more expensive to borrow and would obviously make servicing debt more expensive, especially for adjustable-rate debt instruments. (Interestingly, Adjustable Rate Mortgages make up just 3.4 percent of all mortgage applications today; as of 2020, approximately 44 percent of U.S. consumers have a mortgage; in Massachusetts the average individual mortgage balance is $261,345, as of 2020.)

I am keenly interested in the breakdown of debts among the demographic groups. The anticipated great transfer of wealth would imply that older generations (Silent Gen and Boomers) would be relatively unencumbered by debts to allow them to freely pass along assets to heirs (Gen X and Millennials) and charities. On the contrary, the data suggest that picture less clear.

Of these four demographic groups, the Silent Gen has the lowest amount of average debt per member ($41,281), while Millennials have the third lowest ($87,448). What is somewhat surprising is that Boomers place second, having an average of $97,290 of debt per member. Meanwhile, Gen X can claim the largest debt burdens for this comparison with an average of $140,643 per Xer. Academically, this all makes sense as Gen X is still paying off the bulk of its mortgage obligations and the same may be said for the youngest Boomer as well.

It seems to me, that despite the fact that Boomers are no longer the largest demographic cluster, they will largely determine whether or not the great transfer of assets actually happens.

I do not see how the bulk of $70 trillion ever gets delivered to younger generations. I believe that future costs (for healthcare, Medicare, and Social Security) will emphatically eat up much of those assets. Boomers will inevitably be more “takers” than “makers” of the great transfer. Finally, I believe that servicing existing individual debt loads will be as much of a factor in the future as it is today. We also should be mindful of the exorbitant levels of debt at the government and institutional levels that will also need adequate funding. Time was when we borrowed for the future. We now borrow from the future. There is no escape from The Great Debt.

Years ago, I did a short stint as a substitute teacher. I would argue that the elementary classroom is a more challenging environment than the Wall Street boardroom, and higher learning more perspicacious than higher returns. One fine day I was teaching first graders. There was some free time before dismissal, so I simply asked them to draw anything they wanted -- a token for the ride home after school. It was a fun exercise. As I was circulating around the children, watching future Picassos toil away, I came across a young girl named Sally. I couldn’t quite figure out what she was sketching. So, I asked, “Sally, what is that?” She paused, and with steely determination, she said, “I am drawing a picture of God.” I made the mistake of responding, “Well, Sally that’s quite something because no one knows what God looks like.” To which she retorted, with breezy confidence: “They will in a minute.”

With regard to the great wealth transfer and attendant ramifications, we will see in a New York minute.

James P. Freeman is the director of marketing at Kelly Financial Services, LLC, based in in Greater Boston. For much of his professional career in financial services he was an officer in the bond administration departments of a number of banks and trust companies. This content is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any interest in any investment vehicles managed by Kelly Financial Services, LLC, its subsidiaries, and affiliates. Kelly Financial Services, LLC does not accept any responsibility or liability arising from the use of this communication. No representation is being made that the information presented is accurate, current, or complete, and such information is at all times subject to change without notice. The opinions expressed in this content and or any attachments are those of the author and not necessarily those of Kelly Financial Services, LLC. Kelly Financial Services, LLC does not provide legal, accounting or tax advice and each person should seek independent legal, accounting and tax advice regarding the matters discussed in this article.

Harris Meyer: Leaders of some New England and other states look to curb prescription-drug-price increases

Massachusetts Gov. Charlie Baker is looking for support from state legislators for his plan to penalize price hikes for a broader range of drugs as part of his new budget proposal.

Fed up with a lack of federal action to lower prescription drug costs, state legislators around the country are pushing bills to penalize drugmakers for unjustified price hikes and to cap payment at much-lower Canadian levels.

These bills, sponsored by both Republicans and Democrats in a half-dozen states, are a response to consumers’ intensified demand for action on drug prices as prospects for solutions from Congress remain highly uncertain.

Eighty-seven percent of Americans favor federal action to lower drug prices, making it the public’s second-highest policy priority, according to a survey released by Politico and Harvard University last month. That concern is propelled by the toll of out-of-pocket costs on Medicare beneficiaries, many of whom pay thousands of dollars a year. Studies show many patients don’t take needed drugs because of the cost.

“States will keep a careful eye on Congress, but they can’t wait,” said Trish Riley, executive director of the National Academy for State Health Policy (NASHP), which has drafted two model bills on curbing prices that some state lawmakers are using.

