Susan Jaffe: Feds rein in Medical Advantage predictive software

From Kaiser Family Foundation Health News

Judith Sullivan was recovering from major surgery at a Connecticut nursing home in March when she got surprising news from her Medicare Advantage plan: It would no longer pay for her care because she was well enough to go home.

At the time, she could not walk more than a few feet, even with assistance — let alone manage the stairs to her front door, she said. She still needed help using a colostomy bag following major surgery.

“How could they make a decision like that without ever coming and seeing me?” said Sullivan, 76. “I still couldn’t walk without one physical therapist behind me and another next to me. Were they all coming home with me?”

UnitedHealthcare — the nation’s largest health-insurance company, which provides Sullivan’s Medicare Advantage plan — doesn’t have a crystal ball. It does have naviHealth, a care-management company bought by UHC’s sister company, Optum, in 2020. Both are part of UnitedHealth Group. NaviHealth analyzes data to help UHC and other insurance companies make coverage decisions.

Its proprietary “nH Predict” tool sifts through millions of medical records to match patients with similar diagnoses and characteristics, including age, preexisting health conditions, and other factors. Based on these comparisons, an algorithm anticipates what kind of care a specific patient will need and for how long.

But patients, providers, and patient advocates in several states said they have noticed a suspicious coincidence: The tool often predicts a patient’s date of discharge, which coincides with the date their insurer cuts off coverage, even if the patient needs further treatment that government-run Medicare would provide.

“When an algorithm does not fully consider a patient’s needs, there’s a glaring mismatch,” said Rajeev Kumar, a physician and the president-elect of the Society for Post-Acute and Long-Term Care Medicine, which represents long-term care practitioners. “That’s where human intervention comes in.”

The federal government will try to even the playing field next year, when the Centers for Medicare & Medicaid Services begins restricting how Medicare Advantage plans use predictive technology tools to make some coverage decisions.

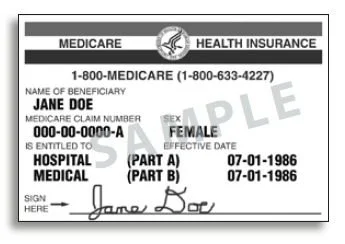

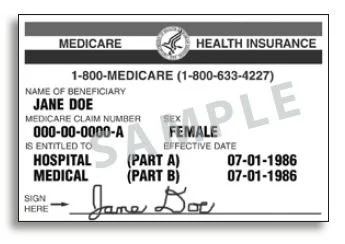

Medicare Advantage plans, an alternative to the government-run, original Medicare program, are operated by private insurance companies. About half the people eligible for full Medicare benefits are enrolled in the private plans, attracted by their lower costs and enhanced benefits like dental care, hearing aids, and a host of nonmedical extras like transportation and home-delivered meals.

Insurers receive a monthly payment from the federal government for each enrollee, regardless of how much care they need. According to the Department of Health and Human Services’ inspector general, this arrangement raises “the potential incentive for insurers to deny access to services and payment in an attempt to increase profits.” Nursing home care has been among the most frequently denied services by the private plans — something original Medicare likely would cover, investigators found.

After UHC cut off her nursing home coverage, Sullivan’s medical team agreed with her that she wasn’t ready to go home and provided an additional 18 days of treatment. Her bill came to $10,406.36.

Beyond her mobility problems, “she also had a surgical wound that needed daily dressing changes” when UHC stopped paying for her nursing home care, said Debra Samorajczyk, a registered nurse and the administrator at the Bishop Wicke Health and Rehabilitation Center, in Shelton, Conn., the facility that treated Sullivan.

Sullivan’s coverage denial notice and nH Predict report did not mention wound care or her inability to climb stairs. Original Medicare would have most likely covered her continued care, said Samorajczyk.

