William Morgan: Why Providence is indeed one of the 'Best Towns'

The Rhode Island State House is just the crowning example of brilliant civic architecture in Providence. Few other American cities can match Providence in the richness of its architectural patrimony.

—- Photo by William Morgan

Providence got a welcome pat on the back when CNN Travel recently ranked it Number 2 on its list of “Best Towns in America To Visit’’; Richmond, Va. was Number 1. Our high scores included Art, Architecture, Design and Food (of the other nine cities, only Macon, Ga., got a nod for its historic buildings). Such a positive national spotlight on Rhode Island’s capital is briefly heartwarming, but it barely hints at why Providence is one of the best towns anywhere in which to live.

Americans seem obsessed with lists and rankings, most of which are so superficial as to be meaningless. The worst are the college ratings, which seem only to increase applications to fewer schools (often called “elite’’) and to create a general atmosphere of insecurity for all the rest. (Examples of criteria used: Last time I checked, The New York Times’s list of the 300 Best Colleges had Providence College dead last in terms of student diversity; the University of Chicago held the bottom rung on the ladder for social life.)

The Zumper real-estate study listed Providence as 98th in 100 spots for best city for this year’s college graduates. Such metrics as median rents and the unemployment rate produced findings giving top spots to far-from-the- ocean Minneapolis, Columbus and Oklahoma City, while admittedly much more vibrant cities with higher costs of living, such as Boston or New York, lagged far behind. Where are the rankings for character, for beauty, for soul?

Beacon Hill, Boston. Who would trade this for Grand Rapids or Duluth?

— Photo by Willliam Morgan

When I was a professor of urban studies at the University of Louisville, students would often ask me what makes a great city. Somewhat tongue in cheek, yet also in a way deadly serious, I said that a great city was one that poets would write poems about and to which musicians would write love songs (“I left my heart in Duluth” doesn’t work). A few other pedagogical chestnuts: All great cities are on water. Street life and the strength of the neighborhoods are key indicators of livable cities. And the acceptance in a city of its gay citizens is also a strong indication of its livability.

A collection of the author’s columns that he wrote as architecture critic of the Louisville Courier-Journal were published as this book.

When my wife, Carolyn, and I decided to leave Kentucky for a new home somewhere in New England, we tried to heed my own urbanism lessons. We agreed that we would seek the ideal place to live in, and then look for work, rather than let a job dictate where we would settle. We drew up a stringent list of urban wants, headed by proximity to the ocean and a city’s strong sense of its history. Needing to work, we wanted a city with several colleges and universities where we could teach.

Our ideal new hometown would have inviting sidewalks with interesting stores and restaurants alongside, including independent bookstores, and and with larger cities nearby. We craved ethnic diversity and a variety of cuisines. Most of all it had to look and “feel right,” with a distinguished collection of high-style and vernacular architecture, gathered together in a human scale. A preservation-minded mayor, the late Vincent “Buddy” Cianci, with seemingly off-the-wall ideas, played an important promotional role. He and other local leaders weren’t afraid to help arrange for the likes of Venetian gondolas and to light up a river.

Note that there were no econometrics in our city-search template.

WaterFire was one of the urban inventions that impressed this city shopper.

— Sketch by William Morgan

Size is not really an accurate gauge of a city’s desirability – CNN Best Towns are actually smaller cities, from about 50,000 to about 225,000 residents. One interesting aspect of the story, however, is that it uses the term town. The word seems to suggest something more accessible than canyons of concrete and glass.

In Britain, the people who shape metropolises are called town planners. Before consolidation into Greater London following World War II, the British capital had been a collection of 23 boroughs, each with its own government, identity and traditions. One thinks of Providence’s two dozen neighborhoods, from Silver Lake to Fox Point, collectively contributing to a lively mosaic instead of an Anywhere USA blanket of sprawl.

Great towns need boldness and innovative out-of-the-box thinking. Providence uncovered a river and moved an interstate highway.

