From Kaiser Family Foundation Health News

“This is really sort of standing out as a sore thumb in a nation that would like to claim that it cares for the less fortunate and it seeks to do anything it can for them.’’

— Eli Adashi, a professor of medical science at Brown University and former president of the Society for Reproductive Endocrinologists.

Mary Delgado’s first pregnancy went according to plan, but when she tried to get pregnant again seven years later, nothing happened. After 10 months, Delgado, now 34, and her partner, Joaquin Rodriguez, went to see an OB-GYN. Tests showed she had endometriosis, which was interfering with conception. Delgado’s only option, the doctor said, was in vitro fertilization.

“When she told me that, she broke me inside,” Delgado said, “because I knew it was so expensive.”

Delgado, who lives in New York City, is enrolled in Medicaid, the federal-state health program for low-income and disabled people. The roughly $20,000 price tag for a round of IVF would be a financial stretch for lots of people, but for someone on Medicaid — for which the maximum annual income for a two-person household in New York is just over $26,000 — the treatment can be unattainable.

Expansions of work-based insurance plans to cover fertility treatments, including free egg freezing and unlimited IVF cycles, are often touted by large companies as a boon for their employees. But people with lower incomes, often minorities, are more likely to be covered by Medicaid or skimpier commercial plans with no such coverage. That raises the question of whether medical assistance to create a family is only for the well-to-do or people with generous benefit packages.

“In American health care, they don’t want the poor people to reproduce,” Delgado said. She was caring full-time for their son, who was born with a rare genetic disorder that required several surgeries before he was 5. Her partner, who works for a company that maintains the city’s yellow cabs, has an individual plan through the state insurance marketplace, but it does not include fertility coverage.

Years after she had her first child, Joaquin , Mary Delgado found out that she had endometriosis and that IVF was her only option to get pregnant again. The news from her doctor “broke me inside,” Delgado says, “because I knew it was so expensive.” Delgado, who is on Medicaid, traveled more than 300 miles round trip for lower-cost IVF, and she and her partner, Joaquin Rodriguez, used savings they’d set aside for a home. Their daughter, Emiliana, is now almost a year old.

Some medical experts whose patients have faced these issues say they can understand why people in Delgado’s situation think the system is stacked against them.

“It feels a little like that,” said Elizabeth Ginsburg, a professor of obstetrics and gynecology at Harvard Medical School who is president-elect of the American Society for Reproductive Medicine, a research and advocacy group.

Whether or not it’s intended, many say the inequity reflects poorly on the U.S.

“This is really sort of standing out as a sore thumb in a nation that would like to claim that it cares for the less fortunate and it seeks to do anything it can for them,” said Eli Adashi, a professor of medical science at Brown University and former president of the Society for Reproductive Endocrinologists.

Yet efforts to add coverage for fertility care to Medicaid face a lot of pushback, Ginsburg said.

Over the years, Barbara Collura, president and CEO of the advocacy group Resolve: The National Infertility Association, has heard many explanations for why it doesn’t make sense to cover fertility treatment for Medicaid recipients. Legislators have asked, “If they can’t pay for fertility treatment, do they have any idea how much it costs to raise a child?” she said.

“So right there, as a country we’re making judgments about who gets to have children,” Collura said.

The legacy of the eugenics movement of the early 20th century, when states passed laws that permitted poor, nonwhite, and disabled people to be sterilized against their will, lingers as well.

“As a reproductive justice person, I believe it’s a human right to have a child, and it’s a larger ethical issue to provide support,” said Regina Davis Moss, president and CEO of In Our Own Voice: National Black Women’s Reproductive Justice Agenda, an advocacy group.

But such coverage decisions — especially when the health care safety net is involved — sometimes require difficult choices, because resources are limited.

Even if state Medicaid programs wanted to cover fertility treatment, for instance, they would have to weigh the benefit against investing in other types of care, including maternity care, said Kate McEvoy, executive director of the National Association of Medicaid Directors. “There is a recognition about the primacy and urgency of maternity care,” she said.

Medicaid pays for about 40 percent of births in the United States. And since 2022, 46 states and the District of Columbia have elected to extend Medicaid postpartum coverage to 12 months, up from 60 days.

Fertility problems are relatively common, affecting roughly 10% of women and men of childbearing age, according to the National Institute of Child Health and Human Development.

