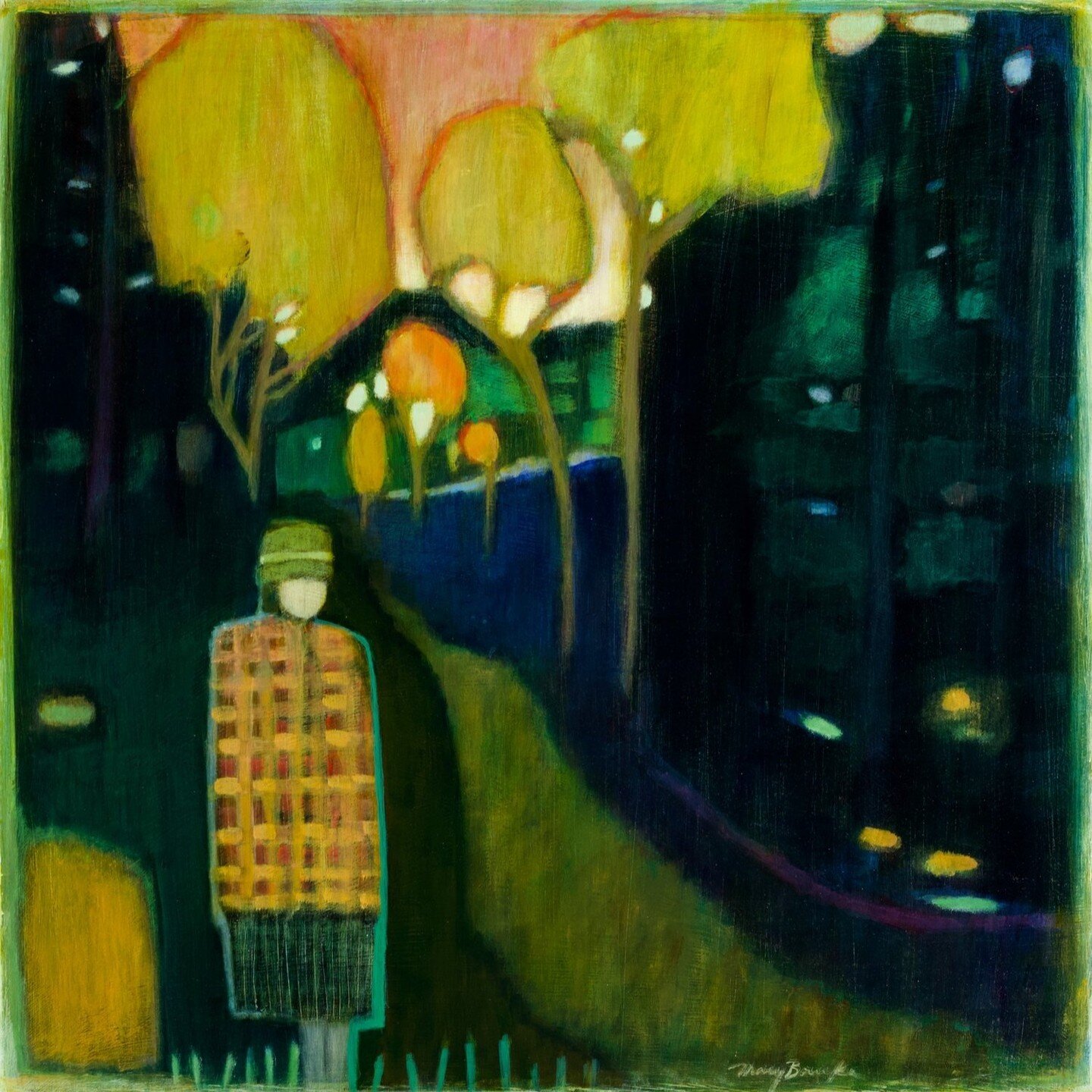

The Prince of Orange landing at Torbay, England, in the Glorious Revolution that overthrew James II and installed the Prince of Orange, a Dutchman, as William III.

— Painting by Jan Hoynck van Papendrecht

SOMERVILLE, Mass.

Many people at least a little about the history of the scientific revolutions of the 16th and 17th centuries; the industrial revolutions of the 18th and 19th centuries; and the democratic revolutions of the 17th, 18th and 19th centuries.

Very few are familiar with the major details of the financial revolution of the early 18th Century, which began with the reforms of England’s “Glorious revolution” of 1688. In the course of the next sixty years, these developments brought into existence the modern military-industrial complex.

This relative obscurity of these long-ago events is not surprising, for, as best I can tell, the term had no currency before Peter G.M Dickson, in 1967, published The Financial Revolution in England: A Study of the Development of Public Credit, 1688-1756. Until then, the power to spend public money was colloquially described as “the control of the purse.”