Several reports released last month heightened the pressure for action. The Rand Corp. said average list prices in the U.S. for prescription drugs in 2018 were 2.56 times higher than the prices in 32 other developed countries, while brand-name drug prices averaged 3.44 times higher.

The Institute for Clinical and Economic Review found that drugmakers raised the list prices for seven widely used, expensive drugs in 2019 despite the lack of evidence of substantial clinical improvements. ICER, an independent drug research group, estimated that just those price increases cost U.S. consumers $1.2 billion a year more.

Democratic legislators in Hawaii, Maine and Washington recently introduced bills, based on one of NASHP’s models, that would impose an 80% tax on the drug price increases that ICER determines in its annual report are not supported by evidence of improved clinical value.

Under this model, after getting the list of drugs from ICER, states would require the manufacturers of those medicines to report total in-state sales of their drugs and the price difference since the previous year. Then the state would assess the tax on the manufacturer. The revenue generated by the tax would be used to fund programs that help consumers afford their medications.

“I’m not looking to gather more tax dollars,” said Democratic Sen. Ned Claxton, the sponsor of the bill in Maine and a retired family physician. “The best outcome would be to have drug companies just sell at a lower price.”

Similarly, Massachusetts Gov. Charlie Baker, a Republican, proposed a penalty on price hikes for a broader range of drugs as part of his new budget proposal, projecting it would haul in $70 million in its first year.

Meanwhile, Republican and Democratic lawmakers in Hawaii, Maine, North Dakota, Oklahoma and Rhode Island have filed bills that would set the rates paid by state-run and commercial health plans — excluding Medicaid — for up to 250 of the costliest drugs to rates paid by the four most populous Canadian provinces. That could reduce prices by an average of 75%, according to NASHP.

Legislators in other states plan to file similar bills, Riley said.

Drugmakers, which have formidable lobbying power in Washington, D.C., and the states, fiercely oppose these efforts. “The outcomes of these policies would only make it harder for people to get the medicines they need and would threaten the crucial innovation necessary to get us out of a global pandemic,” the Pharmaceutical Research and Manufacturers of America, the industry’s trade group, said in a written statement.

Colorado, Florida and several New England states previously passed laws allowing importation of cheaper drugs from Canada, an effort strongly promoted by former President Donald Trump. But those programs are still being developed and each would need a federal green light.

Bipartisan bills in Congress that would have penalized drugmakers for raising prices above inflation rates and capped out-of-pocket drug costs for enrollees in Medicare Part D drug plans died last year.

“If we waited for Congress, we’d have moss on our backs,” said Washington state Sen. Karen Keiser, a Democrat who sponsored the state’s bill to tax drug price hikes.

Based on ICER data, two of the drugs that could be targeted for tax penalties under the legislation are Enbrel and Humira — blockbuster products used to treat rheumatoid arthritis and other autoimmune conditions.

Since acquiring Enbrel in 2002, Amgen has raised the price 457% to $72,240 for a year’s treatment, according to a report last fall from the House Committee on Oversight and Reform.

In a written statement, Amgen denied that Enbrel’s list price increase is unsupported by clinical evidence and said the company ensures that every patient who needs its medicines has “meaningful access” to them.

The price for Humira, the world’s best-selling drug, with $20 billion in global sales in 2019, has gone up 470% since it was introduced to the market in 2003, according to AnalySource, a drug price database.

In contrast, AbbVie slashed Humira’s price in Europe by 80% in 2018 to match the price of biosimilar products available there. AbbVie patents block those biosimilar drugs in the U.S.

AbbVie did not respond to requests for comment for this article.

Manufacturers say the list price of a drug is irrelevant because insurers and patients pay a significantly lower net price, after getting rebates and other discounts.

But many people, especially those who are uninsured, are on Medicare or have high-deductible plans, pay some or all the cost based on the list price.

Katherine Pepper of Bellingham, Wash., has felt the bite of Humira’s list price. Several years ago, she retired from her job as a management analyst to go on Social Security disability and Medicare because of her psoriatic arthritis, diabetes and gastrointestinal issues.

When she enrolled in a Medicare Part D drug plan, she was shocked by her share of the cost. Since Pepper pays 5% of the Humira list price after reaching Medicare’s catastrophic cost threshold, she spent roughly $15,000 for the drug last year.

Medicare doesn’t allow drugmakers to cover beneficiaries’ copay costs because of concerns that it could prompt more beneficiaries and their doctors to choose high-cost drugs and increase federal spending.