— Photo by William Morgan

Let’s stop worrying about lists and ratings and simply strengthen those attributes that make a place beloved – attributes that Providence has in spades. Economic development has a major role, of course, but stressing monetary concerns over humanizing factors cannot ensure a high quality of urban life. And worse than lists are one-size-fits-all advertising, such as the current slick but trite “All that …” campaign. If Providence is an urban success, people will come to visit those who live here and who have helped make it one the best towns anywhere.

People connecting make a lively town, not statistics. Hope Street is the main drag of Providence’s East Side.

— Photo by William Morgan

Architectural historian, critic and photographer William Morgan has lived in Providence for 25 years. His latest book is Academia: Collegiate Gothic Architecture in the United States.

‘Chronological markers’

“Coded #000000 [Black]”, by Triton Mobley, in the show “Coloured Aesthetica,’’ at the Chazan Gallery at Wheeler, Providence, through March.

— Image courtesy of the Chazan Gallery

The gallery says:

Triton Mobley is a new media artist whose practice pulls together "critical making methodologies across performative installations, programmable fabrications, and speculative industrial design…. Mobley's work in the show is digital but pulls from the tangible and real to trace "chronological markers across the archived memories from America’s amalgamation of public, private, racial, economic, and religious spaces."

Coming distractions

Above,“Winter Blues” (encaustic), by Providence-based artist Nancy Whitcomb. Below, her “Winter Blues” in oil.

The glory of 'gravy'

“Gravy is what Italian-Americans call tomato sauce, the three-hour kind with enough meat to feed a small country. My mother makes a huge pot of it every Sunday. It isn't so much about cooking as it is about connecting with her heritage. She likes knowing that generations of her maternal ancestors spent their Sunday mornings stirring what they called 'ragu' in their own kitchens. Even when we ate Sunday dinners at Nonna's, my mother made her own gravy before we went. She'd give half the pot to me to bring to the city, and before the end of the week we had each used up our share for lasagne, sausage-and-pepper sandwiches, baked stuffed peppers, and veal parmigiana.”

― Nancy Verde Barr (born 1944) in Last Bite. The food expert is a native of Providence, famous for its large Italian-American community and eateries.

What works for downtowns

Boston skyline on a windy, rainy day.

— Photo by Bert Kaufmann

In downtown Providence.

— Photo by Payton Chung

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

Obviously, many jobs that have required being in a company’s office five days a week won’t be coming back, as remote work (whose adoption was rapidly accelerated by COVID) and artificial intelligence (which will probably destroy many millions of jobs) keep chomping away at them. This, of course, has presented a big challenge to city downtowns – some of which continue to report scary vacancy rates. But things aren’t as bad as has been presented, and indeed some downtowns are rebounding.

And even as employers have cut back on office space, more and more are demanding that employees who have been entirely remote return to the office at least several days a week. This requires precision planning! Good companies know that many good ideas, especially for problem-solving, come from in-person collaboration.

Hit these links:

https://centercityphila.org/uploads/attachments/clnkqulms0ngyngqdkvd1ozpk-downtowns-rebound-2023-web.pdf?utm_source=ccd&utm_medium=web&utm_campaign=downtowns&utm_id=report&utm_content=oct2023

https://www.bloomberg.com/news/articles/2023-10-31/despite-remote-work-downtown-nashville-is-thriving-for-residents-and-visitors?srnd=citylab

City officials are coming to realize that thriving downtowns will depend much more on recreational visitors and new and old residents drawn to their conveniences and cultural and other nonwork-related attractions and activities, and much less on workplaces (except the work done by staff at such places as restaurants, performance venues, museums and so on).

The Providence Food Hall, scheduled to open next year in the old Union Station, is an example of the exciting attractions that will keep people coming downtown as visitors and get some to want to live there. It will build on Rhode Island’s reputation as a food center.