It is, however, something of a shame, since what we now call “the national debt” these days is the engine that powers military interventions around the world, from the misadventures of the George W, Bush administrations forays in Afghanistan and Iraq to Vladimir Putin’s quagmire plunge in Ukraine. You can’t fathom those periodic $60 billion appropriations bills without knowing something about the enormous multinational purse that supports NATO.

Instead, our understanding of these matters depends on combinations of vignettes and modern analysis, a sauce that often doesn’t come together.

Among vignettes, an especially appealing recent example is Ways and Means: Lincoln and his Cabinet and the Financing of the Civil War, by social historian Roger Lowenstein. It relates how Treasury Secretary Salmon Chase, Lincoln’s defeated presidential rival, turned the tide of war against the South on the financial front, “levying taxes and marketing bonds, while desperately batting inflation.” A more encompassing account of government bond markets was related twenty-five years ago and updated in 2010 in Hamilton’s Blessing: The Extraordinary Life and Times of Our National Debt, by John Steele Gordon.

A welcome addition among analytics In Defense of Public Debt, by Barry Eichengreen, Asmaa El-Ganainy, Rui Esteves, and Kris James Michener (2021), a hard-headed survey of debt in the service of the state and what’s known about the limits of borrowing. The wind has largely gone out of the sails of the fad called “modern monetary theory,” thanks to books like this, and the papers cited herein. And the book synthesizes a good deal of valuable history. But the topical treatment of the issues is unlikely to make an impression on the broad public mind. That take a lifetime of research in the manner of Dickson, or, in the case of the cadre of researchers working over insights derived from a famous 1989 article about the origins of modern democracy, by Douglass North and Barry Weingast.

Thus the lack of understanding is of the financial revolution is to some degree the story of a lost book. Dickson died last year, having spent sixty years as a Founding Fellow of St. Catherine’s College, Oxford University. He revised his English Financial Revolution book in 1993, but that second edition is out of print. Even the library copy of the original was missing when I arrived yesterday. You can get some idea of the scope of the problem from its table of contents — and why the story of government bond markets is a hard tale to tell.

The Financial Revolution — 2. The Contemporary Debate — II. Government Long-Term Borrowing — 3. The Earliest Phase of the National Debt 1688-1714 — 4. Problems of Administration and Reform 1693-1719 — 5. The South Sea Bubble (I) — 6. The South Sea Bubble (II) — 7. Financial Relief and Reconstruction 1720-1730 — 8. Financial Relief and Reconstruction 1720-1730 — 9. The National Debt under Walpole – 10. War and Peace 1739-1755 — 11. Public Creditors in England and Abroad– 12. Public Creditors Abroad – 12. Government Short-term Borrowing — 13. Borrowing by Exchequer Tallies — 14. Borrowing by Exchequer Bills — 15. Departmental Credit — 16. The Bonds of the Monied Companies — 17. The Ownership of Short-dated Securities and the Market in Securities — 18. The Turnover of Securities — 19. The Rate of Interest in Theory and Practice — 20. The Origins of the Stock Exchange

A parallel history of events in France adds dimensionality to the story. French Finances, 1770-1795; From Business to Bureaucracy (1970), by John F. Bosher, describes role of the French Revolution in transforming a thoroughly corrupt system of government finance into a less venal and more efficient system. In A Financial History of Western Europe (1993), Charles P. Kindleberger, who assigned the two books in courses he taught in 1979 and 1980, wrote, “Note that the financial revolution of England preceded that of France by a century, and that the view that British military success owed to her financial capacity is matched by the statement that financial incompetence of the French monarchy was the main reason for its ultimate collapse.”

The good news is that not one but two top-flight economic historians are once again working on telling the story of the revolution charted by Dickson fifty years ago. Casualties of Credit: The English Financial Revolution 1688-1720, by Carl Wennerlind, of Barnard College, at Columbia, was under-appreciated when it appeared ten years ago. The author bent over backwards to avoid triumphalism by incorporating, as the financial revolution’s first great success, the story of Britain’s entry into the Atlantic slave trade – the usually glossed-over precipitant and still-less-remembered outcome of the South Sea Bubble.

Anne L. Murphy, of the University of Portsmouth, who spent twelve years working trading interest-rate and foreign-exchange derivatives in the City of London, re-tooled as a historian and published The Origins of English Financial Markets: Investment and Speculation before the South Sea Bubble in 2009. The book won the Economic History Society’s best monograph prize the next year. She is preparing to publish Virtuous Banking: a day in the life of the late eighteenth-century Bank of England.

Meanwhile, Wennerlind’s new book, A Philosopher’s Economist: Hume and the Rise of Capitalism, co-authored with Margaret Schabas, of the University of British Columbia, appears next month. The financial revolution of the eighteenth century is with us every day. The extent and significance of its evolution has yet to be fully spelled out to a 21st Century audience.

David Warsh, a veteran columnist and an economic historian, is proprietor of Somerville-based economicprincipals.com, where this essay first ran.