Many patients with rheumatoid and other forms of arthritis are forced to switch from Enbrel or Humira, which they can inject at home themselves, to different drugs that are infused in a doctor’s office when they go on Medicare. Infusion drugs are covered almost entirely by the Medicare Part B program for outpatient care. But switching can complicate a patient’s care.

“Very few Part D patients can afford the [injectable drugs] because the copay can be so steep,” said Dr. Marcus Snow, an Omaha, Nebraska, rheumatologist and spokesperson for the American College of Rheumatology. “The math gets very ugly very quickly.”

To continue taking Humira, Pepper racked up large credit card bills, burning through most of her savings. In 2019, she and her husband, who’s retired and on Medicare, sold their house and moved into a rental apartment. She skimps on her diabetes medications to save money, which has taken a toll on her health, causing skin and vision problems, she said.

She’s also cut back on food spending, with her and her husband often eating only one meal a day.

“I’m now in a situation where I have to do Russian roulette, spin the wheel and figure out what I can do without this month,” said Pepper.

Harris Meyer is a Kaiser Health News reporter.

This article is part of a series on the impact of high prescription drug costs on consumers made possible through the 2020 West Health and Families USA Media Fellowship.

Harris Meyer: @Meyer_HM

Sophia Paslaski: Supreme Court just made the case for Medicare for All

From OtherWords.org

People of the menstruating persuasion: how dare you. The highest court in the land demands to know.

This July, the Supreme Court of the United States decided that President Trump, who does not have a uterus, was quite right to object to Obama-era rules under the Affordable Care Act that allowed Americans who do have uteri access to free birth control through their employer-provided health-insurance plans.

Specifically, NPR reports, the Supreme Court upheld a Trump administration rule that “would give broad exemptions from the birth control mandate to nonprofits and some for-profit companies that object to birth control on religious or moral grounds.”

Not just religious — “moral.”

So even if Jesus is cool with it, if you have personal “moral” quandaries with the people in your employ taking birth control, you’re free to cut your workers off from essential medications.

And I do mean absolutely essential. While some of us use ACA-covered birth control like “the pill” or an intrauterine device (IUD) as an optional measure to prevent pregnancy, many of us depend on it to treat hormonal conditions.

Birth-control medication is commonly used to help manage premenstrual syndrome and painful periods. Doctors prescribe it to control the growth of painful ovarian cysts that can lead to life-threatening complications if left untreated. It helps those with challenges like depression level out the hormonal fluctuations that can trigger cyclical mood changes around menstruation.

And for one in 10 of us, it is the best line of defense, short of surgery, against endometriosis, a debilitating condition that many struggle to manage without birth-control medication.

But perhaps that’s not the point.

Plenty of us have made this medical appeal before to no avail. Medicine doesn’t seem to matter to those employers who deem themselves religiously or morally opposed to “providing” birth control to their employees — as if employers are handing out pill packs at the reception desk like free swag at Comic Con.

Maybe, as always, this is about the medical-industrial complex.

In this country, where much health insurance is tied to employment, employers often take the position that they are “giving” their employees health care — and therefore, that they are entitled to some say over what that care entails.

That’s nonsense — but so is tying health care to employment in the first place.

Politicians who oppose Medicare for All like to cite the concerns of voters who, allegedly, love their employer-provided health insurance. But this court decision proves what most of us, I expect, already know: private health insurance isn’t all that great.

It doesn’t cover everything you need it to cover. It’s beholden to the whims of the employers who provide it. It’s expensive for the self-employed who purchase it on their own. It prioritizes profit over care, yet still never seems to get the billing done right.

As Sen. Elizabeth Warren said at a debate last year, “Let’s be clear: I’ve never actually met anybody who likes their health insurance company.”

So fine. Refuse to offer health-insurance plans that cover birth control, if you must. I’m not happy about it, especially as I write this an hour before an appointment with my OBGYN to talk about birth control and endometriosis.

But I won’t fight you either, because I think you’ve done my fighting for me — I can think of no better argument for Medicare for All than the freeing of the noble employer from the dreadful moral quandary of birth control.

Great job, team. Drinks are on Justice Brett Kavanaugh.

Sophia Paslaski is on the staff of the Institute for Policy Studies.

Julie Appleby: Whither hospital-at-home services after pandemic?

After seven days as an inpatient for complications related to heart problems, Glenn Shanoski was initially hesitant when doctors suggested in early April that he could cut his hospital stay short and recover at home — with high-tech 24-hour monitoring and daily visits from medical teams.