BUT, the success of the food hall will depend to no small degree on the city stopping the social chaos and crime, and fear of crime, that sometimes envelop Kennedy Plaza. There are some fine examples of how public spaces that had become messes have been cleaned up and restored to the civic treasures that they had been. Consider Bryant Park, in Manhattan. (Thanks for the reminder, Brian Heller.)

Hit this link for an update on the Providence Food Hall project (named Track 15):

https://www.golocalprov.com/business/providence-food-hall-announces-name-and-initial-vendors

Downtown Providence is better positioned than many places to thrive in cities’ brave new world because of its walkable compactness, its colleges, whose students and staffs patronize local business, and the fact that a middle-and-upper-class neighborhood abuts it.

In Bryant Park, next to the New York Public Library.

— Photo by Kamel15

Lunching with The Prince

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

The recent death at 75 of Gennaro Castellano, former captain of downtown Providence’s well known Capriccio restaurant, brought back cinematic memories of a few lunches I had there with Vincent “Buddy” Cianci in his heyday as mayor and “Prince of Providence’’ in the ’90’s. The lunches were very long, and he wasn’t averse to drinking stuff stronger than water during them. Considering that Cianci allegedly had a good-sized city to run, he seemed in no hurry to get back to work even as we approached 3 p.m. Indeed, it was I who became increasingly anxious to get back to my job running The Providence Journal’s commentary pages, with its not very forgiving deadlines.

Buddy would say as I kept looking at my watch: “Relax! Nice place, eh?”

The waiters were very able, if obsequious, as if they feared the mayor, with his semi-mobster persona. They probably had good reason to.

Of course, being mayor of a good-sized city has always involved various degrees of show business. Consider besides Buddy, such flamboyant examples as New York Mayors Jimmy Walker and Fiorello LaGuardia (see the musical Fiorello!) and Boston Mayor James Michael Curley (read the novel The Last Hurrah).

Utilitarian interior

Acrylic on canvas painting from Susan Graseck’s series “Celebrating Barns,’’ in the group show, with Michael Manni and Kate Chute, titled “Exploring Edges,’’ at the Providence Art Club through June 16.

‘Invite and suspend’

Work from Claire Crews’s show “I Walked Up to the Cloud,’’ at Paper Nautilus, in Providence. It’s an exhibition of decorative and utilitarian woolen works. The title is a borrowed line from the poem “Samuel Palmer: the Characters of Fire,’’ by prairie poet Ronald Johnson.

Paper Nautilus says: “Like clouds—or translucent windows reflecting a changing sky—these geometric structures invite and suspend. They remind us that fog up close is radiant.

”All pieces are handwoven on a four-harness floor loom, using natural toned and dyed churro wool, the compositions based on watercolor sketches in the artist's daybooks.’’

Thinking of heaven and earth

Spring clouds over Temple Emanu-El on the East Side of Providence

— Photos by Lydia Whitcomb

Grandeur or at least mystery at Good Fortune

— Photo and text by William Morgan

At a time when most public art is too realistic, too political, and just too awful, it can be a pleasure to stumble upon some unplanned artistic achievement– art in spite of itself.

This urinal in Good Fortune, the giant warehouse of Asian food in the Elmwood section of Providence, offers humor, dignity, and an appropriate aura of mystery befitting an intriguing work of art.

This plumbing fixture is broken, but the sign, “Operation Suspended,’’ hints at grander exploits, such as the cancellation of a moon shot or an aborted Navy Seals raid.

Set off by faux marble and black poly-something-or-other, the flushing mechanism takes on the look of a sleek, abstract chromium sculpture – a tribute to American industrialization, perhaps. A dismembered torso, or perhaps a tuxedo on a coat hanger, lurks beneath the shiny, elegant, mink-coat-black drape.

High fashion or a postponed plumbing repair?

William Morgan is a Providence-based writer and architectural historian. He holds a Ph.D. in American Art from the Bidens’ alma mater, the University of Delaware. His latest book, Academia: Collegiate Gothic Architecture in the United States, will be published this fall.