Sullivan appealed twice but lost. Her next appeal was heard by an administrative law judge, who holds a courtroom-style hearing usually by phone or video link, in which all sides can provide testimony. UHC declined to send a representative, but the judge nonetheless sided with the company. Sullivan is considering whether to appeal to the next level, the Medicare Appeals Council, and the last step before the case can be heard in federal court.

Sullivan’s experience is not unique. In February, Ken Drost’s Medicare Advantage plan, provided by Security Health Plan of Wisconsin, wanted to cut his coverage at a Wisconsin nursing home after 16 days, the same number of days naviHealth predicted was necessary. But Drost, 87, who was recovering from hip surgery, needed help getting out of bed and walking. He stayed at the nursing home for an additional week, at a cost of $2,624.

After he appealed twice and lost, his hearing on his third appeal was about to begin when his insurer agreed to pay his bill, said his lawyer, Christine Huberty, supervising attorney at the Greater Wisconsin Agency on Aging Resources Elder Law & Advocacy Center in Madison.

“Advantage plans routinely cut patients’ stays short in nursing homes,” she said, including Humana, Aetna, Security Health Plan, and UnitedHealthcare. “In all cases, we see their treating medical providers disagree with the denials.”

UnitedHealthcare and naviHealth declined requests for interviews and did not answer detailed questions about why Sullivan’s nursing home coverage was cut short over the objections of her medical team.

Aaron Albright, a naviHealth spokesperson, said in a statement that the nH Predict algorithm is not used to make coverage decisions and instead is intended “to help the member and facility develop personalized post-acute care discharge planning.” Length-of-stay predictions “are estimates only.”

However, naviHealth’s website boasts about saving plans money by restricting care. The company’s “predictive technology and decision support platform” ensures that “patients can enjoy more days at home, and healthcare providers and health plans can significantly reduce costs specific to unnecessary care and readmissions.”

New federal rules for Medicare Advantage plans beginning in January will rein in their use of algorithms in coverage decisions. Insurance companies using such tools will be expected to “ensure that they are making medical necessity determinations based on the circumstances of the specific individual,” the requirements say, “as opposed to using an algorithm or software that doesn’t account for an individual’s circumstances.”

The CMS-required notices nursing home residents receive now when a plan cuts short their coverage can be oddly similar while lacking details about a particular resident. Sullivan’s notice from UHC contains some identical text to the one Drost received from his Wisconsin plan. Both say, for example, that the plan’s medical director reviewed their cases, without providing the director’s name or medical specialty. Both omit any mention of their health conditions that make managing at home difficult, if not impossible.

The tools must still follow Medicare coverage criteria and cannot deny benefits that original Medicare covers. If insurers believe the criteria are too vague, plans can base algorithms on their own criteria, as long as they disclose the medical evidence supporting the algorithms.

And before denying coverage considered not medically necessary, another change requires that a coverage denial “must be reviewed by a physician or other appropriate health care professional with expertise in the field of medicine or health care that is appropriate for the service at issue.”

Jennifer Kochiss, a social worker at Bishop Wicke who helps residents file insurance appeals, said patients and providers have no say in whether the doctor reviewing a case has experience with the client’s diagnosis. The new requirement will close “a big hole,” she said.

The leading MA plans oppose the changes in comments submitted to CMS. Tim Noel, UHC’s CEO for Medicare and retirement, said MA plans’ ability to manage beneficiaries’ care is necessary “to ensure access to high-quality safe care and maintain high member satisfaction while appropriately managing costs.”

Restricting “utilization management tools would markedly deviate from Congress’ intent in creating Medicare managed care because they substantially limit MA plans’ ability to actually manage care,” he said.

In a statement, UHC spokesperson Heather Soule said the company’s current practices are “consistent” with the new rules. “Medical directors or other appropriate clinical personnel, not technology tools, make all final adverse medical necessity determinations” before coverage is denied or cut short. However, these medical professionals work for UHC and usually do not examine patients. Other insurance companies follow the same practice.