Traditionally, a couple is considered infertile if they’ve been trying to get pregnant unsuccessfully for 12 months. Last year, the ASRM broadened the definition of infertility to incorporate would-be parents beyond heterosexual couples, including people who can’t get pregnant for medical, sexual, or other reasons, as well as those who need medical interventions such as donor eggs or sperm to get pregnant.

The World Health Organization defined infertility as a disease of the reproductive system characterized by failing to get pregnant after a year of unprotected intercourse. It terms the high cost of fertility treatment a major equity issue and has called for better policies and public financing to improve access.

No matter how the condition is defined, private health plans often decline to cover fertility treatments because they don’t consider them “medically necessary.” Twenty states and Washington, D.C., have laws requiring health plans to provide some fertility coverage, but those laws vary greatly and apply only to companies whose plans are regulated by the state.

In recent years, many companies have begun offering fertility treatment in a bid to recruit and retain top-notch talent. In 2023, 45 percent of companies with 500 or more workers covered IVF and/or drug therapy, according to the benefits consultant Mercer.

But that doesn’t help people on Medicaid. Only two states’ Medicaid programs provide any fertility treatment: New York covers some oral ovulation-enhancing medications, and Illinois covers costs for fertility preservation, to freeze the eggs or sperm of people who need medical treatment that will likely make them infertile, such as for cancer. Several other states also are considering adding fertility preservation services.

In Delgado’s case, Medicaid covered the tests to diagnose her endometriosis, but nothing more. She was searching the internet for fertility treatment options when she came upon a clinic group called CNY Fertility that seemed significantly less expensive than other clinics, and also offered in-house financing. Based in Syracuse, New York, the company has a handful of clinics in upstate New York cities and four other U.S. locations.

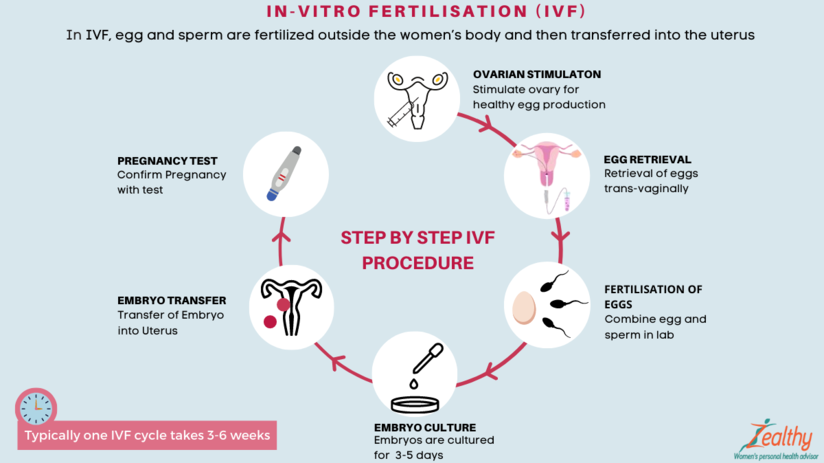

Though Delgado and her partner had to travel more than 300 miles round trip to Albany for the procedures, the savings made it worthwhile. They were able do an entire IVF cycle, including medications, egg retrieval, genetic testing, and transferring the egg to her uterus, for $14,000. To pay for it, they took $7,000 of the cash they’d been saving to buy a home and financed the other half through the fertility clinic.

She got pregnant on the first try, and their daughter, Emiliana, is now almost a year old.

Delgado doesn’t resent people with more resources or better insurance coverage, but she wishes the system were more equitable.

“I have a medical problem,” she said. “It’s not like I did IVF because I wanted to choose the gender.”

One reason CNY is less expensive than other clinics is simply that the privately owned company chooses to charge less, said William Kiltz, its vice president of marketing and business development. Since the company’s beginning in 1997, it has become a large practice with a large volume of IVF cycles, which helps keep prices low.

At this point, more than half its clients come from out of state, and many earn significantly less than a typical patient at another clinic. Twenty percent earn less than $50,000, and “we treat a good number who are on Medicaid,” Kiltz said.

Now that their son, Joaquin, is settled in a good school, Delgado has started working for an agency that provides home health services. After putting in 30 hours a week for 90 days, she’ll be eligible for health insurance.

Michelle Andrews: is a Kaiser Family Health News contributing writer.

andrews.khn@gmail.com, @mandrews110