#art #Providence

Homeless and classically draped

Photo and text by William Morgan

It’s 11 on a Saturday morning in downtown Providence, and someone is sleeping in. This stretch of Chapel Street between Grace Church and the Providence Performing Arts Center has two or three encampments, where building-entrance alcoves provide a modicum of shelter from the elements.

The sadness and embarrassment of homeless people, and the failure of a supposedly enlightened city to take care of its marginalized and less fortunate, tear at one’s heartstrings.

Whatever the issues around social conscience and civic breakdown, some credit is due to this intrepid street denizen. He or she is wrapped in an ecclesiastical purple blanket, like a giant burqa without eye holes. The draping of the fabric recalls classical Greek statuary, such as the Elgin Marbles, from The Parthenon.

As I passed, from a tent pitched in the next entryway, a female voice wafted out, “Have a nice day.’’

William Morgan is an architecture writer and historian based in Providence. His latest book, Academia: Collegiate Gothic Architecture in the United States, will be published in October.

The leaves speak

“Shrine” (oil on linen), by New England painter Nancy Friese, in her show “Eloquent Landscapes,’’ at Cade Tompkins Projects, Providence, through April 29. See this video.

‘Vehicle for self-knowledge’

“I think you are the bravest person I know, in that I can't predict” (hand-cut paper), by Antonius Bui, in the show “New Explorations in Mediascapes and Memoryscapes, at the Bannister Gallery, Providence, through April 21.

— Photo courtesy Bannister Gallery

The gallery explains that the show presents the work of Karen Azoulay, Antonius Bui, Natalia Nakazawa, Sagarika Sundaram, Yelaine Rodriguez and Ayoung Yu as they "interpret their personal histories" through a wide array of mixed media. Through this diverse collection of works, these artists explore "human perception and connection as a vehicle for self-knowledge."

Bringing them back at night

The Shubert Theatre at the Boch Center, in Boston’s threatre district.

The Paradise Rock Club (formerly known as the Paradise Theater) is a 933-person capacity music venue in Boston.

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

I love the title. Corean Reynolds has been named Boston’s “director of nightlife economy,’’ by Mayor Michelle Wu, in a post-COVID bid to re-energize consumers to patronize the capital of New England’s entertainment and eating-and-drinking sectors.

Her duties will include improving transportation and law enforcement.

Ms. Wu, like some other big city mayors, is animated by the desire to make the city less dependent on office workers as the move to remote work has slammed the city’s commercial real estate sector. This must include getting more people to live in the city, some via the conversion of office buildings into housing (much easier said than done) and, say, turning some streets into pedestrian-only ways.

I’m sure that Brett Smiley, Providence’s new mayor, will be watching how it goes

Those not entirely wasted hours at journo-favored bars

— Photo by Ragesoss

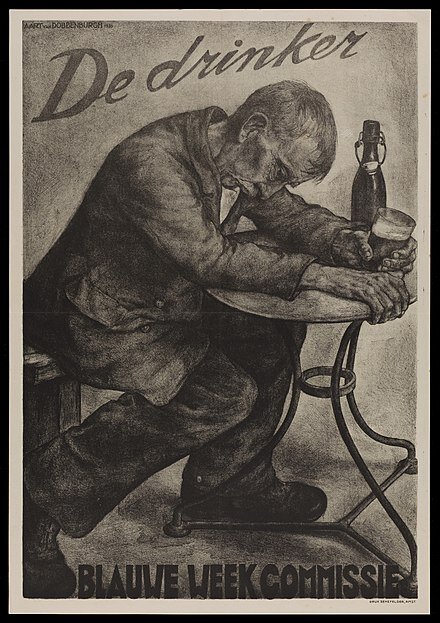

A 1936 anti-drinking poster by Aart van Dobbenburgh

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

For various reasons, going to New York City, as I did recently, reminds me of the bars that we newspaper and magazine reporters and editors used to patronize. This wasn’t a particularly healthy practice, but these places planted some evergreen memories.