David Lipschutz, associate director of the Center for Medicare Advocacy, is concerned about how CMS will enforce the rules since it doesn’t mention specific penalties for violations.

CMS’ deputy administrator and director of the Medicare program, Meena Seshamani, said that the agency will conduct audits to verify compliance with the new requirements, and “will consider issuing an enforcement action, such as a civil money penalty or an enrollment suspension, for the non-compliance.”

Although Sullivan stayed at Bishop Wicke after UHC stopped paying, she said another resident went home when her MA plan wouldn’t pay anymore. After two days at home, the woman fell, and an ambulance took her to the hospital, Sullivan said. “She was back in the nursing home again because they put her out before she was ready.”

Susan Jaffe is Kaiser Family Foundation reporter.

Chris Powell: Prosecute kids for wearing blackface? Perpetual poverty in New Haven

Promotional poster for Spike Lee’s 2000 film Bamboozled, about a disgruntled black television executive who reintroduces the old blackface style in a series concept to try to get himself fired, and is instead horrified by its success.

Kids can be horrible -- stupid, cruel, hateful, sadistic, reckless, and worse. But in spite of the indignation lately contrived by the Connecticut chapter of the National Association for the Advancement of Colored People, wearing blackface is not high on the scale of youthful offenses.

The other week, at a press conference outside a middle school in Shelton, Conn., one of whose white students recently posted on the Internet a photo of herself wearing blackface, the NAACP suggested that kids deserve to be shot for that kind of thing or at least criminally prosecuted for a "hate crime."

On top of that, according to the Valley Independent Sentinel, the NAACP demanded that Shelton authorities account to the organization for the progress of the "investigation" of the incident and include the organization in a mandatory discussion with students and school staff about racial diversity.

Make wearing blackface a "hate crime"? That's fascism. For no matter how offensive the blackface-wearing student was, and no matter what she meant, if anything, she did it on her own time to her own looks in her own life. A school can disapprove of certain things that rise to public attention, and of course a school always should be teaching decent behavior, but First Amendment freedom of expression in one's personal life is and must remain inviolate. The government has no authority to punish it.

In peacefully protesting racial oppression in the segregationist South, the civil rights advocates of a half century ago struggled and even died for freedom of expression. The NAACP was part of that struggle. Now the organization wants 12-year-olds prosecuted for putting on makeup and making faces.

But it's even more ironic. Lately the NAACP has supported Connecticut's new laws increasing leniency for juveniles who commit crimes like car theft. So now in Connecticut juveniles can get caught stealing cars twice before a court can impose any punishment on them. Many of those juveniles are black. But the NAACP thinks wearing blackface is worse than car theft.

Most kids grow up. The premier of Canada wore blackface when he was young. So did the governor of Virginia. They lately were caught through old photos and repented. Blackface is not who they are now. Most of the kids in Connecticut who lately have advertised themselves wearing blackface have been reprimanded and likely will grow up too. With luck many of Connecticut's young and coddled car thieves will not only grow up but stay out of prison.

The NAACP should grow up as well. There are far more serious things to be indignant about.

* * *

WHY THE PERPETUAL POVERTY? Fresh from his victory in New Haven's Democratic primary for mayor, Justin Elicker has urged Yale University students to devote some time to civic life in the city. According to the Yale Daily News, one student snarked back, "We're a university, not a soup kitchen."

Elicker replied that some city residents "can't put food on the table" while Yalies enjoy an all-you-can-eat dining hall.

But despite that snarky student, Yale is not quite the bastion of privilege it once was. Now about half Yale's students receive the university's own scholarships under "need-blind" admissions policy so that even kids who grew up dining at soup kitchens and don't have much money can get into the university.

Also the other week CTNewsJunkie reported that Connecticut is the only state in which poverty recently increased. So Yale students and Elicker himself might perform a great civic service if they could ever determine why poverty and urban policies are failing so badly.

Chris Powell is a columnist for the Journal Inquirer, in Manchester, Conn.