Some of the joints I most remember:

Foley’s, in Boston, beloved of Boston Herald Traveler, Record American and Globe editors and reporters, especially scruffy police reporters, with their tales of gruesome or comic crimes and police and political corruption, and news and copy editors having their “lunch” at around 8:30 p.m. between edition deadlines.

Some actually consumed the bar’s pickled eggs as they knocked back their boilermakers --- a shot of whiskey followed by a beer, or pouring a shot of whiskey into their beers and then chugging that – or downing other, not very elegant beverages. I was often amazed that some of these journos could function at all under deadline pressure upon returning to the newsroom after “lunch” at Foley’s. Certainly many of them looked ill and aged fast. Some had noses that were tributes to the distillers’ art.

The older guys (and virtually all these colleagues were men) told vivid stories going back to the ’40s of life in what was then a gritty city. Others were taciturn, as if battered into silence by bad hours and what they had seen and heard on the job in a business in which grim news usually sells better than good.

Then there was the bar off Broad Street in Lower Manhattan where a couple of Wall Street Journal editing colleagues and I would occasionally retreat in mid-evening after work. (We’d stop working soon after listening to WQXR, then The New York Times’s radio station, to learn if we had missed a story that our biggest rival had so we could make necessary adjustments. The station helpfully broadcast a review of its next day’s Page One at 9 p.m.)

One night we came across what appeared to be a corpse on the sidewalk outside the bar that appeared to have been there for a while. A cop came along to deal with the body. (The neighborhood was virtually deserted at night in those days because few people lived there then and there were few food stores, etc., to serve them. Now there are many apartment buildings, put up during the off-and-on boom years from the mid-‘90s to COVID, and so it has much more of a 24/7 feel, though less than before the pandemic.)

In the bar we almost got into a fist fight with a drunk who insulted our colleague Ruth; in the event, he was evicted from the establishment.

I well recall the bar/restaurant in Wilmington, Del., called The Bar Door. That’s where some of us working for the News Journal, The First State’s statewide rag, then owned by the remarkably kindly DuPont family, would lunch at least once or twice a week. My colleagues there were the most abstemious of the newspaper types I hung out with in my career, usually just confining themselves to a Rolling Rock beer. And the food, especially softshell crab from nearby Chesapeake Bay, was good, so there was less drinking on empty stomachs.

The local pols, such as, I think, Joe Biden, then a recently elected U.S. senator, would show up to gossip. My favorite was Melvin Slawik, the charming New Castle County (which includes Wilmington) executive, who was a font of stories, including very funny, self-deprecating ones about himself. He later served time for perjury, obstruction of justice and bribery. He was one of the most likeable people I’ve ever met.

There was Le Village, a bar and restaurant dangerously close to the offices of the International Herald Tribune, in the affluent Paris inner suburb of Neuilly. Because French labor law mandates frequent work breaks, too many of the staff spent too much time there drinking, and, as at all journalist hangouts in those days, smoking. Several were what you might call merely recreational alcoholics. (Growing up, I learned enough about alcoholics, recreational and full time, to last me several lifetimes.)

As the finance editor, in charge of overseeing a third of the paper, I was sometimes put in the awkward position of trying to stop the working-hours drinking of people reporting to me. In one case, I had to remove an engaging and smart, but too often drunk, colleague from consideration for a promotion. In any case, labor law sharply restricted disciplining staffers. It was tough to hire people and even tougher to fire them.

There were other journo bars too, where I heard wild stories that could be the bases of a few novels and/or film-noirish movies, some of which stories were actually true. But my time in such places mostly ended about 30 years ago. One reason I’m still alive.

Oh, yes! There was a bar called Hope’s that was heavily patronized by Providence Journal people, and owned by two of them, but I only made a few clinical research visits.

Malcolm Muggeridge (1903-1990), the great English journalist, satirist, spy, womanizer and late-in-life religious fanatic, once said something to the effect that he regretted the smoking he did, but not the drinking, because of the stories and camaraderie he got out of the latter. But drinking and smoking are two devils embracing.

America's culture of cocophany

Paint on a piece of film wrap over a bass speaker playing very loud music.

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

America is a noisy place, often painfully so. But many people seem to like that.

The other night, six of us went to a Mexican restaurant in Providence called Dolores. The food was pretty good, though the service was a bit slow because of what appeared to be the staffing shortage that bedevils many restaurants. Always a tough business, but much more so in the Age of COVID.

It was a painful meal for us. The bass-heavy background music made it very arduous to try to hear what people across the table were saying. The next day, our ears still hurt from two hours in the racket.

And yet the place was packed on that Monday evening. You could see customers shouting to each other, but most were smiling. My hunch is that for many people in our culture of cacophony, a noisy place signifies excitement and somehow evokes the happy idea that they’re where the action is – that they’re not missing out.

Since the last two generations have grown up amidst increasing noise – rock music, etc. – that’s more and more difficult to escape – perhaps quiet makes them nervous.

Meanwhile, the gasoline-powered leaf blowers shriek from dawn to dusk, polluting the air and driving away the birds and indeed many walkers who try to avoid the racket, the fumes and the grit by finding other routes. And drugstores have automated bad music.

Adam Bush: In Providence, rethinking higher education for older students

From The New England Journal of Higher Education, a service of The New England Journal of Higher Education (nebhe.org)

We all received the “good” news recently that students are gradually returning to college, slowing the loss of 1 million students in post-secondary classrooms over the past two years to a trickle. But just as COVID-19 has exposed many of the cracks in our social framework, so, too, has it laid bare what an outspoken few have known for years: Higher education isn’t working. Or, to speak more plainly, it is working—to maintain the perception of “meritocracy” that cements hierarchies based on race and inherited wealth.

Meanwhile, in just two years, the number of adults with some college but no degree has spiked by 9 percent, growing to 39 million.

The problem should not be framed, “How can we bring these folks back to college?” but instead, “How can we transform higher education to meet their needs—and what might that transformation mean for all learners seeking a college degree?”

College Unbound (CU), based in Providence, is designed for adults looking to advance in their current careers, move into new vocations or spark change that improves the quality of life for themselves and others. In 2020, we were accredited by the New England Commission of Higher Education. During the pandemic, CU more than doubled our enrollment, and became one of two designated Hispanic Serving Institutions in Rhode Island. Our retention rate for fall 2021 students was 90 percent.

Over the past 13 years, we have designed a college from the ground up, informed by the experiences of our adult learners. Students came to us, and were recruited by us, from moments of frustration in their lives—of being kept from promotions, of financial hurt from accumulating debt and from being misunderstood as lacking agency, intellect and leadership capacity because they did not possess a bachelor’s degree. Students also came to us with a wealth of professional and personal experience and a wealth of learning from both their failures and successes.

While the average age of CU students is 36, we believe that colleges serving students of all ages should think about everyone returning to the classroom as adult learners. And instead of just adding academic, financial and social support, we urge colleges to rethink how they see their learners. Here are a few ways to do so:

Honor your students’ interests.

College Unbound’s curriculum, a single major in Organizational Leadership and Change, is built around student projects that connect to professional development and personal growth. Students meet weekly in professional or place-based cohorts to advance their scholarship, building community, engagement and momentum for learning. In a 2021 survey of our alumni that received a 100 percent response rate, 87 percent report thast they have continued to work on their project after graduation. Notably, 81 percent of CU alumni reported that the project has had a demonstrable impact in their lives, workplaces, organizations, communities or for others beyond CU.

Credit their skills.

Students in their first semester are required to take a course called “Learning from Experience,’’ which introduces them to what we call The Big 10: leadership and change competencies that provide a foundation for CU’s single major of Organizational Leadership and Change. These competencies, which include Problem Solving, Intercultural Engagement, and Communication, align closely with the skills that employers value most. The Big 10 also form CU’s process for obtaining credit for prior learning (CPL). This process is detailed on our website at Building Your Big 10 Leadership & Change Portfolio. While many colleges offer CPL, only 11 percent of adult students earn credit for prior learning. We are unique in that 100 percent of our students complete at least 10 credits via prior learning, because the Big 10 are graduation requirements. By requiring Learning from Experience in the first year, CU graduates earn an average of 21 CPL credits, accelerating their time to completion by more than three semesters.

Meet students where they are already learning.

CU is exploring ways in which college can be accessed through trusted providers of lifelong learning. In partnership with Peer 2 Peer University (P2PU), CU offers free learning circles with an option for college credit, initially at the Providence Public Library and Providence Community Library. Participants who attend learning circles work and learn together at their local community library in a “study group” atmosphere, led by a facilitator. Course materials come from online course providers, universities, and nonprofit organizations from around the world—meaning the courses are both free to take and facilitate.

P2PU and CU now offer these learning circles nationwide through open trainings that will reach an additional 100+ library staff across the country. This project seeks to transform the learning that happens in libraries into a viable degree-completion pathway for radically increasing earnings, uplifting families and transforming communities. Locally, we plan to launch a cohort of BA completers at the Providence Community Library next spring. Long term, we hope this initiative can lead to a global infrastructure that enables public library staff to serve their patrons close to home by offering high-quality credit-bearing training and microcredentialing at low cost in in-demand topics.

The 39 million adults with some college, but no degree, deserve better opportunities than what our current system has to offer. It has been clear for far too long that higher education needs a radical shift in its approach to truly create the “student-centered” learning environment that so many institutions hope to foster. We must meet our students where they are, recognizing that at any age, they will bring an array of interests and prior learning—which should be lifted up, appreciated and credited. We at College Unbound will continue to push for these changes in these critical next few years.

The COVID pandemic has exposed and widened many of the cracks that have existed in higher education since its inception. But this time of recovery also represents an opportunity for all of us to rethink how we might seal up many of those cracks at their very foundation.

Adam Bush is provost and co-founder of College Unbound.

Overwrought fears of a Providence bike trail

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

The controversy over setting up a bike and walking lane (sometimes called an “urban trail”) in a commercially successful and charming stretch of Hope Street on Providence’s East Side has raised the inevitable issue of parking, which upsets some merchants and shoppers alike.

See:

The proposal would replace some of the street-side space now allocated to parked cars. Big parts of the fight come both from too many Americans’ unwillingness to walk more than a few feet from their cars to shop (and you can see the results in their physiques) and residential neighbors not wanting cars crowding nearby streets.

This gets me to think that the strip needs some sort of attractive (faced with brick or wood?) parking garage to take off some of the pressure.

Meanwhile, a big problem with bike lanes in some places is the failure of bicyclists to learn and obey basic traffic rules, e.g., signaling, and of police to enforce them. Time for Providence Police and other officials to work on that, including with signs and hefty fines!

Some of the local merchants want the city to call off a trial of the trail set for Oct. 1-8. No, the experiment should go forward! Let’s see how it unfolds and then either drop the idea or, if the project is to become permanent, adjust as needed. Of course, any change like this brings out Nimbyism and anxiety in people who have operated in a setting that has changed relatively little over the years.

But read what’s happened elsewhere.

https://thesource.metro.net/2017/11/20/biking-is-good-for-business/

https://www.cbc.ca/news/business/biking-lanes-business-health-1.5165954

https://medium.com/sidewalk-talk/the-latest-evidence-that-bike-lanes-are-good-for-business-f3a99cda9b80

Bicycle parking at the Alewife subway station, in Cambridge, Mass., at the intersection of three cycle paths.

— Photo by Arnold Reinhold

Through the haze of longing

“Still Life 8” (watercolor, 1990), by celebrated Providence-based painter and art professor Thomas Sgouros (1927-2012), in a show of his work at Cade Tompkins Projects, Providence, through July 22.